The Standing Committee of the 14th National People's Congress (NPC), China's top legislature, started its 12th session Monday in Beijing https://t.co/jST2yO4sYe pic.twitter.com/x1AYiTWE0C

— China Xinhua News (@XHNews) November 4, 2024

A

A

China: 3 Obstacles Threatening The Recovery Of The Economy

Tue 05 Nov 2024 ▪

4

min read ▪ by

Getting informed

▪

Invest

The Chinese economy is experiencing a worrying slowdown, despite recent stimulus measures introduced by the Xi Jinping government. Drastic decisions have not been enough to reverse the trend, and it is likely that billions of additional yuans will need to be injected to counter the crisis. Meanwhile, the National People’s Congress is busy developing a recovery plan with significant repercussions for the Chinese economy, pending the outcome of the American presidential election.

The Chinese economic challenge: between recovery and uncertainties

China is facing significant economic challenges, far beyond just real estate issues. Despite several measures deemed unacceptable such as interest rate cuts and loosening restrictions on home purchases, the markets remain skeptical.

The ongoing meeting of the National People’s Congress aims to design a new large-scale economic aid plan to revive Chinese growth. Analysts hope to see this plan include massive investments, particularly to support local communities and banks struggling with non-performing loans.

The three priorities of this economic recovery seem obvious:

- Strengthening support for heavily indebted local communities;

- Injecting 1 trillion yuan in aid to banks to stabilize the financial sector;

- Encouraging consumption by restoring confidence among Chinese households.

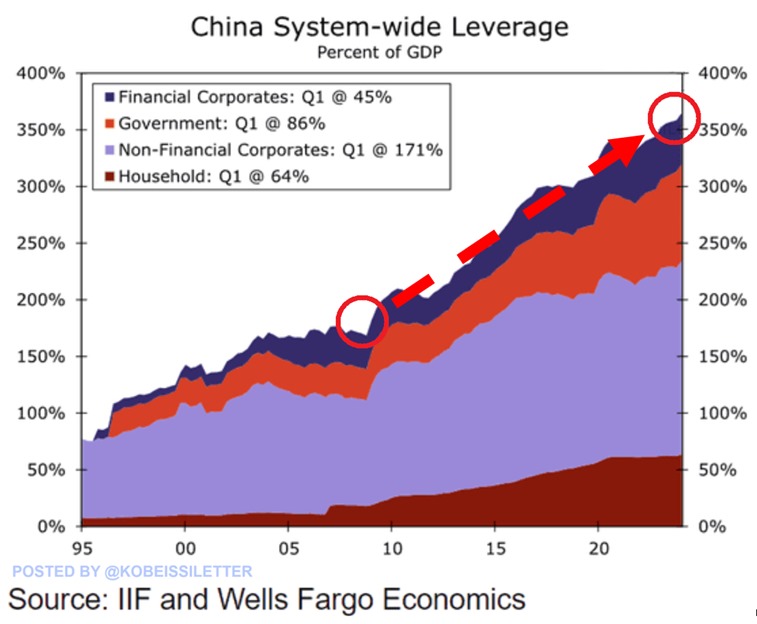

However, challenges remain: the real estate market is at a standstill, households prefer to save, and public debt continues to rise. An additional budget is therefore expected to give a boost to the economy, but uncertainties remain high regarding the effectiveness of this recovery.

Real estate crisis and effects of American foreign policy

The real estate crisis weighs heavily on the Chinese economy. Since the tightening of credit conditions in 2020, construction sites in China have multiplied, without completing initial projects, devaluing real estate assets. This depreciation discourages households from investing in property, while housing prices continue to fluctuate.

To revive this vital sector, Beijing recently announced an increase in credits to complete unfinished projects. Although real estate prices are showing some signs of recovery, consumer confidence in China remains fragile.

Simultaneously, the American election also influences Beijing’s strategy. A victory for Donald Trump could increase the pressure on China, with the threat of higher tariffs on Chinese exports.

In this context, economists estimate that China may be forced to further strengthen its recovery plan to cushion against possible external shocks. According to economist Ting Lu, if Trump were to win the election, the magnitude of assistance could increase by 10 to 20% to counter an unfavorable American economic situation.

Let us not forget that China’s political decisions can reshape the global economy, and its current choices could have lasting effects on the overall economic balance.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

A

A

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.