'Official' numbers show #China did not buy any #gold in May! Nothing lasts forever.@JanGold_, what does your data, including unofficial gold-buying, say?

— jeroen blokland (@jsblokland) June 7, 2024

(chart via @KrishanGopaul) pic.twitter.com/wPhGK8OHyC

A

A

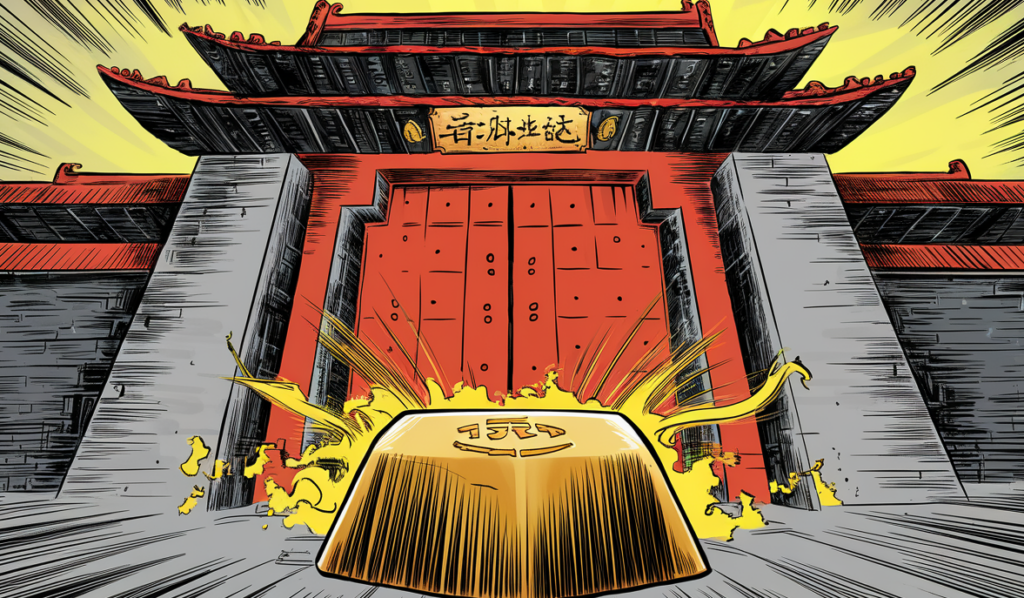

China Suspends Its Gold Purchases

Sat 08 Jun 2024 ▪

6

min read ▪ by

Getting informed

▪

Payment

The Chinese central bank significantly slowed down its gold purchases in May. Is this the beginning of a strategic shift? And what about Bitcoin?

1.

Change of Strategy?

2.

Why Do Central Banks Buy Gold?

Change of Strategy?

While India has just repatriated 100 tons of gold from London, China has sent the opposite signal. The Middle Kingdom seems to have stopped its gold purchases.

The latest figures show stagnation. Zero tons bought in April after only two tons in May. This is to be compared with the 225 tons consumed for the entire year of 2023.

Normally, no country buys as much gold as China. This dynamic started in 2002, the year of the U.S. invasion of Iraq. That is, right after Saddam Hussein decided to sell his oil in euros instead of dollars. Hence France’s opposition to the Iraq war, by the way. Another era…

This gold strategy was further reinforced in 2008, when the Fed started its money printing (Quantitative Easing). China now holds 2,264 tons of gold, compared to 400 tons in 2002.

The other countries that have significantly increased their gold reserves in recent years include Russia, India, Singapore, Poland, and Turkey.

Many smaller nations are also active behind the scenes. For example, the Czech Republic has been continuously accumulating for the past 18 months. Its reserves now reach 40 tons.

With over 8,000 tons, the United States owns more than any other country. They are followed by Germany, Italy, France, and Russia.

Why Do Central Banks Buy Gold?

Because the West and the Sino-Russian tango are playing a dangerous game in Ukraine and Palestine. The situation strongly resembles a cold war, if not worse.

Gold allows China to store the gains from its significant trade surpluses. It is a substitute for the dollar. Its dollar reserves (in treasury bonds) have melted by $50 billion in the first quarter.

That said, let us note that gold represents only 5% ($170 billion) of its total foreign exchange reserves. This is less than the world average of 20%:

The freezing of Russian reserves (mainly euros) also encourages Beijing to diversify. And given the statements of Chinese senior officials at the security conference in Singapore, it is unlikely that Beijing has changed its stance.

Moreover, it is not uncommon for the Chinese central bank to cease communicating its gold purchases. Its reserves are generally revealed in bursts, every five years. However, it is true that the PBOC has changed its approach since 2022. The amount of its gold stocks has since been updated monthly.

This is why the significant slowdown in May is causing a buzz. The gold market immediately reversed when the news broke.

In Search of a New Reserve Currency (Bitcoin…)

The wars in Donbass and Gaza divide the international community into rival camps: the West (G7) on one side and the BRICS alliance on the other. Southern countries try to stay neutral, but Russia and China seem to be winning the hearts.

The crux of geopolitical tensions is actually American monetary hegemony. Let’s recall that World War II ended with the Bretton Woods agreements (gold/dollar standard). It is likely that nothing will get back to normal as long as the United States refuses to give up its exorbitant privilege.

The idea that the dollar will remain the supreme currency no matter what, “for lack of an alternative”, is losing ground. As the Russian president said on Friday at the St. Petersburg Economic Forum:

“In 2023, the share of the ruble for Russian export payments tripled and now reaches 39%. In collaboration with foreign partners, we will increase the use of national currencies […]. We are working to establish an independent payment system. A system sheltered from political pressures, abuses and external sanctions.”

Speaking of payment systems, the Saudi central bank joined the mBridge (CBDC) project this week. The latter is developed by China under the auspices of the Bank for International Settlements (BIS).

Saudi Arabia will become a full participant in this project launched in 2021 by the central banks of China, Hong Kong, Thailand, and the United Arab Emirates. It is a step closer to the end of the “petrodollar”…

The question now on everyone’s lips is this. Why join a project overseen by the BIS, a bank controlled by the West?…

Finally, let us emphasize that until proven otherwise, the only international payment system absolutely immune to censorship (unlike the SWIFT network) is Bitcoin. It also has the immense advantage of being both a currency (reserve), two in one.

Check out our article Thailand and China Abandon the Dollar for more information on mBridge.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

A

A

Bitcoin, geopolitical, economic and energy journalist.

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.