Buy Bitcoin With Coinhouse: Why And How To Invest?

Bitcoin today stands as an essential pillar of digital investments, combining innovation and exceptional growth opportunities. Whether you are a novice or an experienced investor, integrating this crypto into your portfolio can be a real opportunity for your personal finances. But how can you ensure a secure and efficient purchase? Coinhouse, the first French platform regulated by the AMF, supports you every step of the way with simplicity and transparency. Discover in this article why Bitcoin is a strategic asset for your wealth, the detailed steps to acquire it on Coinhouse, and how a quick registration process with KYC ensures a smooth and secure experience.

Why buy Bitcoin (BTC)?

The Bitcoin is often referred to as “digital gold”. Its limit set at 21 million units gives it a rarity comparable to that of gold, but with characteristics suited to the digital age. Unlike traditional currencies subject to inflation, Bitcoin relies on an immutable protocol that guarantees its limited supply. This feature makes it a reserve of value favored by many investors.

Integrating Bitcoin into a crypto wallet allows for asset diversification and reduces the risks associated with fluctuations in traditional markets. In times of economic instability, this crypto provides a secure refuge due to its independence from the monetary policies of states.

A globally recognized and adopted asset

Bitcoin is currently benefiting from increasing institutional adoption. Companies like Tesla and MicroStrategy have made it an integral part of their financial strategy. Major banks and investment funds are now offering products based on Bitcoin, bolstering its legitimacy.

Faced with the erosion of purchasing power caused by inflation, Bitcoin stands out as a protection tool. In an uncertain economic context marked by expansionary monetary policies, it represents a solid alternative to fiat currencies.

An opportunity in 2025

The crypto market is undergoing a remarkable growth phase in 2025, driven by a new bull run and widespread adoption worldwide. Events such as the approval of Bitcoin ETFs in the United States and the entry into force of the MiCA regulatory framework in Europe have facilitated its rise.

Bitcoin continues to assert itself as the central pillar of the crypto ecosystem, attracting both individuals and institutions. Investing in Bitcoin this year could represent a strategic opportunity to capitalize on its growth potential and market trends. As a pioneering asset, it remains the essential reference for anyone looking to position themselves in the crypto universe.

What are the steps to buy Bitcoin on Coinhouse?

Coinhouse simplifies the process of buying Bitcoin by offering an intuitive and regulated platform, suitable for beginners and seasoned investors. Here are the steps to make a purchase safely.

Prepare your purchase

Before buying Bitcoin (BTC) today, it is essential to choose a reliable and regulated platform. Coinhouse, the first French platform registered by the AMF, guarantees transparency and security.

Several payment methods are offered to meet users’ needs. You can pay by credit card, make a bank transfer, or use the Coinhouse Euro Account for quick and uncomplicated transactions. Each of these options has specific advantages.

The step-by-step purchase process

The purchase of Bitcoin on Coinhouse takes place in four main steps:

1. Create an account

- To begin, go to the official Coinhouse website and click on “Get Started” to create an account.

- Enter your personal information, such as your email address, name, and a secure password.

- Be sure to choose a complex password to protect your data.

- After accepting the terms and conditions, you will receive an email to confirm your registration. This step only takes a few minutes.

2. Perform KYC (Know Your Customer)

Once the account is created, you need to complete the identity verification (KYC).

To do this, upload a valid ID (passport or identity card) and take a selfie according to the platform’s instructions. Coinhouse ensures compliance with anti-money laundering regulations.

Validation is generally quick, taking a few minutes to a few hours, depending on the volume of requests. Once this step is completed, you can access the main features.

3. Add funds

After your account is validated, you can add funds to make your first purchase. This can be done through:

- Credit card: the fastest method, with instant deposit. You must register your card (Visa or MasterCard) and validate the payment;

- Bank transfer: ideal for larger amounts. Coinhouse provides its banking details and a label to include in your transfer. Funds are received within one to three business days;

- The Euro Account: if you prefer speed, use the Euro Account offered by Coinhouse. Once activated with a first deposit of at least €1, this account allows you to make instant transactions.

