Coinbase Practical Guide: How To Trade On Coinbase?

In a world where cryptocurrencies play an increasingly important role in digital economies, Coinbase has established itself as an essential platform. With its simplicity and varied features, it allows users to buy, sell, and trade digital assets with complete confidence. This comprehensive guide provides you with the keys to mastering trading on Coinbase, whether you are a beginner or an experienced user.

Introduction to Coinbase and Crypto Trading

Coinbase is one of the most popular platforms for exchanging cryptocurrencies. Launched in 2012, it was designed to simplify access to a complex market, focusing on security and intuitiveness. Today, it has millions of users worldwide.

The trading on Coinbase offers an ideal entry point for novices thanks to its clear interface. It offers a wide selection of digital assets such as Bitcoin, Ethereum, and stablecoins like USDC. In addition to these basic features, the advanced version, Coinbase Advanced, allows experienced traders to explore more complex tools.

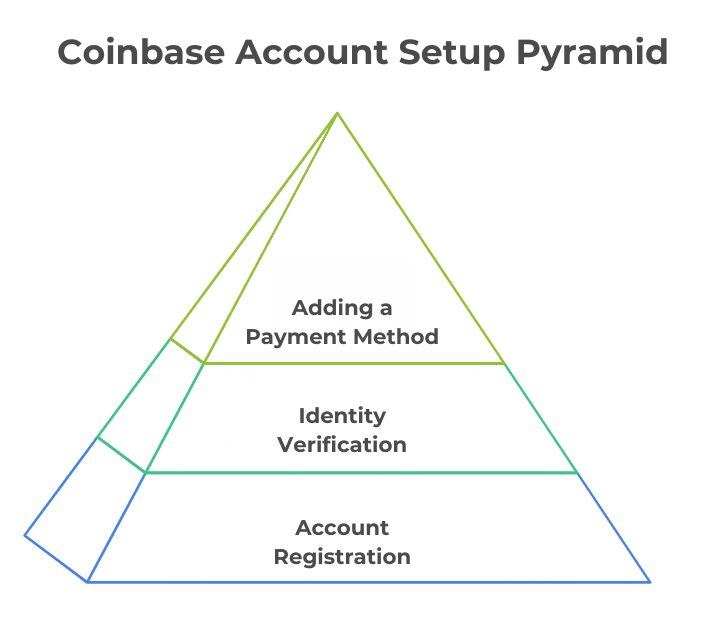

Creating a Coinbase Account: The First Steps

To access Coinbase’s trading services, it is essential to create an account. This process, although straightforward, includes several steps aimed at securing your information and funds.

Registering on the Platform

Start by going to the website or the Coinbase mobile app. Click on “Sign Up” and provide the requested information: name, email address, and password. Once this data is submitted, you will receive an email to verify your account. It is advisable to choose a complex password to secure your assets.

Identity Verification

To ensure compliance with international regulations, Coinbase requires identity verification. Upload an official ID and provide a phone number to activate two-factor authentication (2FA). This step is essential to ensure the security of transactions.

Adding a Payment Method

Once your account is verified, link a payment method. You can use SEPA bank transfers, credit cards, or PayPal depending on your location. Transfers are often preferred for their lower fees, while cards allow for quick deposits.

