In the complex world of trading, understanding and analyzing market trends are essential for success. Among the various tools of technical analysis, the Hurst cycle stands out for its ability to predict market movements based on historical trends. This article explores in detail the Hurst cycle, starting with its fundamental principle, its advantages, and its practical application in trading.

Finance

Trading on financial markets requires precise analysis and a deep understanding of market trends. Technical indicators are essential tools in this process. They provide key information to guide trading decisions. However, with the multitude of indicators available, it can be difficult for traders to choose those that best suit their needs and strategies. This article offers a clear guide on the most popular technical indicators, their selection, and optimal usage.

In the world of trading, moving averages stand out as prominent technical indicators. They allow traders to analyze short-term price fluctuations, providing a clearer view of market dynamics. However, their use requires a deep understanding and prudent interpretation. This article explores the fundamentals of moving averages, their different types, their limitations and pitfalls, as well as practical tips for their use.

In the dynamic world of trading, technical indicators play a crucial role in traders' decision-making. Among these tools, the Relative Strength Index (RSI) stands out for its versatility and effectiveness. This indicator helps assess the strength of market trends and identify potential reversal points. However, despite its popularity, the RSI presents challenges and limitations that traders must understand to use it effectively. This article explores the RSI in detail, from its functioning to its practical application, while highlighting the precautions to take to optimize its use in trading strategies.

Bollinger bands are a technical analysis tool that provides essential insights into volatility and price trends in financial markets. However, this widely recognized indicator requires a deep understanding to be used effectively. Overview of the specifics of Bollinger bands.

Support and resistance are levels at which prices stop on the chart, confronting buyers and sellers of the asset. Aiming to understand price movements, they serve as the foundation for stock market investment strategies. But how can these levels be identified? What are the advantages and limitations? How to trade cryptocurrencies using these indicators? The answers in this article.

Chartism is a graphical analysis technique of financial markets. Widely used in crypto trading, it is an essential decision-making tool. Will this digital currency rise or fall? When is the right time to buy or sell? Let’s discover everything there is to know about this analysis method in the crypto market.

The MACD is a leading technical indicator in the trading field. Used to analyze market trends, it helps traders make informed decisions based on price movements. However, despite its popularity, the MACD can sometimes be misunderstood or misused, raising questions about its interpretation and practical application. This article explores the MACD in detail, from how it works to its use in trading, including its advantages and limitations.

Blockchain technology, with its promise of decentralization and transparency, is paving the way for disruptive innovations in many fields. Among these innovations, a new business model stands out, offering a unique perspective on digital content consumption. Instead of spending money to access information, users are rewarded for their engagement and curiosity. This article reveals the ins and outs of Read to Earn and explains how it could reshape the content economy in the digital age.

Day trading is an increasingly popular practice in financial markets, attracting many investors due to its potential for quick gains. This form of trading involves buying and selling financial assets within the same day, exploiting short-term price fluctuations. However, despite its appeal, day trading carries risks and demands a thorough understanding of market strategies. This article reveals the fundamentals of day trading, its benefits, risks, and the tools needed to succeed with this strategy.

Scalping is one of the most well-known and widely used strategies in cryptocurrency trading. This technique can be highly profitable, provided that you have a solid understanding of it. Let’s explore what scalping entails and how you can significantly increase your profits using this strategy.

As financial markets continue to evolve, many individual investors seek ways to achieve gains while managing their busy schedules. This is where swing trading comes in. This medium-term trading strategy is known for its profit potential and flexibility. But how can one practice it successfully? This article outlines the basics of swing trading, its advantages and disadvantages, and the steps to practice it effectively.

The recent arrest of Telegram’s CEO, Pavel Durov, has shaken the crypto market, leading to a sharp 20% drop in the value of Notcoin. A Crypto Market Shaken by Pavel Durov’s Arrest Pavel Durov’s arrest has cast a shadow over the entire crypto market. Within…

The world of cryptocurrencies offers a multitude of investment opportunities, among which masternodes stand out as both intriguing and complex. These powerful nodes play a crucial role in maintaining the stability and efficiency of blockchain networks while offering potential rewards to their operators. However, setting up a masternode involves specific challenges, including significant initial investment, technical knowledge, and ongoing management. This article provides a comprehensive guide for those considering venturing into the masternode world, covering each step from selecting the appropriate cryptocurrency to the daily maintenance of the masternode.