4. Buy your bitcoins

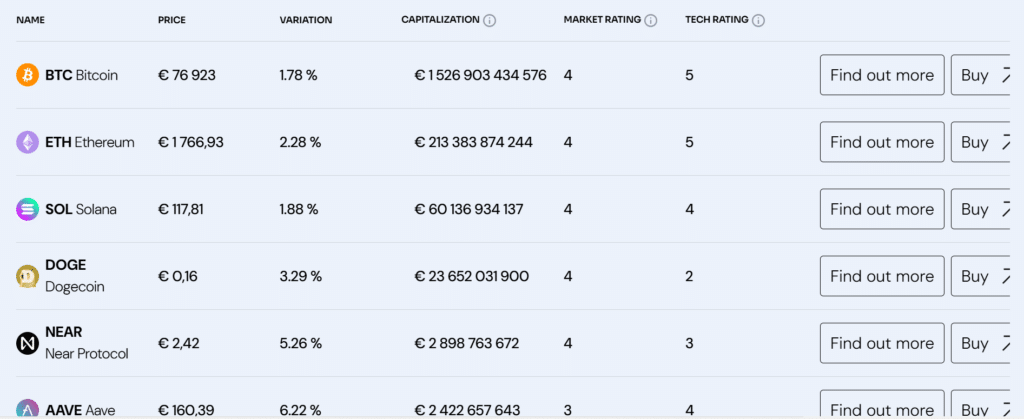

To complete your purchase, log in to your account and go to the “Buy cryptocurrencies” section.

Select Bitcoin (BTC) from the offered assets and indicate the amount you wish to invest, in euros or in BTC. The platform displays the price of Bitcoin and the applicable fees before validation. Verify the transaction details, then click on “Confirm”.

Confirmation and transaction tracking

After your purchase is validated, you will receive a detailed invoice via email. Coinhouse ensures a smooth experience by allowing you to track your transactions directly from your dashboard.

Your purchased Bitcoins are automatically stored in your Coinhouse wallet, but you can choose to transfer them to an external wallet for added security. Coinhouse also offers advice on choosing a suitable wallet, such as a Ledger Wallet.

Buying Bitcoin via Coinhouse is a structured and secure process. With its intuitive tools and responsive customer support, the platform stands out as a ideal solution for new investors as well as experienced users.

Quick registration with KYC on Coinhouse

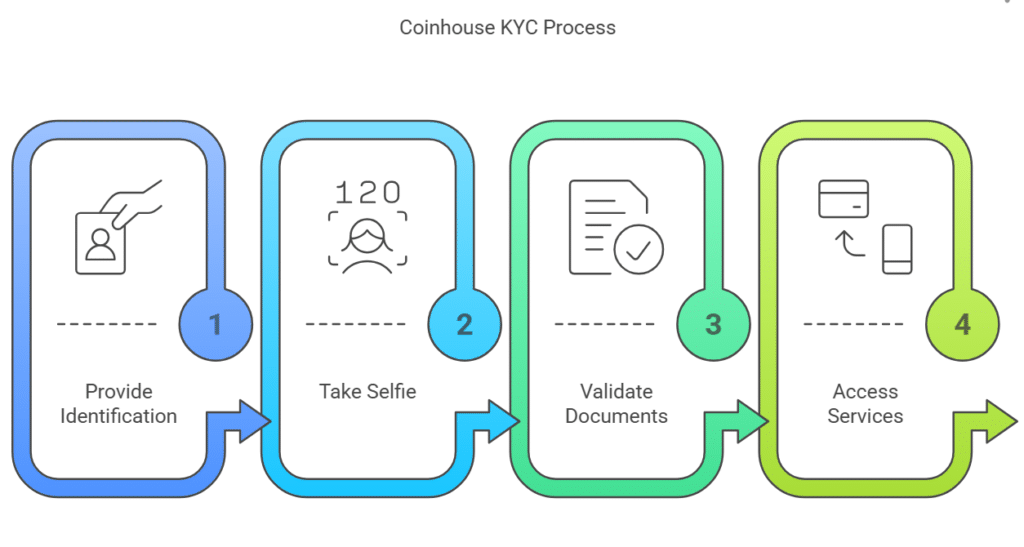

The registration process with identity verification (KYC) is a crucial step to ensure the security and compliance of transactions on Coinhouse. The platform is committed to simplifying this procedure while adhering to regulatory standards.