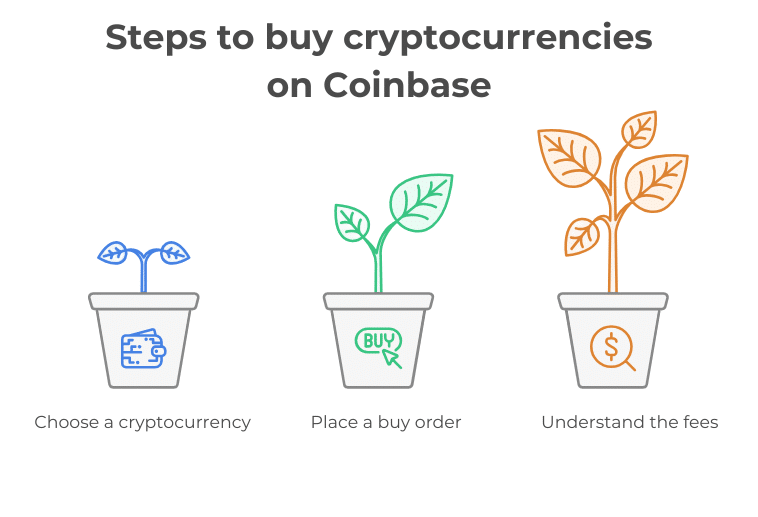

Buying Cryptocurrencies on Coinbase

Buying cryptocurrencies is the first step towards trading. Coinbase offers a smooth process for acquiring your digital assets.

Choosing a Cryptocurrency

In the “Buy/Sell” section, select a cryptocurrency from the available options. Coinbase offers a wide range of assets, from the most popular currencies like Bitcoin to lesser-known altcoins.

Placing a Buy Order

Specify the amount you wish to invest. You can buy based on a fixed amount or a specific quantity of assets. Coinbase displays the associated fees before confirmation, offering transparency on the total cost of the transaction.

Understanding Purchase Fees

Coinbase applies fees based on the payment method and purchase volume. These fees may seem high compared to other platforms, but they include a secure service and an intuitive interface.

Selling and Exchanging Cryptocurrencies on Coinbase

After acquiring your cryptocurrencies, you may decide to sell or exchange them to diversify your portfolio or recoup funds.

Selling Your Cryptos

To sell your assets, go to the “Buy/Sell” section, select “Sell,” and specify the amount to liquidate. The funds will be converted into fiat currency and credited to your Coinbase wallet. This allows for easy withdrawal to your bank account.

Exchanging Cryptos

Coinbase allows you to exchange one cryptocurrency for another. This feature is ideal for adjusting your portfolio according to market trends or investment opportunities.

