Crypto: Is Ethereum Catching Up?

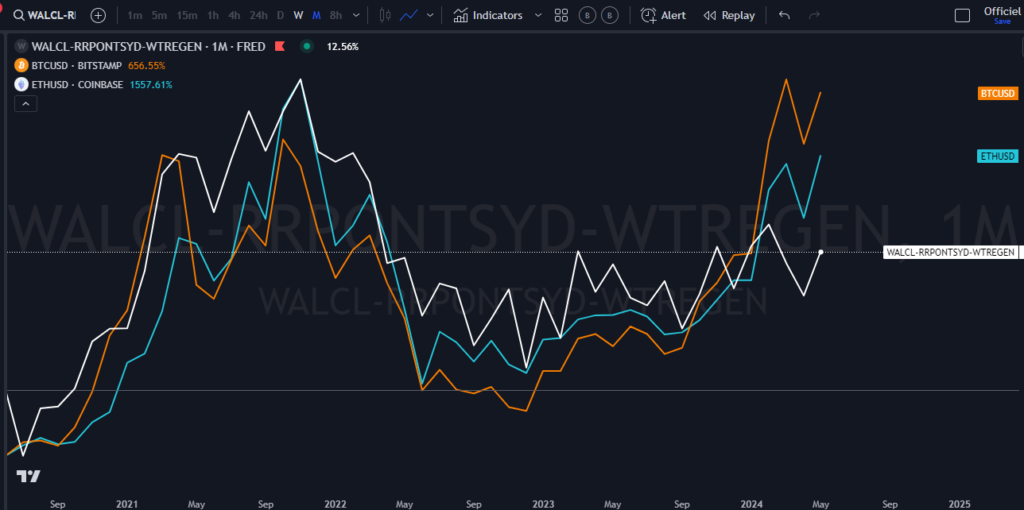

Each bull run in the past has gone through different phases stimulated by a capital rotation. In general, bitcoin is often the leader of the bull run and the favorite in the early phases. Following Ethereum’s weaker performance compared to bitcoin, we will look at the factors favorable to a capital rotation towards Ethereum.

The Principle of Asset Rotation

In traditional finance, there are several types of asset rotations. This can involve a sectoral rotation (technology, industrial, financial, health…) or a rotation of asset types (bonds, stocks, commodities, forex…). Capitals move according to the context and the economy. The rotation can come from profit-taking after a significant performance to move into another sector or a less valued type of asset while following the economic context. This is often the case between cyclical and defensive sectors, for example.

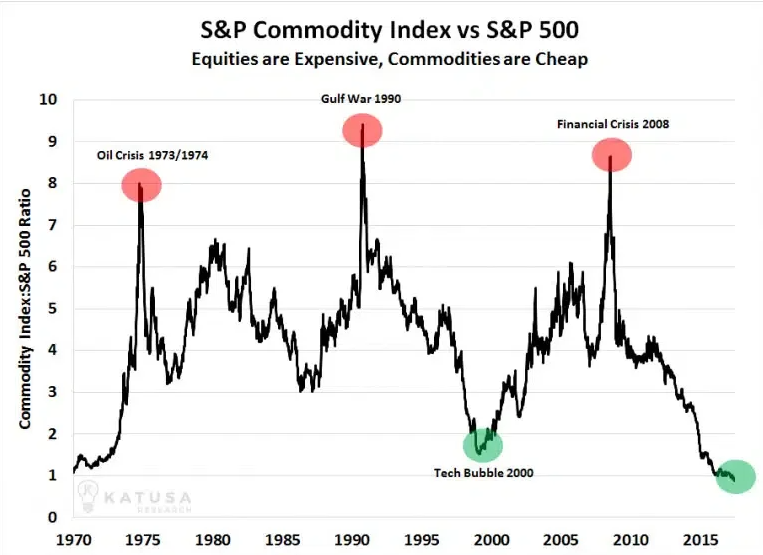

Let’s also take an example over a very long-term horizon, that is to say over several decades, we can see this cyclical rotation between commodities and the S&P500 index in the graph below:

This type of graph highlights that in the coming years, performances in commodities should be more advantageous than in the S&P500.

