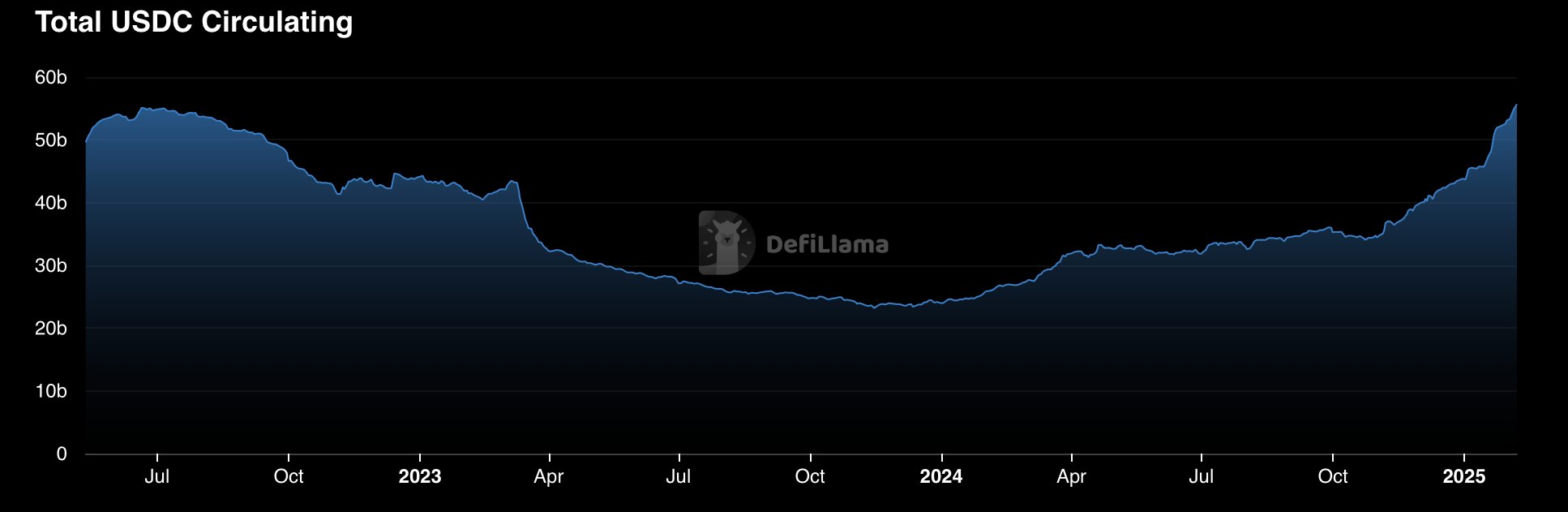

With a year-over-year growth rate of over 100%, USDC adoption is accelerating globally, and today reached $56 billion in circulation.

— Circle (@circle) February 7, 2025

The future of money is here. pic.twitter.com/RslZ0xXYCM

A

A

Crypto: USDC Recovers Its Losses And Challenges USDT!

Wed 12 Feb 2025 ▪

4

min read ▪ by

Getting informed

▪

Stablecoin

Is it the glory hour for stablecoins? While CBDCs struggle to take off, Tether’s USDT continues to dominate. But a challenger joins the dance: Circle’s USDC, which is breaking records. With explosive growth and adoption skyrocketing, this stable crypto could very well shuffle the deck of a rapidly changing market. The shadow of a reversal looms over Tether’s empire…

USDC accelerates and nibbles at market shares

The ambitious little brother of Tether is no longer content to play second fiddle. USDC recently crossed the threshold of $56.3 billion in market capitalization, representing a rise of 23.4% since January. In one year, it went from 19.4% to 25% market share, a strong signal announcing a titanic duel.

Behind this rise, Circle is playing on multiple fronts:

- Blockchain expansion: USDC is stepping onto Sui, Aptos, and Solana, where it made a big impact with $6 billion newly issued;

- Global usage: More than 500 million users have access, thanks to partnerships with banks and exchanges;

- Transaction volumes: By November 2024, the stablecoin reported $1 trillion in monthly exchanges, with a total exceeding $18 trillion.

Circle does not hide its ambitions. According to a recent tweet from the company:

“With an annual growth of over 100%, the adoption of USDC is accelerating globally. The future of money is here.“

A statement that smells like provocation for Tether, whose supremacy is starting to waver.

The crypto market in full transformation

The world of stable cryptos is no longer a simple duel between USDT and USDC. With a total market capitalization rising from $121 billion in August 2023 to $224 billion in February 2025, the sector is exploding and attracting attention.

On one hand, governments are taking a close interest. The White House sees these cryptos as a digital extension of the dollar, a means to strengthen its monetary dominance. Regulators are also advancing their pawns: a U.S. bill aims to establish a “pro-growth and secure” framework to prevent excesses.

On the other hand, traditional finance is starting to pay attention. Institutions are gradually adopting these new forms of payment, particularly for global payroll, money transfers, and commercial settlements. And with nearly instantaneous transactions and reduced fees, it is hard not to see it as an alternative to aging banking systems.

The stablecoin market is evolving rapidly, and Circle seems to have taken a lead in modernizing the sector. As blockchain infrastructures become more efficient, USDC is establishing itself as a smooth, secure, and accessible payment tool.

In 2024, USDC saw its market capitalization soar by 80%. A growth that raises the question: what if Circle finally holds the key to overthrowing Tether’s empire?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

A

A

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.