Can Bitcoin Still Avoid a Total Collapse? 5 Key Signals to Watch

Bitcoin is entering a crucial week after a marked drop shaking the market. Amid macroeconomic uncertainties, tensions over interest rates, and technical indicators under pressure, investors are closely examining the upcoming movements. Despite an extreme fear sentiment, some signals suggest a potential turnaround. Here are 5 major elements to watch this week!

Bitcoin: five key factors to absolutely watch this week

Bitcoin is on a razor’s edge this week, flirting with a critical threshold of $82,000 that could trigger a massive wave of liquidation. To make matters worse, concerning technical signals and certain market pressures could exacerbate this situation.

1. The price of Bitcoin is plummeting

Bitcoin has experienced a brutal drop, losing 14% of its value in one week and closing around $80,000. This retreat marks the most significant weekly decline in dollars ever recorded. Some analysts, like Kevin Svenson, point out that BTC is at a critical level of its weekly parabolic trend.

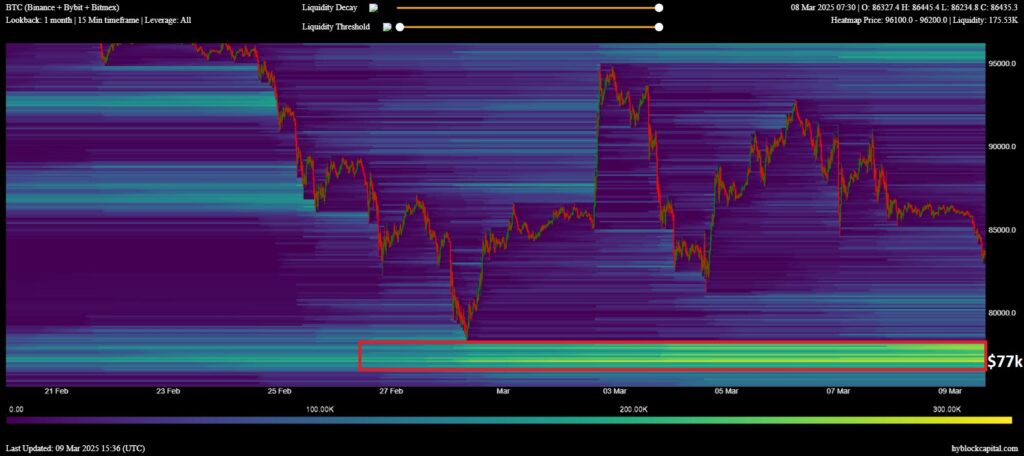

Others, like trader SuperBro, foresee a new descent towards $78,000, while CrypNuevo emphasizes the importance of the $77,000 threshold due to observed liquidations. Despite this drop, the consensus among analysts is that Bitcoin has not yet entered a bear market, but caution is advised.

2. Macroeconomics weighs on the market

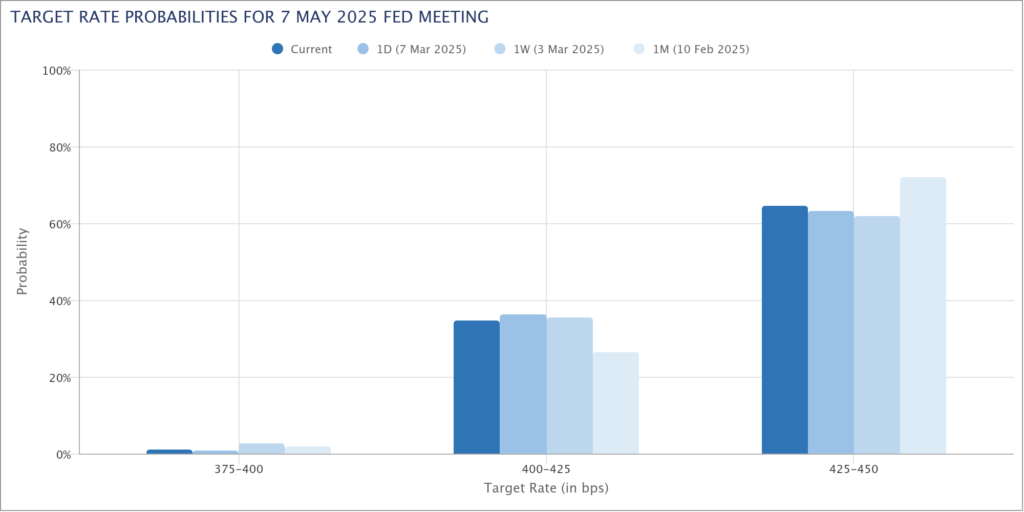

This week is also marked by major macroeconomic publications in the United States, notably the CPI (Consumer Price Index) and PPI (Producer Price Index). Recent inflation figures have exceeded expectations, fueling market uncertainty. The general sentiment is “risk-off,” prompting investors to remain cautious.

Expectations for a rate cut by the Federal Reserve are dwindling, with only a 3% chance of monetary easing as early as March, according to CME Group. Meanwhile, forecasts for economic growth are declining, intensifying tensions in financial markets.

3. A return to 2021 levels?

Bitcoin may retest lower levels, with several technical indicators pointing towards the $69,000 to $75,000 zone. The “Lowest Price Forward” tool, developed by Timothy Peterson, estimates a 95% chance that BTC will not fall below $69,000. Other indicators, such as the simple moving average over 50 weeks ($75,560), are also being watched by analysts.