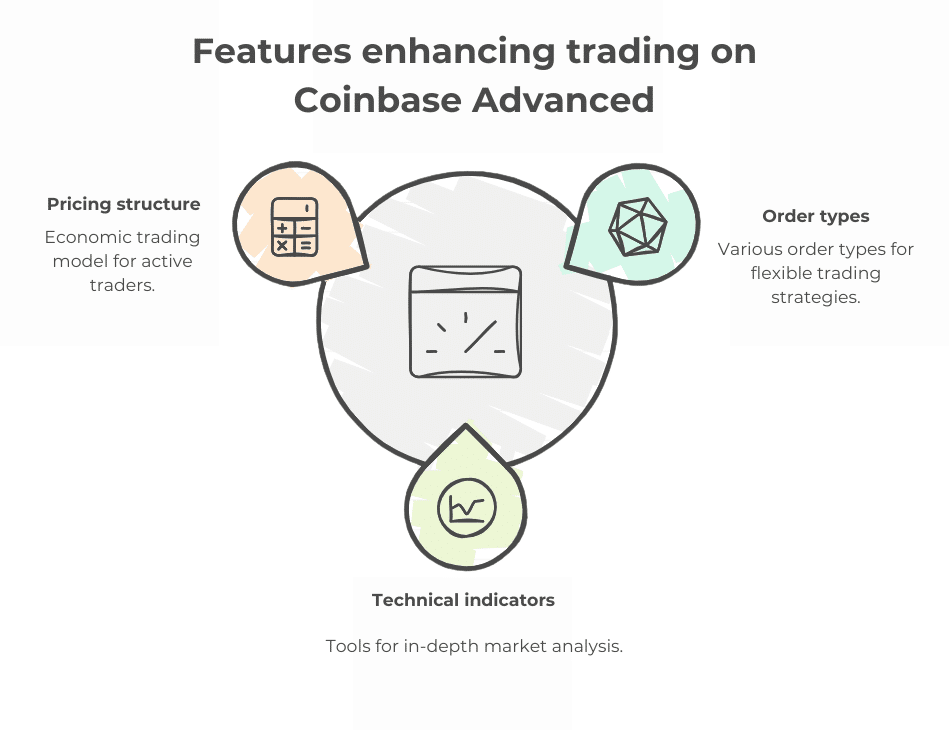

Explore Coinbase Advanced for Advanced Features

Coinbase Advanced is an advanced trading platform designed for traders looking to access sophisticated features. It stands out with an interface focused on analysis and developed trading strategies, suitable for both casual and professional traders. The platform offers powerful tools and a fee structure suited for frequent transactions. Here’s an overview of the main features offered by Coinbase Advanced.

The Different Types of Orders

Coinbase Advanced offers a variety of orders to meet various trading strategies:

- Market orders: these orders are executed immediately at the best available price on the market, allowing for quick transactions;

- Limit orders: they allow you to set a specific price at which to buy or sell an asset, offering precise control over transactions. The order will only be executed if the market reaches the set price;

- Stop-limit orders: these orders combine the features of stop orders and limit orders. They are used to limit losses or protect gains in the event of unexpected market fluctuations.

This flexibility allows traders to adapt their strategies based on market conditions.

Charts and Technical Indicators

Coinbase Advanced integrates interactive charts developed by TradingView, offering in-depth market analysis. Users have access to a range of technical indicators, including:

- Simple (SMA) and Exponential (EMA) Moving Averages: they help identify market trends by smoothing price fluctuations;

- Relative Strength Index (RSI): this indicator measures the speed and change of price movements, helping to identify overbought or oversold conditions;

- Bollinger Bands: they provide insights into market volatility and potential price levels.

These tools allow traders to develop informed strategies based on precise and real-time data.

Reducing Trading Fees

Coinbase Advanced uses a “maker-taker” fee model to determine trading fees. Orders that provide liquidity (maker orders) are charged differently from orders that take liquidity (taker orders).

Fees are calculated based on your current pricing tier at the time of the order, not on what you would qualify for once the transaction is complete. You can check your fee tier at any time, as it is recalculated every hour based on your total transaction volume. This advantageous fee structure encourages active trading while limiting the impact of fees on profits, making the platform ideal for regular traders.

In summary, Coinbase Advanced offers a comprehensive range of features and tools suited to the needs of traders looking to optimize their strategies and maximize their gains.