Why is KYC essential?

KYC or Know Your Customer is a regulatory requirement imposed by European regulations. It aims to combat money laundering and illegal activities by formally identifying users.

This step also ensures the security of funds by confirming that each account indeed belongs to a legitimate person. For users, KYC enhances trust in Coinhouse by ensuring a secure and transparent investment environment.

As the first French platform registered with the AMF, Coinhouse scrupulously adheres to these obligations to provide a reliable and secure experience for its clients.

A simplified process on Coinhouse

Coinhouse has optimized the KYC process to make it both quick and intuitive. Here are the main steps:

1. Provide a valid form of identification

The user must upload a copy of a valid identity document, such as an ID card or passport. This document verifies the personal information provided during registration.

2. Take a selfie for verification

A selfie is requested to ensure that the account holder matches the provided ID. This measure adds an extra layer of security by preventing identity theft.

3. Quick validation by Coinhouse

Once the documents are submitted, the Coinhouse teams review the information and validate the account within minutes or hours, depending on the volume of requests. This speed allows users to quickly access the platform’s features.

Full access after validation

After KYC validation, the user gains full access to all Coinhouse services. This includes activating the Euro Account, allowing instant transactions, and accessing quick cryptocurrency purchase tools.

The KYC verification also contributes to ensuring a secure environment for all users of the platform. Coinhouse thus protects investors by minimizing risks related to fraudulent activities and enhancing the transparency of its services.

Thanks to this simplified process and the support offered, the Coinhouse platform provides an ideal solution for a smooth entry into the world of cryptocurrencies.

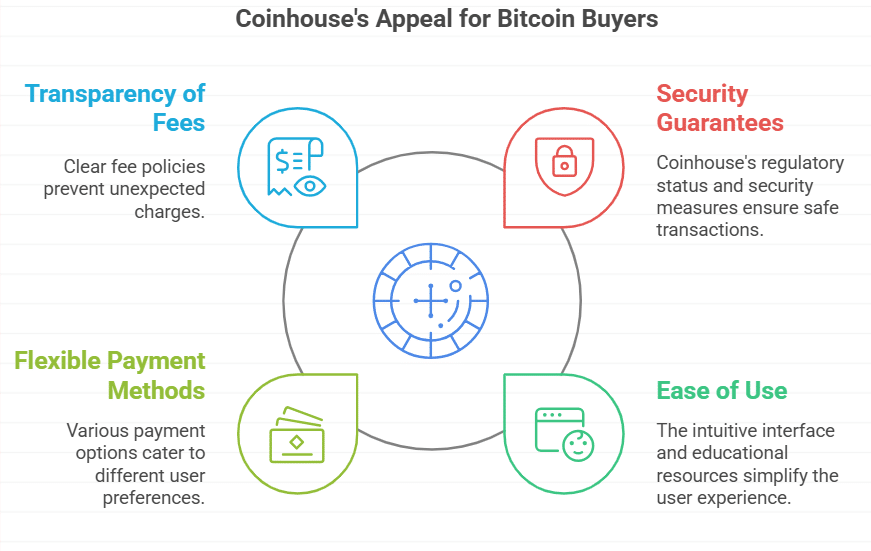

What are the advantages of buying bitcoin on Coinhouse?

Coinhouse stands out as an ideal platform for buying bitcoin due to its security guarantees, ease of use, and adapted payment methods. These advantages make it a preferred solution for investors, particularly in France.

A regulated and secure platform

Coinhouse is the first French platform registered as a PSAN (Digital Assets Service Provider) by the Financial Markets Authority (AMF). This status ensures a clear legal framework, reassuring users about the compliance of their transactions.

In addition to this regulation, Coinhouse offers customer service in French accessible via chat, e-mail, or phone. This personalized assistance allows for quick responses to users’ questions or concerns, enhancing trust and customer experience.

Ease of use

The intuitive interface of Coinhouse is specially designed for everyone. Navigating the platform is simple, even for those discovering the world of cryptos.

Coinhouse supports its users with educational resources such as detailed articles and practical guides. These contents allow for a better understanding of the fundamental concepts of bitcoin, such as its value or how its blockchain works. This educational approach helps investors make informed decisions.

