Coinbase Becomes The Largest Ethereum Node Operator

Ethereum is advancing at full speed with Proof of Stake (PoS), and guess who is in control of a significant part of the network? Coinbase. With 11.42% of the staked ETH, amounting to nearly $6.8 billion, the platform establishes itself as the largest node operator. Good news for stability… or the beginning of a future monopoly? Breakdown.

Coinbase, the boss of staking

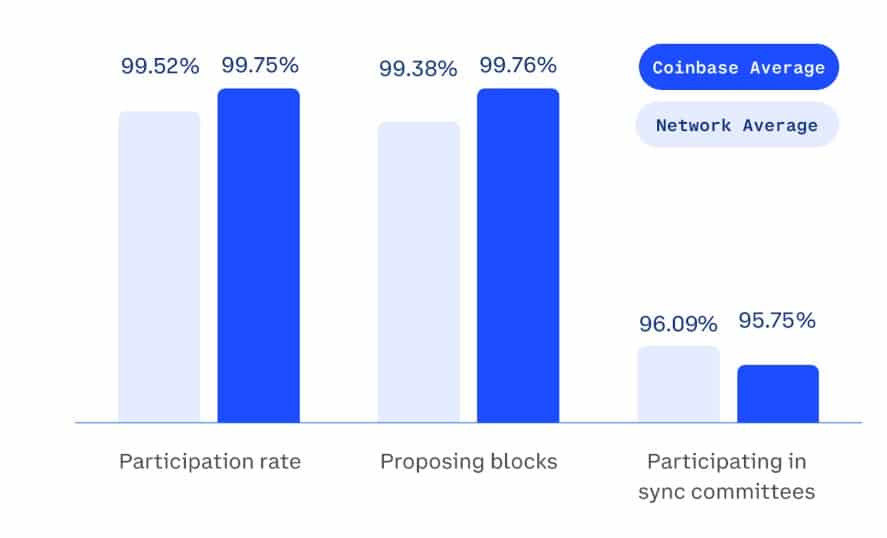

If you have ever tried to stake ETH, you know it’s a bit like planting a tree hoping it grows without too much maintenance. But Coinbase, on the other hand, has a whole forest: 120,000 validators work day and night to secure Ethereum. With a participation rate of 99.75%, let’s just say these validators don’t even take their weekends off.

It’s no coincidence that Coinbase stands out as the boss of node operators. While some staking protocols struggle to ensure proper availability, Coinbase is at the head of the class with near-perfect performance.

A giant that worries?

Of course, there’s always an elephant in the room (and here, it’s a mammoth): centralization. If Coinbase continues on this path, Ethereum could see its network controlled by a few big players. Sure, Lido remains the largest in total staking, but Coinbase is the largest single operator. And that makes you think…

On the other hand, the platform is trying to limit the damage by spreading its validators across several regions, notably Singapore, Germany, Ireland, Japan, and Hong Kong. Not yet the perfect decentralization, but it’s a start.

Good for Ethereum or not?

From a user’s point of view, seeing a player like Coinbase dominate staking has its advantages: more stability, less risk of slashing, easy participation. But by wanting simplicity too much, there’s a risk of a network that is too controlled, which goes completely against Ethereum’s decentralized spirit.

So, Coinbase, hero or villain of staking? The debate is open. What’s certain is that with such weight in the balance, the platform could well influence the future of staking and, in turn, the price of ETH, which indicators predict a drop below $1500. We’ll see if the Ethereum community will let it happen or if it will find a way to balance the forces. Game on!

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.