The world of cryptocurrencies offers unique investment opportunities, notably through masternodes. These key components of blockchain networks not only support cryptocurrencies but also offer possibilities for passive income. However, given the diversity of available options, identifying the most profitable masternodes represents a real challenge for investors.

Cryptocurrency investors are constantly faced with crucial strategic choices, especially regarding the optimization of their investments. In 2023, two popular methods are available: masternodes and staking. Each offers unique advantages and specific challenges, making the choice difficult for investors. This article explores in detail masternodes and…

Masternodes attract investors' attention for their potential income and significant role in blockchain networks. These nodes supporting cryptocurrency operations offer a unique combination of financial benefits and active network participation. However, they also come with risks related to cryptocurrency market volatility and technical requirements. This article explores in detail the advantages and risks associated with masternodes and provides concrete strategies to maximize potential benefits.

Learn about masternodes: earn by validating transactions on blockchains. Choose wisely to maximize profitability.

Cryptocurrency staking has become a popular income source for investors looking to profit from their digital assets. However, the resulting tax complexity is often underestimated, leading to costly errors when reporting to tax authorities. It's crucial to understand the distinction between staking rewards and capital gains, as well as the specifics of tax regulations per country to successfully file taxes. This article reveals some common mistakes to avoid and offers advice for effective tax management.

Cryptocurrency staking has become a popular method for digital currency holders to grow their assets. However, with the rise of this practice, the tax implications associated with staking have become a major concern for investors worldwide. Each country applies its own tax rules to staking, which can significantly impact returns. This article provides an overview of the taxation of staking in various jurisdictions in 2023, and offers practical advice for cryptocurrency investors to succeed in this complex and evolving field.

Cryptocurrency staking is an increasingly popular method to grow digital assets. By locking up cryptos to support the operation of a blockchain network, investors can receive regular rewards. However, in France, these gains are taxed and must be treated with the same rigor as any other type of income. This article will examine the tax implications of staking and unveil strategies to minimize taxes on these earnings.

Staking cryptocurrencies is becoming increasingly popular among investors looking to profit from their digital assets. By locking up cryptos to support the functioning of a blockchain network, investors receive rewards in return that increase their digital portfolio. However, these rewards are not exempt from tax obligations and must be declared like any other type of income. This article will guide you through the tax implications of staking and provide a detailed procedure for declaring these incomes.

Staking cryptocurrencies is an increasingly popular practice among investors seeking passive income. By locking their digital assets to support the operation of a blockchain network, they can receive regular rewards. However, in France, these incomes are subject to tax, and it is essential to understand the legislation to avoid unpleasant surprises. This article deciphers the tax obligations related to staking, explores recent developments in the finance law, and provides practical advice for optimal tax management.

Cointribune and Huahua team up to reward reading with $HUAHUA tokens! Get involved and earn crypto today.

Staking has become an essential practice for cryptocurrency holders. It allows them to actively participate in validating transactions on blockchain networks. This technique, which involves locking a certain amount of digital currency to support a network's operation, offers attractive rewards. However, to make the most of it, it is imperative to understand how it works, its advantages, as well as the associated strategies and risks. Let's take a look at the benefits of this activity and strategies to maximize the gains it offers.

