Coinbase Card: The Complete Guide To Understanding Everything

The Coinbase card stands out as an essential tool for integrating cryptocurrencies into everyday life. Designed to combine simplicity and flexibility, it allows users to use their digital assets like traditional currency, facilitating payments and withdrawals on a global scale. The services and features of the Coinbase card, such as instant payments and cryptocurrency rewards, appeal to both beginners and experienced users. In this guide, discover everything you need to know about its operation, fees, as well as its advantages and limitations.

What is the Coinbase card?

The Coinbase card is a debit card issued by the VISA network, allowing users to use their cryptocurrencies for payments or withdrawals. Directly linked to the user’s Coinbase account, it automatically converts cryptocurrencies into fiat currency for each transaction. Its main objective is to simplify the adoption of cryptocurrencies by making their use as seamless as that of a traditional bank card.

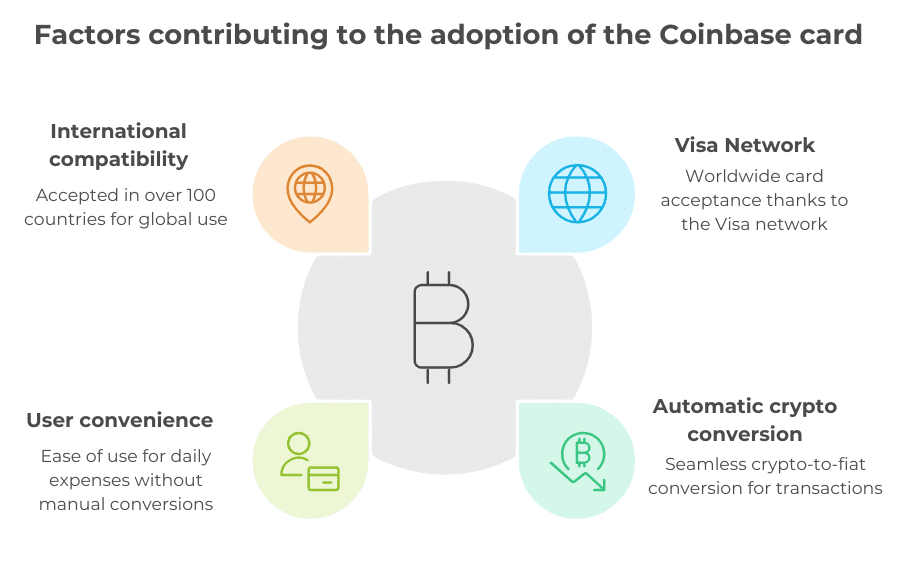

Why choose the Coinbase card?

The Coinbase card is aimed at users looking to integrate their cryptocurrencies into their daily expenses. It offers a simple solution for spending digital assets without having to manually perform conversions or bank transfers. Whether for online purchases or in-store payments, this card combines technological innovation with practicality.

International compatibility

Thanks to its integration with the VISA network, the Coinbase card is accepted in over 100 countries. It can be used at millions of points of sale, from physical stores to e-commerce sites. This global compatibility makes it a versatile tool for regular users as well as travelers.

How does the Coinbase card work?

The Coinbase card simplifies the use of cryptocurrencies for daily payments. By integrating modern features and automatic conversion, it offers a seamless and convenient experience for its users.

A simplified use

The Coinbase card functions like a standard debit card. During a transaction, the platform performs an instant conversion of the chosen cryptocurrency into euros or the local currency. This conversion occurs automatically at the time of payment, requiring no additional intervention from the user.

