Crypto: The Summer will be Decisive for Bitcoin (BTC)

Bitcoin seasonality shows that summer can often be an accumulation zone for bitcoin (BTC). While the end of summer has historically shown significant risks, this summer could be pivotal. The simultaneous rise in gold prices along with bitcoin rekindles hopes for new bitcoin highs.

Bitcoin seasonality (BTC): summer as a turning point

Bitcoin prices still reliably follow their cyclicity. A new bullish wave could thus form to unveil its bullish potential, and summer would have a major psychological role in this dynamic.

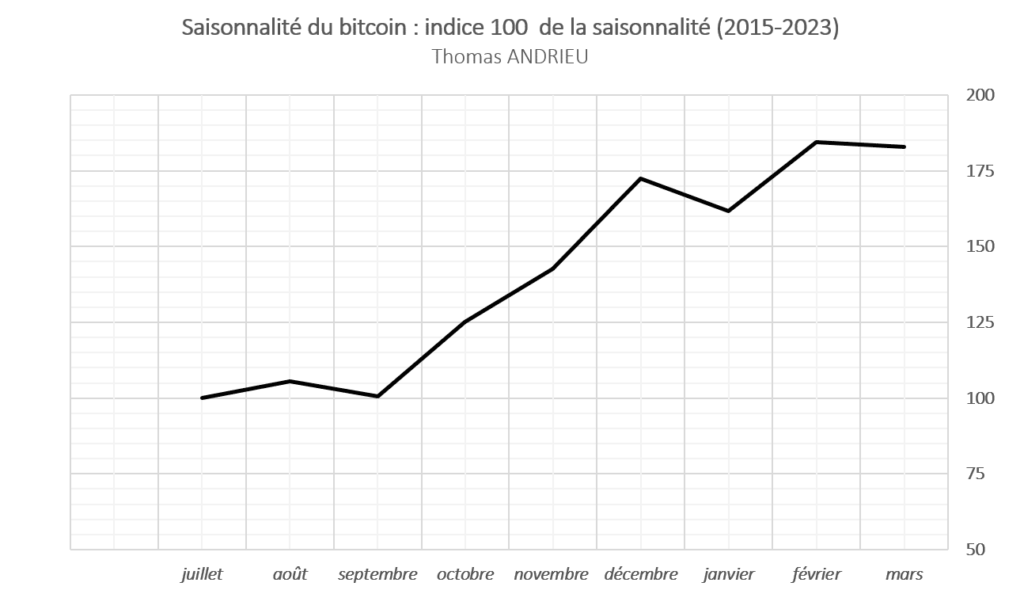

In a statistical study conducted a year ago, we established the typical pattern of bitcoin variations over the year. The study of data from 2015 to 2023 led to the following conclusion:

This chart shows the “ideal” evolution of bitcoin by the months of the year based on price history from 2015 to 2023. It shows that July, August, and September are generally stagnant months. A strong bullish phase usually starts from late September to December. Therefore, autumn seems to be bullish for bitcoin prices. A new stagnation phase begins between December and January, followed by a rebound in the following month. […] 62% of the time, bitcoin prices rise between (late) September and December. The average increase during this period is more than 70%.

Bitcoin seasonality (BTC) – Cointribune

Summer: an “ accumulation ” zone for bitcoin?

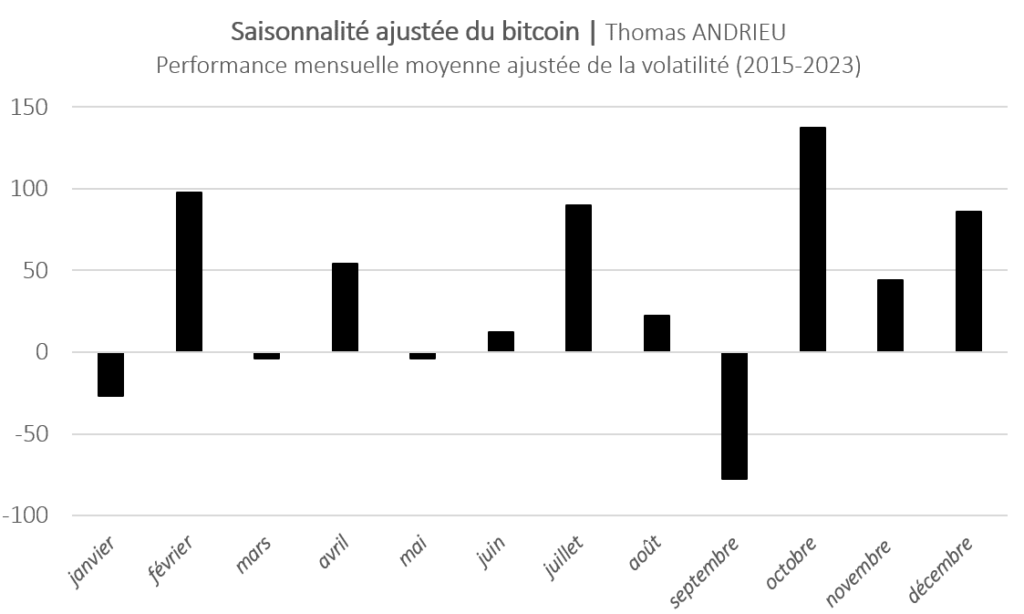

The study of data between 2015 and 2023 shows that summer, on average, is conducive to slight “ rises ”. However, when we adjust the average performances for their statistical reliability, the conclusions change slightly. July appears, on average, to be a moderately bullish month but with significant reliability. In contrast, August is generally less performant and less reliable.