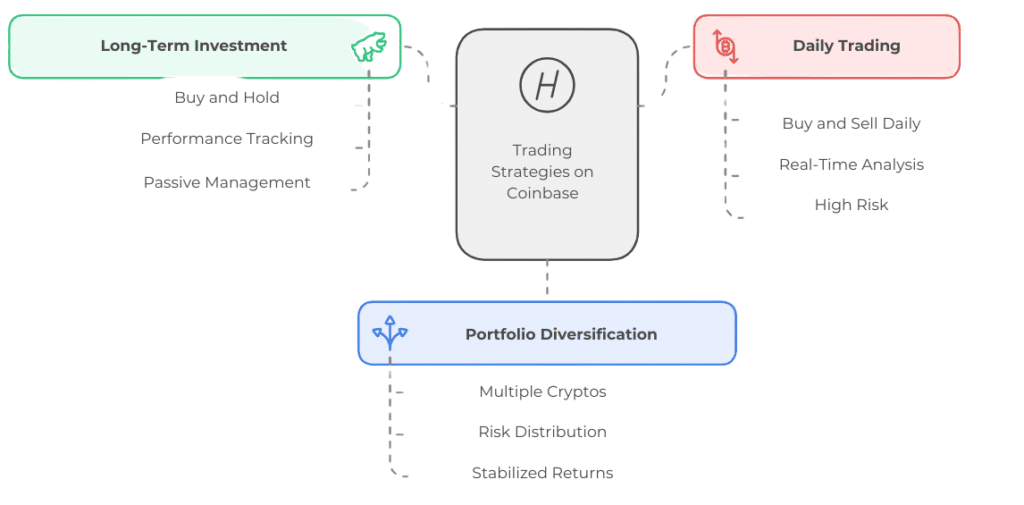

The development of trading strategies on Coinbase

An appropriate strategy is essential for effectively navigating the cryptocurrency market. Every investor must set clear goals and assess their risk appetite before diving in. Coinbase offers tools and features that facilitate the implementation of various trading approaches, whether it’s long-term investments or more active trading. Here are three common strategies to consider.

Long-term investment

Long-term investment involves purchasing cryptocurrencies and holding them over an extended period, often several months or years. This approach is based on the assumption that the value of digital assets, such as bitcoin or ethereum, will increase over time due to the growing adoption of cryptocurrencies.

Users on Coinbase can take advantage of this strategy by using performance tracking tools to assess the evolution of their portfolio. This method is particularly suitable for investors seeking passive management.

Day trading

Day trading, or daily trading, aims to profit from short-term price fluctuations. Traders buy and sell cryptocurrencies within the same day to maximize gains from minor variations. This strategy requires constant market analysis and quick decision-making.

Coinbase Advanced is ideal for this type of trading due to its real-time charts and advanced order options. However, this approach carries more risks and requires strict discipline to avoid significant losses.

Portfolio diversification

Diversifying your portfolio means investing in multiple cryptocurrencies to spread risk. Instead of concentrating your investments on a single asset, such as bitcoin, you can include stablecoins, ethereum, or emerging cryptocurrencies.

This method reduces the impact of value declines on a single asset and stabilizes overall returns. Coinbase facilitates diversification with its broad selection of cryptocurrencies and its analysis tools that allow tracking the individual performance of assets.

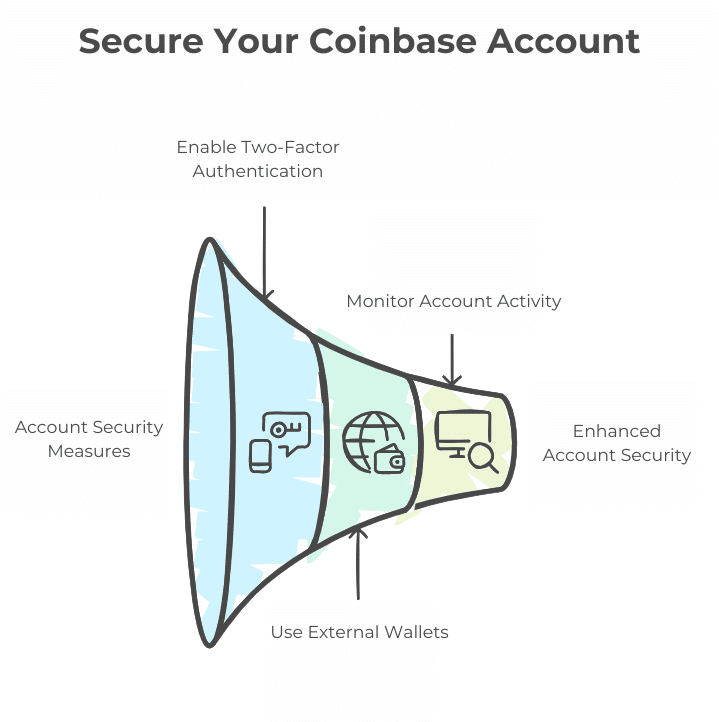

How to secure your Coinbase account?

Security is a key element of any activity on a trading platform. Coinbase offers several tools and recommended practices to ensure the protection of your funds and personal information. These measures help minimize risks related to cyberattacks or human errors.

