Crypto: Ethereum Reaches A New Inflation Peak

In 11 years of existence, Ethereum has demonstrated an unprecedented capacity for innovation in the world of blockchain. Yet, despite its revolutionary advancements, the quest for perfection remains out of reach. Today, the network faces a significant challenge: rampant inflation fueled by recent updates and a surge in staking, questioning the fragile balance of its ecosystem.

The influence of the Dencun upgrade on Ethereum

Latest Ethereum news : the Dencun update, deployed in March, has disrupted the dynamics of the Ethereum ecosystem. With an inflation rate of 0.35 %, the network has seen its total supply exceed 120.4 million ETH, erasing in seven months the reduction efforts of the past two years.

This increase is explained by key changes:

- The reduction of base fees through the creation of specific spaces for data blocks;

- The introduction of proto-danksharding, optimizing data availability;

- A decrease in competition for transactions on the main chain.

Result? Ethereum burned 45,022 ETH while issuing 78,676 ETH over the last 30 days, representing a net increase of 30,000 ETH. According to Ultrasound.money, these mechanisms weaken the balance between issuances and destructions of ETH, reminding us that every technical evolution can have collateral effects.

Crypto ETH: when staking exacerbates inflation

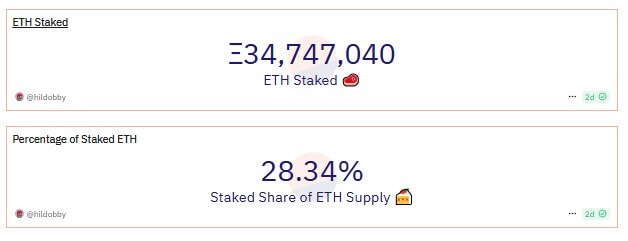

Beyond the updates, staking plays a crucial role in increasing supply. With 34.7 million ETH locked, or 28 % of total supply, the rewards allocated to validators accumulate, amplifying inflation. According to David Han, an analyst at Coinbase, this dynamic is intensified by the ” restaking “.

By reinvesting their earnings via protocols like EigenLayer, users participate in an inflationary loop.

This trend illustrates a double reality:

- Enhanced security : the transition to Proof-of-Stake has solidified the network;

- Increased emissions: each staked ETH produces more tokens, complicating supply management.

For the ecosystem, this unstable balance raises questions about the long-term viability of this monetary policy in a context of increased competition with other altcoins.

Thus, crypto investors are closely monitoring Ethereum’s inflation, between challenge and opportunity. In August 2022, an inflationary peak had already sown the fear of a price drop in its ecosystem. Today, these fluctuations remain a strategic puzzle for ETH network enthusiasts and its ambitions.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.