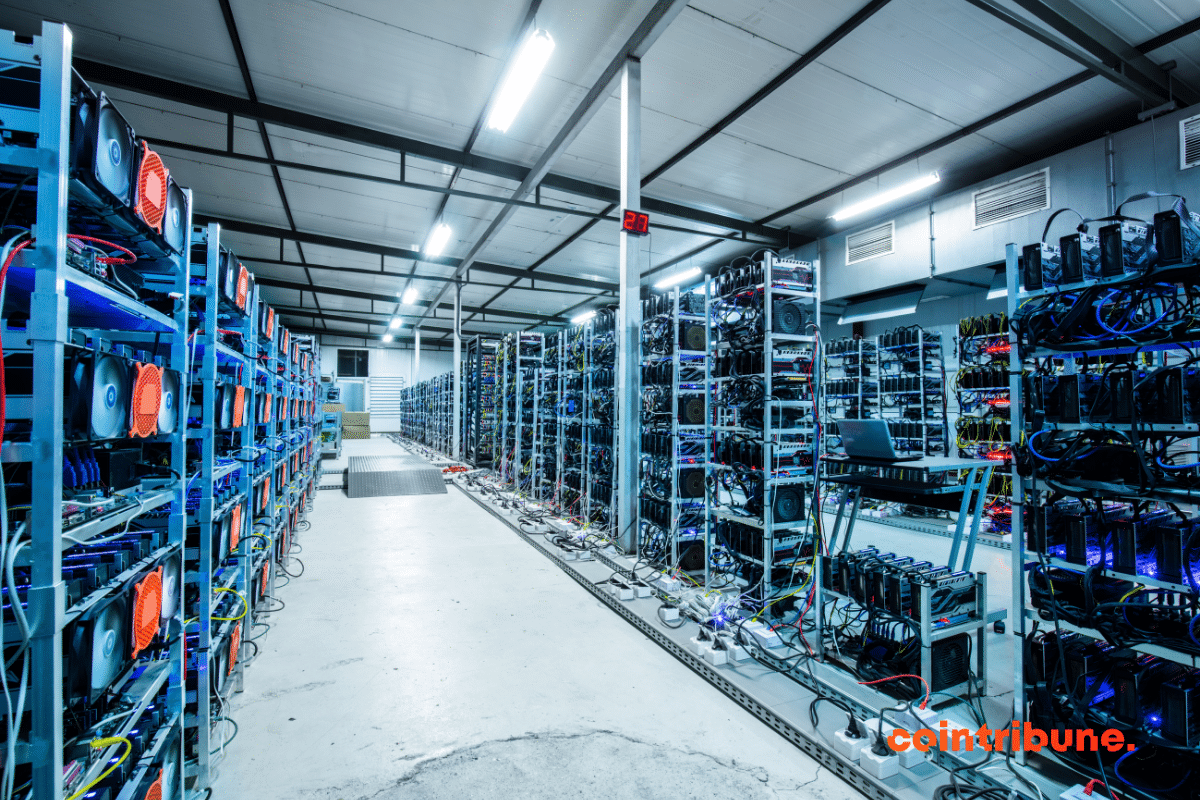

In the world of cryptocurrencies, staking and mining are two key strategies for increasing one's digital assets. While mining relies on computational power to secure the network and validate transactions, staking involves holding funds in a cryptocurrency to support the integrity of the network. This article compares these two methods in detail, exploring their techniques, profitability, and associated risks. Whether you're a seasoned investor or a newcomer to the crypto industry, understanding the nuances between staking and mining will allow you to optimize your investments and navigate the crypto ecosystem with confidence.

Cryptocurrency staking has become a popular practice for those looking to profit from their digital assets. It involves locking cryptocurrencies to support the operation and security of a blockchain network and allows for the generation of passive income. This article is designed to guide beginners through the fundamentals of staking. It explains how it works, the steps to get started, strategies to maximize gains, and pitfalls to avoid.

Making money in the crypto universe isn’t just about trading or mining. There are other ways to generate income, notably staking. Staking allows holders of cryptocurrencies whose blockchain uses the proof of stake (PoS) mechanism to earn money. If you want to grow your money while being environmentally friendly, crypto staking is ideal. Follow along in this article to fully grasp its functioning, its advantages, and the potential profits of this very interesting activity.

Trading in financial markets is a complex and dynamic activity, requiring not only a deep understanding of the markets but also access to the right tools. In this rapidly evolving environment where information and trends change swiftly, having the best trading tools is a must to remain competitive and effective.

Technical analysis is a fundamental component of trading, allowing investors to navigate the financial markets insightfully. It is based on studying price movements and trading volumes to predict future trends. This article aims to demystify technical analysis by explaining its basic principles, essential tools and indicators, how to read and…