This behavior can explain why bitcoin shows a contrasting pattern during the summer months. Furthermore, the end of summer is often conducive to strong bearish phenomena. Therefore, summer often appears as a transitional phase in the bitcoin price behavior. Consequently, this transition can occur from a bullish market to a new bullish wave, or from a bullish market to a bearish market.

Towards a final bullish wave in the coming months?

The study of annual seasonality allows us to take advantage of statistical anomalies. But bitcoin does not necessarily follow annual cycles. Indeed, it rather appears that bitcoin follows traditional stock market cycles lasting 3 to 4 years.

Observing the simple dates of bitcoin’s peaks and troughs leads us to several conclusions.

Is there a 3.5-year cycle on cryptos? – Cointribune

- The average duration between two major bitcoin (BTC) troughs is 3.6 years. The duration of these cycles tends towards 4 years in recent years.

- During the bullish phase, the average duration is 2.6 years (2 years for cycle 1; 2.9 years for cycle 2; and 3 years for cycle 3). This duration tends towards 3 years in recent years.

- For the bearish phase, the average duration is 1 year. These phases seem to be of less variable duration… The great regularity of the bearish phases is a major argument.

We have represented below the trajectory of bitcoin over the last two 3.6-year cycles. We have also added our current position in this cycle (blue curve). It clearly appears that bitcoin’s trajectory in recent months is, on average, close to that of the past. However, we also see that the coming months could mark a resurgence in volatility.

Is the movement still framed?

In an analysis article in May, we highlighted the risk of a correction in bitcoin prices. This consolidation now seems to be ending. The end of the bearish movement in June seems to confirm the importance of the bitcoin cycle in the current dynamics.

The rise in bitcoin prices since early 2024 would even tend to slightly exceed its historical norm. Therefore, the immediate conclusion would be that the consolidation movement observed since March 2024 would not be abnormal, on the contrary. The reciprocal would even be that since the historical scenario is respected, we could witness a second bullish phase in the summer of 2024.

Finally, we will note that bitcoin (BTC) price trajectory becomes less “normed” from the 25th or 30th month of the cycle. In other words, volatility increases because agents’ behavior is more euphoric. It will therefore theoretically be more difficult to make projections for 2025 or 2026 on bitcoin prices than in 2024.

Has bitcoin (BTC) exhausted its bullish potential? – Cointribune

Towards a final bullish impulse?

Summer is often perceived as a slack period in many economic sectors. For financial markets, this season is marked by reduced transaction volumes due to summer vacations. However, the impact of summer on Bitcoin (BTC) prices presents interesting particularities that deserve special attention. The study of the 3.6-year cycle would indeed align with this particularity of the summer market.

In view of cyclical phenomena, it is possible that the next peak in bitcoin will be rather brief. That is, a double peak would be less likely. But this remains in the realm of hypothesis. In our cyclical study conducted a year ago, we reached the following conclusion.

Assuming our hypotheses hold true in the future, the next peak would be around mid-2025. This aligns with the cyclicity of many other assets. However, we must specify certain conditions. To be valid, a bullish market on bitcoin should ideally be accompanied by a prior peak in volatility and rather accommodative monetary policy.

Is there a 3.5-year cycle on cryptos? – Cointribune

The trend holds, gold shines, does bitcoin bug?

In recent weeks, gold prices have begun a new wave of increases. A major reason for this movement is the anticipation of a rate cut by the Fed in the fall. Additionally, the increasing probabilities of a recession or economic slowdown favor safe-haven assets. In this context, which has not yet led to increased volatility, bitcoin ideally benefits from this movement.

Consistently, bitcoin seems to be on a path to rebound towards its latest peaks. The corrective movement observed in recent weeks corresponds to a 61.8% retracement of the last cycle.

Moreover, a bullish breakout of the last consolidation pattern (wedge) would certainly allow us to envision 79,000 to 80,000 dollars. By extension, we would need to confirm a structural bullish strength to conceive a 5th bullish wave to 100,000 dollars, or even 120,000 dollars.

What to expect from the summer of 2024?

We have shown that summer is often favorable for a transition in bitcoin behavior. While July is historically bullish and rather reliable, the end of summer shows some risks. In a general bullish dynamic, summer proves to be generally optimal for managing positions in anticipation of a final upward move, the magnitude of which can be minimal or major. Seasonality is not the only indicator that supports this. Indeed, the study of bitcoin cyclicity seems to explain the movements of the previous months. Therefore, summer is indeed a transitional period. Given the bitcoin upward rebound, it is possible to see a return to previous peaks, which would potentially be followed by a breakthrough. Bitcoin benefits from the anticipation of monetary easing.

However, an increase in economic risk and volatility would certainly be detrimental in the long term. Consequently, the recent consolidation appears technically and temporally framed. A breakthrough of the recent peaks would lead to significant adherence to the cyclical patterns at play.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Author of various books, financial and economics editor for many websites, I have been forming a true passion for the analysis and study of markets and the economy.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.