Multiple payment methods supported

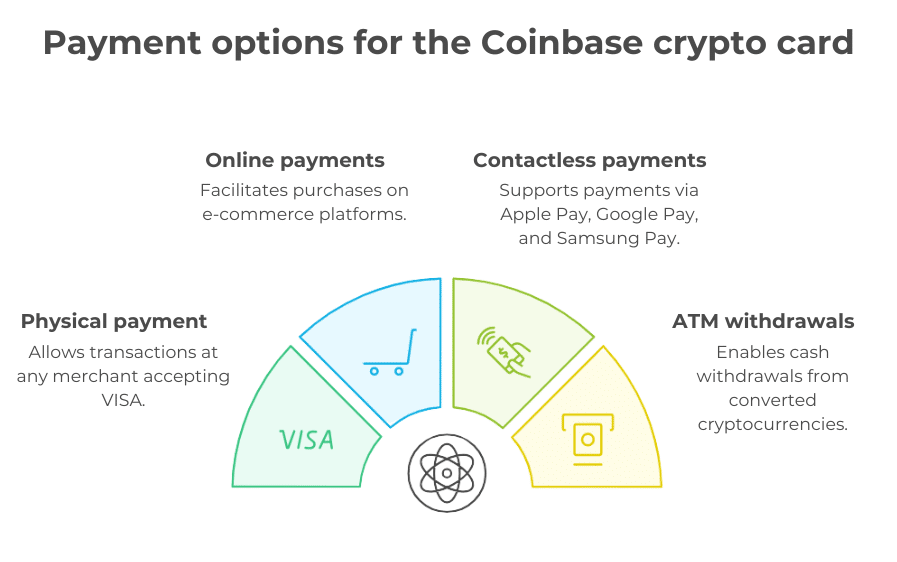

The Coinbase crypto card offers several payment methods:

- Physical payments: transactions are accepted by all merchants accepting the VISA network.

- Online payments: the card allows for easy purchases on e-commerce platforms.

- Contactless payments: compatible with Apple Pay, Google Pay, and Samsung Pay, it offers a modern and quick option.

- Withdrawals at ATMs: users can withdraw cash directly from their converted cryptocurrencies.

These options ensure maximum flexibility for all types of transactions.

Automatic conversion

When making a purchase or withdrawal, the card automatically selects the available cryptocurrency in your account. If you have multiple assets, you can set a priority in the Coinbase app. This allows for optimized management according to your preferences.

How to obtain and activate the Coinbase card?

The Coinbase card is available to all eligible users of the platform. Its ordering process is quick, accompanied by an option for a virtual card for immediate use.

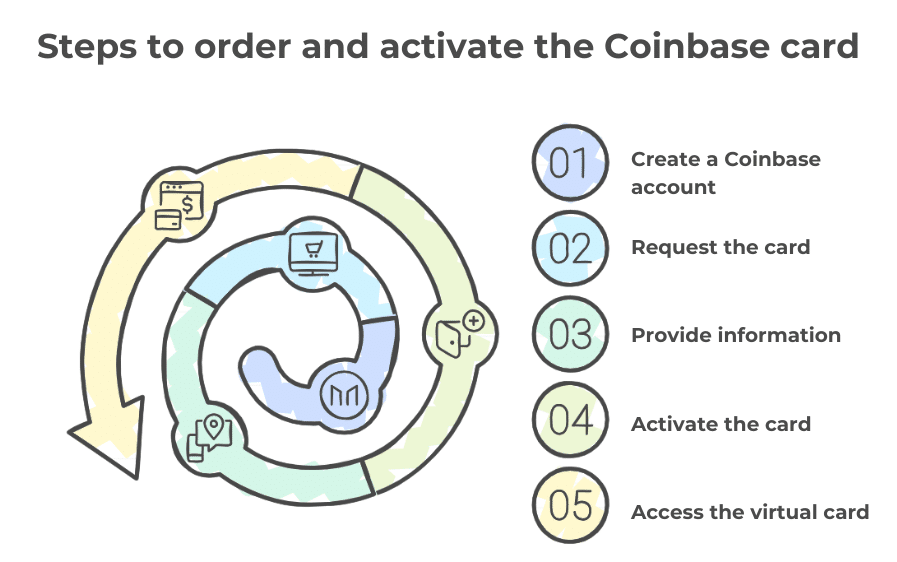

Steps to order the card

Ordering the Coinbase card is simple and fast. Here are the steps to follow:

- Create a Coinbase account: sign up on the platform and complete the identity verification process (KYC).

- Request the card: go to the “Card” tab in the app or on the website, then click “Order”.

- Provide necessary information: supply your address for sending the physical card.

- Activate the card: once received, activate it via the app to start using it.

Once the order is confirmed, the virtual card becomes instantly available in the Coinbase app. It allows for online payments or using contactless services like Apple Pay and Google Pay.

This virtual version offers a convenient solution to start enjoying the features of the card without waiting for its physical receipt. This is particularly useful for users who wish to conduct transactions quickly.

Delivery time

The physical card is typically shipped within 4 weeks. This timeframe may vary slightly depending on the shipping address and logistical constraints. Meanwhile, users can continue using the virtual card for their daily payments. This seamless transition ensures a smooth experience, even before receiving the physical card.

What are the fees associated with the Coinbase card?