Arthur Hayes, former CEO of BitMEX, believes that if Bitcoin breaks below $78,000, the next major support is at $75,000, with increased volatility expected around the open options between $70,000 and $75,000.

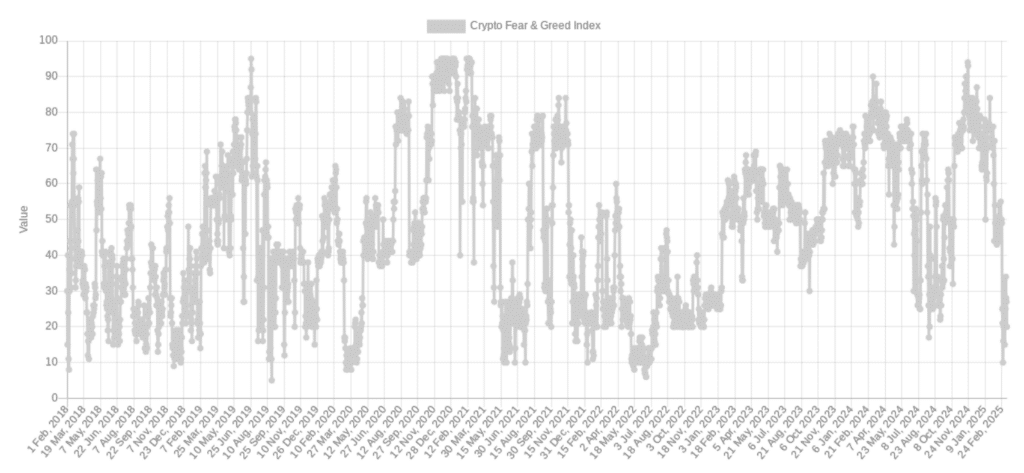

4. A historically low market sentiment

The Crypto Fear & Greed Index shows a reading of “extreme fear,” reaching levels rarely seen in the past three years. However, some investors, like Anthony Pompliano, remind that this type of extreme sentiment can precede a bullish reversal. He highlights that despite an extreme fear index today, Bitcoin is 20% higher than a year ago when it was in “extreme greed.”

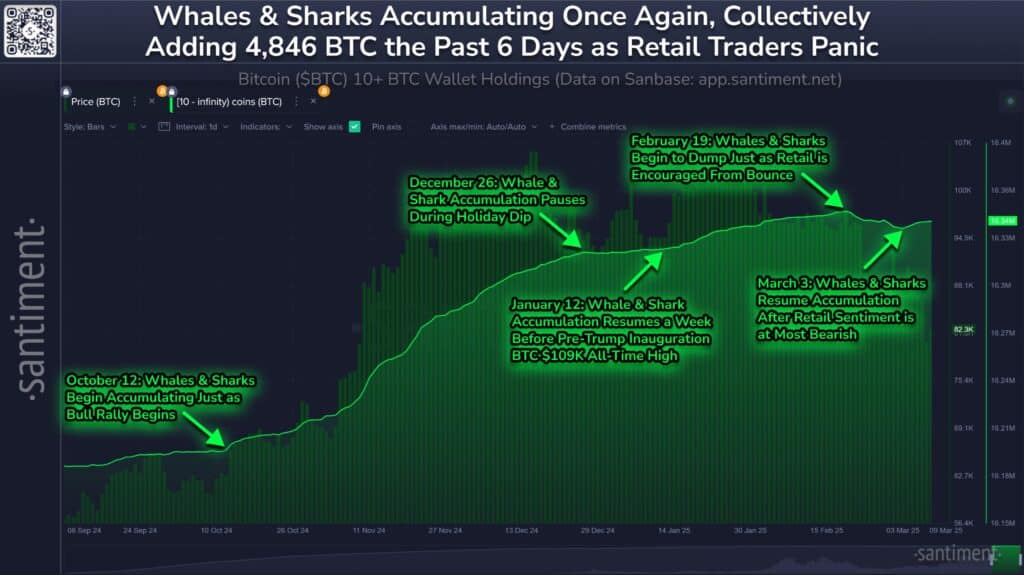

5. Bitcoin whales are buying

Despite the uncertainty, a positive signal emerges: whales and sharks (investors holding more than 10 Bitcoins) are resuming their purchases. According to Santiment, these large portfolios have accumulated nearly 5,000 BTC since March 3, after a period of selling between mid-February and early March. If this accumulation continues, a recovery could be on the horizon for the second half of March.

The solution in Michael Saylor’s hands?

Michael Saylor recently proposed a strategy at the recent crypto summit at the White House, aiming for a Bitcoin market worth $100 trillion that could have an explosive impact on its price. By strengthening institutional adoption and positioning BTC as an essential store of value, this vision could accelerate demand while limiting the available supply.

If major companies and states widely adopt this approach, the buying pressure could push Bitcoin well beyond its current peaks. However, regulatory and macroeconomic challenges remain to be monitored.

Bitcoin is thus going through a period of high volatility, like the crypto market as a whole, which has just lost $440 million in capitalization. With increasing accumulation by whales and critical technical levels approaching, this week will be decisive for the market trend.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.