BTC: How Does It Work?

The Bitcoin blockchain is a distributed ledger technology that underpins the first and most iconic cryptocurrency: bitcoin. Since its creation in 2009, it has sparked global interest, challenging our conception of money and transactions. With its growth, debates have intensified around its environmental impact and its capacity to evolve without compromising its principles of decentralization. This article reveals the mechanisms of the Bitcoin blockchain, clarifying its complex functionality and its practical implications for users and society as a whole.

Bitcoin: definition and functioning

Bitcoin is a form of digital currency, created and managed electronically. Unlike fiat currencies, bitcoin has no physical form and is not backed by any government entity. It is produced by individuals and businesses around the world using software that solves mathematical problems. Bitcoin is the first cryptocurrency in terms of market capitalization. It was the first to solve the double spending problem (where a user could potentially make multiple transactions with the same money) without the need for a central authority.

The Bitcoin blockchain

At the heart of Bitcoin’s operation lies the blockchain, a distributed ledger technology that records all transactions in a series of blocks. Each block contains a history of recent transactions and a reference to the previous block, thus creating a continuous chain of blocks. This chain is maintained by a network of nodes, or computers, that validate and record transactions without the intervention of a central authority. The blockchain is public and transparent, meaning that anyone can view the complete history of bitcoin transactions.

The transaction process

A bitcoin transaction is a transfer of value between Bitcoin wallets that is included in the blockchain. Bitcoin wallets keep a secret piece of information known as private key, which is used to sign transactions, providing mathematical proof that the transaction comes from the wallet owner. The signature also prevents the transaction from being altered by anyone once it has been issued. All transactions are broadcast to users and generally start to be confirmed by the network within the next 10 minutes, through a process called mining.

The Proof-of-work (PoW)

The Proof-of-work underpins the security and integrity of the Bitcoin network. This consensus method requires proof that work has been done to validate transactions and create new blocks. An overview of the specifics of this consensus mechanism and its role in the mining process.

Foundations of Proof-of-work

Proof-of-work is a mechanism that solves the trust problem in a decentralized environment. For a transaction to be added to the blockchain, it must be validated by miners. These miners use powerful computers to solve complex cryptographic puzzles. The first person to solve the problem shares the solution with the network. If the solution is correct, the block of transactions is added to the blockchain. This process requires a significant amount of computation, ensuring that it is not economically viable to attempt to manipulate the system.

Securing the network

Proof-of-work secures the Bitcoin network by making the modification of the blockchain costly and difficult. To modify a previous transaction, an attacker would need to redo the mining work for the block containing the transaction and all subsequent blocks. This would require an astronomical amount of energy and computational power, making such an attack impossible. Additionally, the Bitcoin network is distributed across thousands of nodes, meaning that the majority of them would need to be compromised for the attack to succeed, another barrier that reinforces the network’s security.

Mining and the creation of new bitcoins

Mining is the process by which transactions are verified and added to the blockchain, and new bitcoins are created. Miners are rewarded for their work with newly created bitcoins. This is known as the block reward. This reward halves at regular intervals during an event known as halving. Mining is thus both a mechanism for securing the network and a means of distributing new bitcoins into the system. It is an open competition, encouraging miners to constantly maintain and improve the efficiency and security of the network.

Bitcoin forks

The Bitcoin forks represent changes in the blockchain protocol that can lead to divergences in the block chain. These events reflect governance dynamics within the Bitcoin community and can have significant implications for the price and stability of the currency.

Nature and function of forks

A fork in Bitcoin is a modification of the rules governing the blockchain. When developers propose changes in the software, all nodes in the network must accept these changes for the fork to be implemented. If some nodes accept the update while others do not, it can lead to a split in the blockchain into two parallel versions. Forks are often the result of disagreements within the community about the direction development of Bitcoin should take, thus reflecting the democratic and decentralized nature of the network.

Soft forks vs hard forks

Soft forks are updates compatible with previous versions of the blockchain. They do not require all nodes in the network to update their software, as the new rules remain in line with the old ones. In contrast, a hard fork is an update that is not compatible with previous versions, which means that nodes must update their software to continue following the correct blockchain. A hard fork can lead to the creation of a new cryptocurrency, as was the case with Bitcoin Cash, which split from Bitcoin due to disagreements over block size.