Enable two-factor authentication

Two-factor authentication (2FA) is an effective method to enhance the security of your Coinbase account. In addition to your password, this feature requires a unique code sent via SMS or generated by an app, such as Google Authenticator. Even if your credentials are stolen, this protection prevents unauthorized access. Enable this option in your account settings to significantly reduce hacking risks.

Use an external wallet

To maximize the security of your digital assets, it is advisable to transfer your funds to a cold wallet. These offline wallets, such as Ledger or Trezor, are isolated from the Internet, making them less vulnerable to cyberattacks. Once your cryptocurrencies are withdrawn from Coinbase, they become inaccessible to online hackers, providing additional peace of mind for long-term holders.

Avoid unauthorized access

Regularly monitor the logins to your account for any suspicious activity. Check IP addresses or connected devices from your Coinbase dashboard. Frequently change your password by choosing a complex and unique combination. Avoid using the same passwords across multiple sites to minimize the risk of intrusion. Finally, prioritize connections on secure networks to protect your data.

Comparison between Coinbase and its competitors

In the world of crypto trading platforms, Coinbase holds an important place thanks to its user-friendly interface and security standards. However, its main competitors, such as Binance and Kraken, stand out for other advantages. Here is a thorough comparison of the features of these platforms.

Binance

Binance attracts users with its highly competitive transaction fees, especially for frequent traders. The platform offers an impressive selection of cryptocurrencies, including rare tokens. Advanced trading tools, such as interactive charts and margin trading options, appeal to experienced users.

However, its complex interface may discourage beginners, who might feel overwhelmed by the range of available features. Therefore, Binance is more suited for users who already have some experience in the field.

Kraken

Kraken focuses on reliability and sophisticated trading tools. With features like staking and leveraged trading, this platform perfectly meets the expectations of experienced traders. Kraken’s customer service is known for its responsiveness, making it a preferred option for those seeking quality support.

Nevertheless, its interface requires an adjustment period, which may slow down new users during their initial trades. This platform is ideal for investors looking for technical performance.

Coinbase

Coinbase, on the other hand, remains the benchmark for beginners due to its accessibility and simplicity. Its reputation for security, with options like two-factor authentication and cold storage, reassures users.

Although its fees are often higher, the platform compensates with a smooth user experience and a vast resource base. Coinbase is suitable for those who prioritize an intuitive approach while ensuring a secure trading environment.

Trading on Coinbase is an accessible and rewarding experience. With its intuitive interface and educational tools, the platform makes entering the world of crypto easy and secure. Whether you are a beginner or experienced, it is essential to consider the Coinbase fees to optimize your transactions. This guide will help you navigate the platform better and refine your investment strategies. By staying informed and taking a thoughtful approach, you will maximize your opportunities in this ever-evolving landscape.

FAQ

No, Coinbase requires identity verification for security and compliance with international regulations. This step is required to access all features, including deposits, withdrawals, and transactions.

Yes, you can control your spending on Coinbase by adjusting transaction limits in your account settings. You can set a maximum amount for purchases or withdrawals to manage your budget effectively.

Yes, Coinbase allows you to track your portfolio’s performance in real time. You can view changes in the value of your assets, analyze returns, and export reports for detailed tracking.

No, once a transaction is confirmed on Coinbase, it cannot be reversed. This is a characteristic of blockchains, where validated transactions are irreversible. Be sure to double-check the details before confirming a transaction.

Coinbase offers support through a detailed online FAQ, automated chat, and email support. Users with Coinbase One receive priority support for faster, more personalized responses.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

The contents and products mentioned on this page are in no way approved by Cointribune and should not be interpreted as falling under its responsibility.

Cointribune strives to communicate all useful information to readers, but cannot guarantee its accuracy and completeness. We invite readers to do their research before taking any action related to the company and to take full responsibility for their decisions. This article should not be considered as investment advice, an offer, or an invitation to purchase any products or services.

Investment in digital financial assets carries risks.

Read more