The Different Phases in Crypto

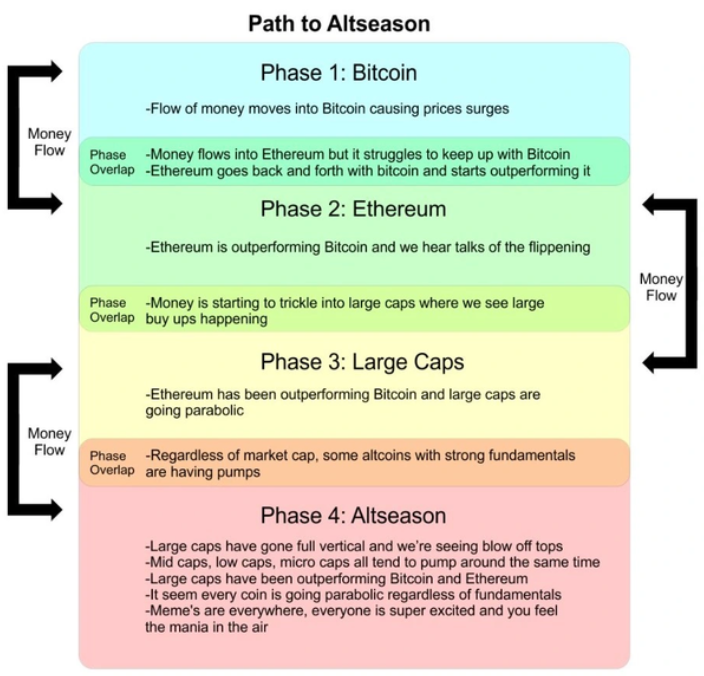

When we look at the cryptocurrency market, there are several phases in terms of rotation, whether it is between bitcoin, Ethereum, large caps, and altcoins. And generally, this comes from a progressive rotation.

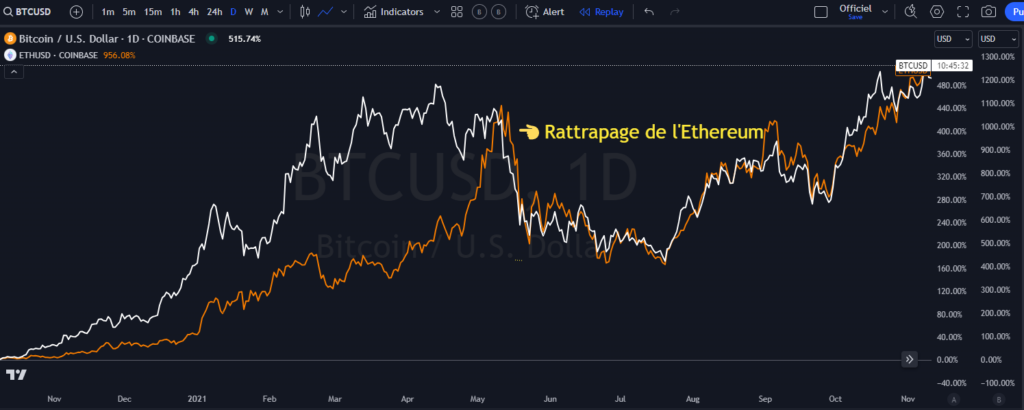

Phase 1: Bitcoin is the leader, the store of value in the crypto market. It is the oldest and most democratized in the cryptocurrency sphere. It is on bitcoin that the first capital inflows arrive at the beginning of a bull market. Since 2024, bitcoin has been available in spot ETF form, which is an advantage to stimulate demand. And in parallel, when the demand is stimulated, it increases the capital inflows. During phase 1, bitcoin tends to outperform Ethereum. And it is only when Ethereum starts to approach bitcoin’s performance that phase 2 is near. We can possibly see this rotation with the example below which highlights the ETC/BTC ratio:

Phase 2: Ethereum, which is the number 2 cryptocurrency in the crypto sphere, outperforms bitcoin. This can be seen in the graph below with the 2021 bull run.

Phase 3: It is the turn of large capitalizations (Doge, LTC, XRP…) to outperform bitcoin.

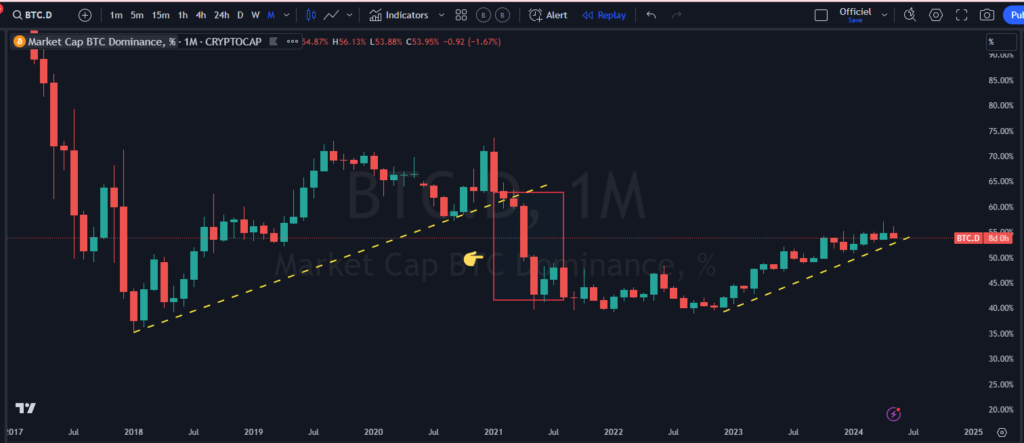

Phase 4: The altcoin season begins when there is a large capital rotation. That is to say, the money invested in bitcoin at the beginning of the bull run moves to other cryptocurrencies, small and mid-capitalizations, or even memes. During the altcoin season, we see a reduction in bitcoin dominance. Here is a graph that highlights this:

To better illustrate this in general terms, here is the chronology below:

