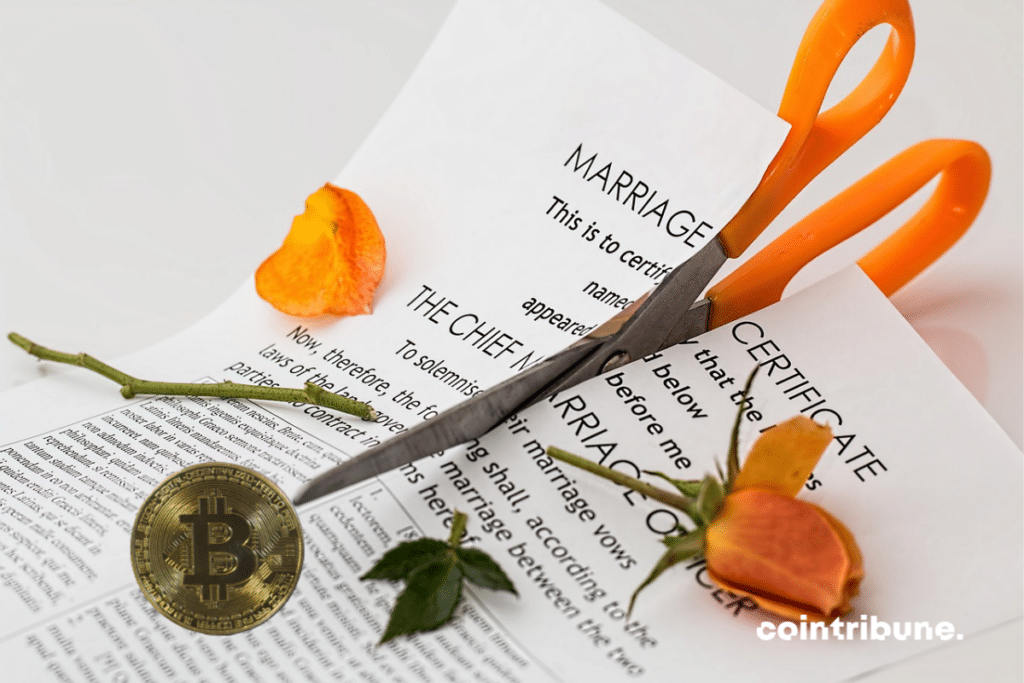

Crypto: A growing problem in divorce cases

In the tumultuous arena of crypto, Bitcoin reigns supreme. However, its omnipresence is starting to reveal itself in an unexpected light: it has become a key player in divorce proceedings. The consequences of this intrusion into the marital sphere are raising new legal and ethical questions.

Divorce proceedings biased by the concealment of bitcoins?

This is a new trend in the United States. Bitcoin (BTC) has become one of the most significant issues in divorce cases. This situation suggests two complementary observations.

The first is that in these proceedings, which typically involve an assessment of assets, digital assets are rarely taken into account. As a result, assets such as Bitcoin, which hold substantial value, are rarely included in the assets to be divided.

This brings us to the second observation, which is that many spouses, often women, find themselves deceived. Particularly when, once the proceedings are concluded, they discover the existence of assets worth a literal fortune. This is what Sarita (a pseudonym) experienced.

Indeed, this New Yorker was taken aback when she discovered, in the midst of her divorce, that her husband owned 12 bitcoins. At the current exchange rate, this amounts to approximately $330,000. A small fortune that would have been worth its weight in gold in the proceedings. And this case is likely not an isolated incident.

Another issue for crypto regulation?

This is a social phenomenon that the law currently fails to adequately address. This is particularly what Kelly Burris, a divorce lawyer, explained. According to her, these situations pose a problem: the tracking of a partner’s digital assets.

The issue is further compounded when a divorce proceeding is initiated because the very nature of the blockchain makes concealing these assets outrageously easy and effective.

“The thing with crypto is it’s not regulated by any kind of centralized bank, so usually you can’t subpoena somebody and get documents and information related to somebody’s crypto holdings,” explains Burris.

In conclusion, crypto are so effective that they allow individuals to protect their assets potentially at the expense of their spouse. This is an entire aspect that crypto regulation must address. However, it is unlikely to happen anytime soon.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.