Flexible payment methods

Coinhouse offers several payment options to adapt to the needs of its users. Card payments are ideal for quick transactions. Two-factor authentication (2FA) ensures enhanced security while allowing for purchases to be completed in just a few minutes.

For those who prefer managing funds on a platform, the Euro Account offers a practical alternative. Users can deposit funds there and make instant purchases with reduced fees while enjoying a price guarantee for 60 seconds.

Transparency of fees

The platform is distinguished by a clear and transparent fee policy. The fees on Coinhouse are systematically displayed before each transaction, avoiding any unpleasant surprises for users.

Compared to other platforms, Coinhouse offers a competitive advantage for French residents. The fees are competitive, especially when compared to services offered by international giants like Binance or Coinbase, where fees may be less transparent or higher.

With these numerous advantages, Coinhouse positions itself as a reliable and suitable solution for buying bitcoin with peace of mind.

Comparison of Coinhouse with other crypto platforms

To choose the platform that suits your needs, it is essential to compare Coinhouse with other major players like Binance and Coinbase.

Coinhouse vs Binance

Binance is known for its competitive fees, especially for experienced traders. However, its interface may be complex for beginners. The variety of options and the lack of support in French can pose obstacles for users seeking a simplified experience.

Coinhouse, on the other hand, offers a fully French intuitive interface. Unlike Binance, Coinhouse is regulated by the AMF, which reassures investors regarding the compliance and security of their transactions. In addition, Coinhouse prioritizes fee transparency, which helps avoid unpleasant surprises during purchases.

Coinhouse vs Coinbase

Coinbase is an international platform appreciated for its ease of use. However, its card purchase fees (often around 3.99%) make it an expensive option for regular users.

Coinhouse offers a competitive alternative, with fees of 2.49% for card purchases, and only 0.99% via the Euro Account. This difference translates into significant savings, especially for French users who can also benefit from the Coinhouse IBAN for smooth and rapid transactions. Coinhouse, like Coinbase, provides a reliable service, but its specific adaptation to French residents gives it a definite advantage.

Why is Coinhouse ideal for beginners?

Coinhouse focuses on support, making it an ideal platform for beginners. The responsive customer service, available via chat, phone, or e-mail, assists users at every step of the process. Unlike other platforms where support is limited, Coinhouse offers a local and personalized customer relationship.

The Euro Account provides an additional asset, simplifying transactions and offering a quick and economical alternative. Thanks to these services, novice users can confidently buy bitcoin and enjoy an optimal user experience, tailored to their specific needs. Coinhouse thus positions itself as an essential choice for beginner investors.

Investing in bitcoin becomes an accessible and secure endeavor thanks to Coinhouse. We have explored the reasons to consider bitcoin as a key asset, the simple steps to acquire it through Coinhouse, and the numerous advantages offered by this platform, particularly suited to beginners. With its regulation by the AMF, its intuitive interface, and personalized support, Coinhouse stands out as an ideal choice for entering the world of cryptos with peace of mind. Create your account on Coinhouse today and start diversifying your assets with bitcoin with confidence.

FAQ

No, Coinhouse requires identity verification (KYC) to comply with French financial regulations. All transactions are secure and adhere to AMF standards.

Yes, Coinhouse allows you to sell bitcoins in just a few clicks. The funds can then be withdrawn to a bank account or kept on the platform.

Yes, Coinhouse has a mobile application that provides easy access to its services. It features an optimized navigation experience and push notifications to keep users informed about Coinhouse updates and market trends.

Bitcoins are generally credited instantly after payment validation, especially when using a credit card or the Euro Account. For a bank transfer, the timeframe depends on bank processing, typically 1 to 3 business days.

No, Coinhouse clearly displays its fees before each transaction. There are no hidden costs, ensuring complete transparency for users.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

The contents and products mentioned on this page are in no way approved by Cointribune and should not be interpreted as falling under its responsibility.

Cointribune strives to communicate all useful information to readers, but cannot guarantee its accuracy and completeness. We invite readers to do their research before taking any action related to the company and to take full responsibility for their decisions. This article should not be considered as investment advice, an offer, or an invitation to purchase any products or services.

Investment in digital financial assets carries risks.

Read more