Crypto: Stablecoins in peril with the application of MiCA

The MiCA law comes into effect on June 30. Too vague, too restrictive, the law is controversial and worries professionals in the cryptocurrency industry. Ultimately, stablecoins like USDT or USDC could completely disappear in Europe.

Why is the MiCA law important for stablecoins?

The “Markets in Crypto-Assets Regulation” (MiCA) will soon apply to the crypto asset market. The stated goal? To strengthen consumer confidence and stabilize the cryptocurrency market in Europe. “The main provisions applicable to issuers and traders of crypto-assets […] focus on transparency, information disclosure, and authorization and monitoring of transactions ” can be read on the European Parliament website, which initiated this law.

MiCA particularly focuses on stable cryptocurrencies. It is mainly targeting industry giants such as Circle (USDC) and Tether (USDT). To continue offering their stablecoins in Europe, these operators will notably need to obtain a specific license, similar to that required for “banking institutions”.

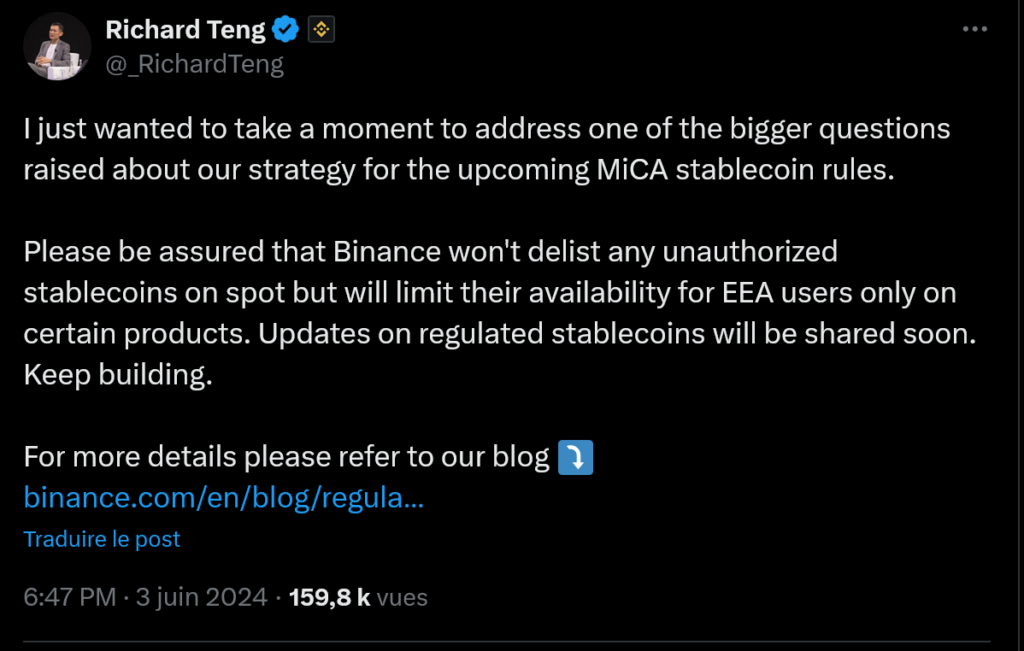

Consequence: Binance, Coinbase, and other major platforms will have to adapt. They must ensure that their cryptocurrency offerings comply with this new regulation. This is why Binance warned its users of disruptions in stablecoins. In a recent email to its clients, the exchange sought to reassure: “Binance will not delist these stablecoins. […] We will implement certain restrictions for EEA users but only on certain products, and we will offer alternatives with regulated stablecoins or other crypto assets.”

https://x.com/_RichardTeng/status/1797671401245053423

Why does the EU target stablecoins?

Why does the European Union specifically target stable cryptocurrencies? It’s an obvious response to the Terra Luna fiasco and its stable cryptocurrency, UST. From Brussels’ perspective, the risks inherent to stablecoins are too significant. In the institution’s crosshairs: opaque capital reserves, a lack of guarantees, and questionable solidity of such cryptocurrencies. The FTX affair did not help alleviate this mistrust.

Unofficially, Brussels is also pursuing other objectives. Stablecoins allow users to avoid the infamous cryptocurrency tax, while benefiting from a way to secure their crypto gains. By staying in stablecoins, users avoid a taxable euro conversion, provided they wish to remain in the cryptocurrency ecosystem without withdrawing to a traditional bank.

Furthermore, there are geopolitical stakes. Europe wants to maintain its sovereignty vis-à-vis the United States. Stablecoins are largely supported by American companies, which are massive capital absorbers. Finally, stable cryptocurrencies could overshadow the digital euro project.

Regulating at all costs: a counterproductive European strategy?

Some cryptocurrency players accuse the European Union of hindering innovation. Worse, by forcing Binance to withdraw their USDT offering, investors might be compelled to turn to unregulated, and thus riskier, platforms. It’s known that DeFI entails more risks. Excessive regulation could also lead to the exodus of companies established in Europe. Middle East, Asia… there’s no shortage of exile destinations. This argument was echoed by former deputy Pierre Person, who declared as early as 2022 that “the European Union is shooting itself in the foot“.

Recently, Tether had expressed its doubts about the MiCA law, hinting at the possibility of permanently leaving Europe. Meanwhile, the company Circle, which issues USDC, had committed to complying with all regulatory criteria.

A legal mess that is difficult to apply

The problem is that this new European regulation on stablecoins has left the ecosystem’s players little time to prepare. Barely a year for a massive legal undertaking. The other problem is that the texts concerning stable crypto-assets lack clarity. “There is uncertainty about how MiCA is drafted, according to Faustine Fleuret, who heads ADAN, the Association for the Development of Digital Assets. “We can expect some leniency on July 1st“.

In a context where the price of Bitcoin is dropping again, uncertainty over USDT or USDC is not good news for investors. Especially since the market today weighs 1.27 trillion dollars on its own.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Fascinated by the history of Bitcoin and the cypherpunk movement, I think that citizens must reinvest in the field of currency. My goal? To democratize and make visible the potential of blockchain and cryptocurrencies.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.