The Coinbase card is distinguished by its transparency regarding fees, offering clear and affordable terms for daily use. However, some specific costs must be considered depending on the types of transactions.

Management fees

The Coinbase card is designed to minimize fixed costs for its users. Here are the main elements:

- Card issuance: free, whether for the physical or virtual version.

- Card replacement: no fee for a lost or stolen card.

- Monthly or annual management: no additional charges.

These conditions make it an accessible card for everyone, with no subscription fees.

Transaction fees

Transactions made with the Coinbase card are subject to the following fees:

- Payments in cryptocurrencies: transactions involving a conversion are charged at 2.49%.

- ATM withdrawals: a fee of 1.5% applies in addition to any costs imposed by the ATM operator.

- Exchange fees: a surcharge of 2.5% applies to payments in a currency different from that of the country of use.

These fees charged by Coinbase must be taken into account, especially for users making frequent cryptocurrency payments.

Transaction limits

- Daily limits: withdrawals are limited to 1,000 euros per day.

- Number of transactions: up to 6 withdrawals per day are allowed.

These limits ensure responsible use while meeting daily needs.

What are the advantages and disadvantages of the Coinbase card?

The Coinbase card offers an innovative solution to integrate cryptocurrencies into daily life, but it also has limitations to consider before adopting it.

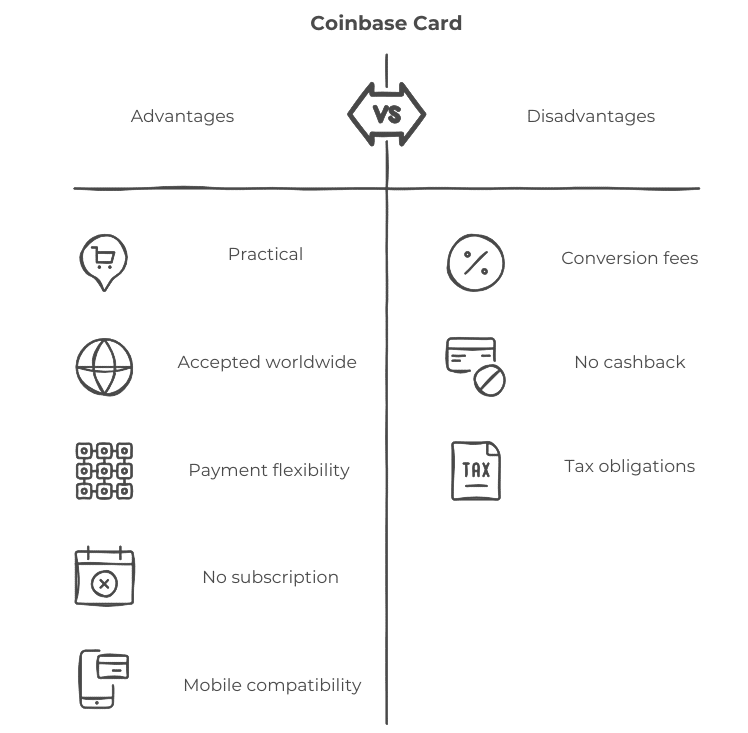

Advantages

The Coinbase card is a practical alternative to integrate cryptocurrencies into everyday transactions. It is accepted in more than 100 countries thanks to the partnership with the VISA network, ensuring global accessibility. Its flexibility is a major asset, as it allows making purchases in both cryptocurrencies and fiat currencies, according to the user’s preferences.

Moreover, no monthly or annual subscription is required, which reduces fixed costs for users. Compatibility with modern solutions like Apple Pay, Google Pay, and Samsung Pay offers great convenience for mobile payments. Additionally, a virtual card is available immediately upon ordering, allowing users to utilize its services without waiting for the delivery of the physical version.

Disadvantages

Some disadvantages deserve mention regarding the Coinbase card. To start, the 2.49% conversion fee on cryptocurrency transactions may discourage frequent use, especially for active users. Unlike some competing cards, the Coinbase card does not offer any cashback program (except for U.S. users), which limits benefits for everyday spending.

Finally, the tax obligations associated with using cryptocurrencies for payments can complicate administrative procedures, as every conversion to fiat must be reported for capital gains realized.

These elements show that while the Coinbase card presents undeniable advantages for those who wish to use their cryptocurrencies daily, it remains less competitive in certain aspects for regular or intensive users.