The Economic Environment and Different Phases in Cryptocurrency Markets

The evolution of cryptocurrency is quite cyclical, just like the economy. That is to say, we find cycles of growth and cycles of decline. Like any riskier asset class, it evolves according to a favorable and accommodating context. A favorable context can be defined in several ways. For example, when growth rebounds, we have an acceleration of growth, which is a favorable environment for cryptocurrencies. Consumer sentiment is positive and this encourages capital inflows. Conversely, when we face an economic slowdown, it is often represented by a bear market in cryptocurrencies. Each cycle often averages one and a half to two years, just like economic cycles. Therefore, if we add up a bull market and a bear market, it represents 4 years, just like the halving process:

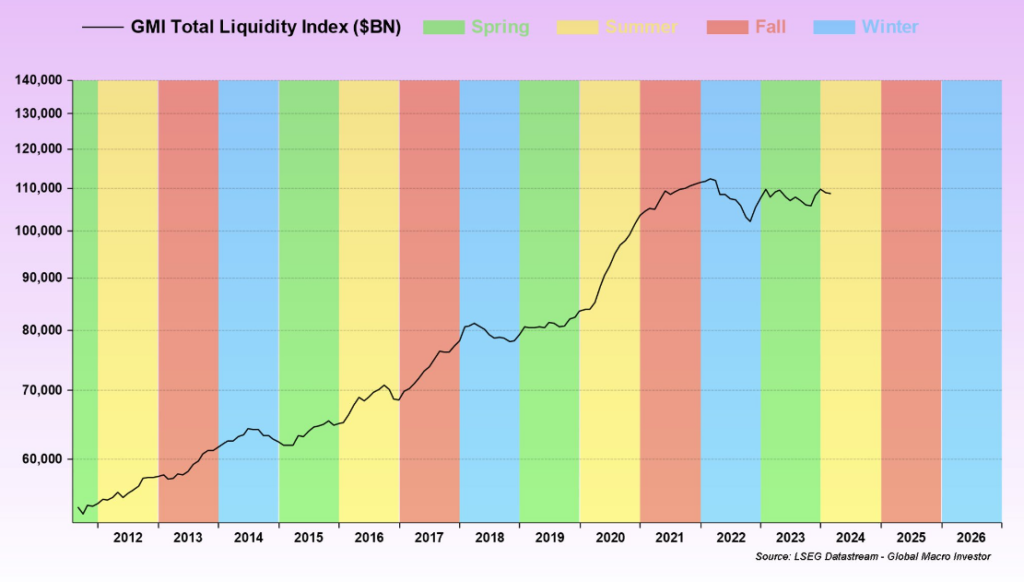

Another positive element for performance is also liquidity. When liquidity is abundant, cryptocurrencies thrive. For example, injections of liquidity during COVID led to more capital circulating in the markets. Financial conditions were highly relaxed. Therefore, more money in circulation to buy the same good implies a price increase.

Regarding liquidity in the current situation, we can see the graph below highlighting the evolution of liquidity and bitcoin:

Remaining in the same context, that is, liquidity, we can also see favorable seasons (summer and fall being the best):

The Delay of Ethereum Explained by Several Factors

As mentioned earlier, Ethereum is often delayed compared to bitcoin during the first months of a bull run. This is mainly because capital first flows into bitcoin, the store of value. As for Ethereum, it is no longer the only one well-positioned as it is closely followed by Solana. This also implies competition. That said, like bitcoin, Ethereum should benefit from more incoming flows since the approval of ETFs is official. Such products imply more potential to attract new investors, whether for tax reasons (introduction of the product into tax-advantaged accounts) or simply because an ETF is an easily accessible product (no need to open multiple brokerage accounts) and is inexpensive. This is why approval would be a good catalyst for catching up with bitcoin. Therefore, there are several arguments that align for Ethereum’s outperformance, such as a favorable context, new available products, and the phase timeline (as indicated above).

Bitcoin or Ethereum, Which to Choose?

Bitcoin and Ethereum have different strengths that can help diversify a crypto portfolio. One of bitcoin’s peculiarities is that it has a limited supply of 21 million, and its production is halved every 4 years. This can be seen as a safe haven, especially in countries suffering from hyperinflation. Ethereum also has certain peculiarities, such as the fact that it can be used to host other cryptos and decentralized applications.

The more adoption and democratization continue with the same dynamic, the more we will face new products as approvals will be increasingly easier. For example, we could have an ETF that brings together bitcoin and Ethereum to simplify the choice. This opens many possibilities in terms of capital.

Conclusion

We can conclude that the capital rotation system is cyclical and that Ethereum has several reasons to take the lead and outperform bitcoin for the rest of the cycle. One of the major catalysts for this would be, like bitcoin, ETF approval. This will improve liquidity in the coming months.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Après avoir travaillé pendant 7 ans dans une banque canadienne dont 5 ans dans une équipe de gestion de portefeuille comme analyste, j’ai quitté mes fonctions afin de me consacrer pleinement aux marchés financiers. Mon but ici, est de démocratiser l'information des marchés financiers auprès de l'audience Cointribune sur différents aspects, notamment l’analyse macro, l’analyse technique, l’analyse intermarchés…

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.