Crypto: The battle of $3000, Ethereum facing a crucial speculative divergence

As the price of Ethereum consolidates around the critical $3000 support, investors are scrutinizing signals from the crypto market. Between the resilience of long-term holders and the fears of short-term speculators, ETH could well have some surprises in store.

Ethereum, a Key Support for Short-Term Holders

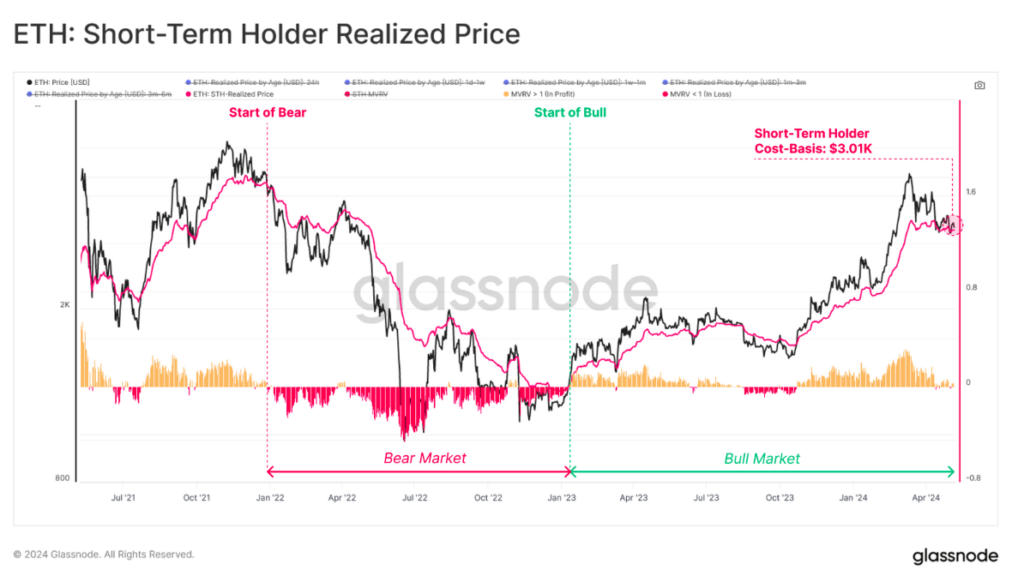

The price of Ethereum (ETH) is currently fluctuating within a narrow range around the key psychological level of $3000. This threshold, which also corresponds to the 100-day and 200-day moving averages, is the focus of all parties in the crypto market.

According to Glassnode, short-term holders (STH), who have owned ETH for less than 155 days, have an average cost basis exactly at $3000. A clear breach of this support could trigger a panic sell-off among these investors, with the most recent buyers then moving into latent loss.

The MVRV (Market-Value-to-Realized-Value) indicator, which estimates the potential gains or losses, highlights the fragility of this group. With a very low premium, the slightest spike in bearish volatility could push their MVRV into negative territory, thus reinforcing the selling pressure.

Long-Term Holders in a Waiting Position

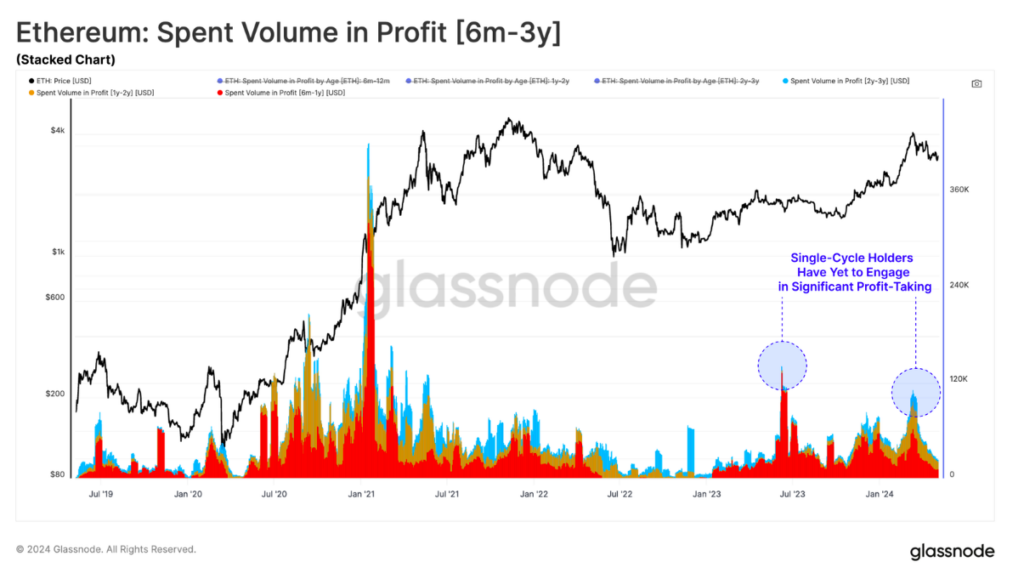

On the other hand, long-term holders (LTH) appear determined not to sell their tokens hastily. Despite significant potential gains for some, they did not take advantage of the recent peaks to cash in their profits massively.

This reluctance to sell is reflected in the realized volume of profits by LTH. Unlike Bitcoin (BTC), where these investors of 6 months to 2 years have increased their profit-taking during the last surge, Ethereum’s LTH seem to be patiently waiting for better exit opportunities.

This behavioral dichotomy between anxious STH and confident LTH feeds a certain “speculative divergence.” The coming weeks will tell us whether the $3000 support will manage to contain the pressure from short sellers.

Bullish Signals in the Medium Term?

Despite these short-term uncertainties, several indicators suggest a potential bullish rebound. Technical analysis reveals signs of increasing demand, which could initiate a recovery in prices from a medium-term perspective.

Moreover, the funding rate for futures contracts, although declining, remains in positive territory, reflecting a market that has not capitulated. Without falling into euphoria, term buyers are maintaining upward pressure, albeit moderate, but substantial.

Finally, the imminent decision by the US SEC regarding the Ether spot ETFs could provide a new catalyst. An approval would undoubtedly create a surge for the prices, opening the way to significant inflows of institutional capital.

In conclusion, Ethereum is currently evolving in a bittersweet context, torn between measured hopes and underlying concerns. Beyond this consolidation phase, the fundamental progress of the ecosystem, especially regarding scalability solutions (Layer 2), could ultimately tip the balance in favor of the bulls. Until then, the suspense remains as to the solidity of the $3000 support.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Passionné par le Bitcoin, j'aime explorer les méandres de la blockchain et des cryptos et je partage mes découvertes avec la communauté. Mon rêve est de vivre dans un monde où la vie privée et la liberté financière sont garanties pour tous, et je crois fermement que Bitcoin est l'outil qui peut rendre cela possible.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.