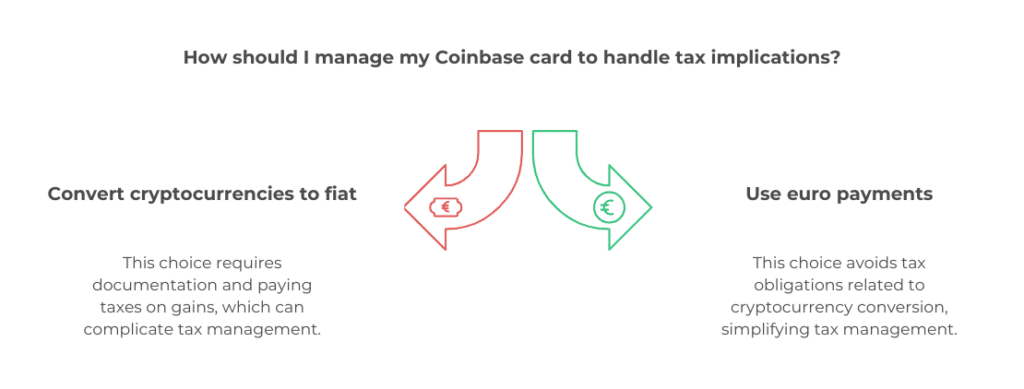

What are the tax implications?

Using the Coinbase card entails specific tax obligations, particularly in France. Understanding these rules is essential to avoid penalties or administrative complications.

Obligations in France

In France, each conversion of cryptocurrencies to fiat currency, such as the euro, is classified as a taxable event by the authorities. This categorization implies that each transaction must be documented and declared in the annual tax return. Users must calculate and pay taxes on realized capital gains, even for minor transactions made with the Coinbase card.

These obligations make regular use of the crypto card complex for users who do not master the nuances of the tax related to digital assets. Declaring your Coinbase income for taxes then becomes a crucial step to ensure compliance. Complete transparency and rigorous documentation of transactions made with the card are essential to avoid any tax disputes.

Possible Simplifications

To avoid tax complications related to cryptocurrency conversions, users have the option to make payments only in euros. By funding their Coinbase account through a SEPA transfer, they bypass the reporting obligations for cryptocurrency transactions.

This method allows users to benefit from the advantages of the Coinbase card while reducing the risks of tax errors or administrative burdens. It is particularly suitable for users who wish to use the card without complicating their tax management.

Taxation remains a central aspect to consider for regular users of the Coinbase card. Proactive management and knowledge of the current rules are essential to maximize the advantages of the Coinbase crypto card while avoiding legal or financial inconveniences.

The Coinbase card marks an important step in integrating cryptocurrencies into daily life. With its international accessibility, its direct link to the Coinbase account, and the absence of fixed fees, it constitutes a practical solution for occasional users. However, its conversion fees and lack of cashback programs limit its appeal for frequent transactions. Before adopting the Coinbase card, it is fundamental to evaluate your needs and understand the tax implications associated with its use. For a smooth transition to cryptocurrencies, it remains an interesting and widely praised option in reviews on Coinbase.

FAQ

No, the Coinbase card cannot be topped up directly with euros or other fiat currencies. It uses only the cryptos available in your Coinbase account for transactions, with automatic conversion to fiat at the time of payment.

No, the Coinbase card is exclusively linked to your Coinbase account. To use cryptos from another wallet, you must first transfer them to your Coinbase account.

Yes, the Coinbase application lets you define the order of priority of cryptos to be used when making payments. You can change these settings at any time to suit your preferences.

If your crypto balance is insufficient, the transaction will be refused. Make sure you have enough funds in the priority crypto or in another crypto set up to avoid this problem.

Yes, as a VISA card, it benefits from the network’s standard protections, notably against fraudulent or unauthorized payments. In the event of a problem, you can contact Coinbase support for follow-up and possible reimbursement.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The Cointribune editorial team unites its voices to address topics related to cryptocurrencies, investment, the metaverse, and NFTs, while striving to answer your questions as best as possible.

The contents and products mentioned on this page are in no way approved by Cointribune and should not be interpreted as falling under its responsibility.

Cointribune strives to communicate all useful information to readers, but cannot guarantee its accuracy and completeness. We invite readers to do their research before taking any action related to the company and to take full responsibility for their decisions. This article should not be considered as investment advice, an offer, or an invitation to purchase any products or services.

Investment in digital financial assets carries risks.

Read more