Impact of forks on the network

Forks can have a significant impact on the Bitcoin network. They can lead to uncertainty and debates within the community, potentially influencing the currency’s price. However, they can also be a sign of a healthy and dynamic community striving to improve the system and adapt to changing needs. Forks allow Bitcoin to adapt and evolve, but they require effective coordination and communication to minimize disruptions and ensure network security.

The electricity consumption of Bitcoin

The electricity consumption of Bitcoin is a topic of intense discussion both in technological circles and in debates about sustainable development. The mining process, which is at the heart of the creation of new bitcoins and the validation of transactions, is indeed energy-consuming.

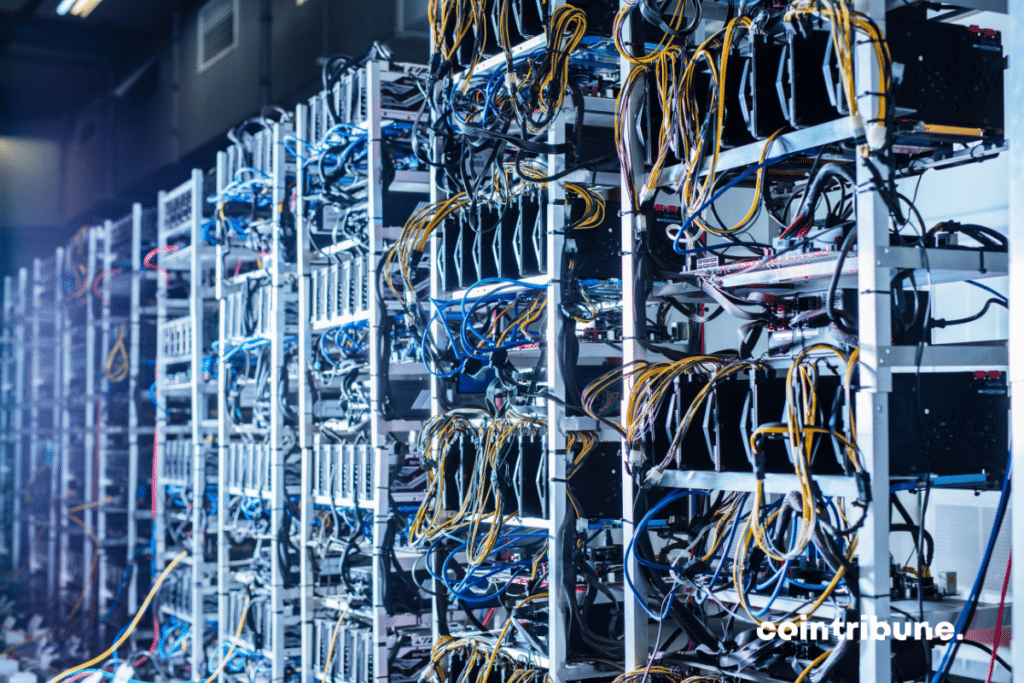

Why is Bitcoin mining energy-intensive?

Bitcoin mining relies on Proof-of-work, which requires considerable computing power to solve complex algorithms and secure the network. Miners around the world use specialized equipment, known as ASICs, to perform these calculations at high speed and efficiency. This equipment is not only expensive, but also energy-consuming. The competition among miners to solve blocks and obtain rewards in bitcoins intensifies the amount of energy consumed, as each miner or group of miners seeks to increase their computing power for a chance to succeed.

Comparison with the consumption of other industries

The energy consumption of Bitcoin is often compared to that of small countries. While this may seem alarming, it is important to put these figures into perspective. Other industries, such as data centers, natural resource extraction, or even the traditional banking system, also have a significant energy footprint. However, the difference lies in the visibility of Bitcoin’s consumption, which is easier to quantify and criticize due to its transparent nature and association with blockchain technology.

Towards a more ecological Bitcoin

The Bitcoin community is aware of the environmental impact of the blockchain and is exploring solutions to reduce its carbon footprint. One approach is the use of renewable energies for mining. Initiatives aim to locate mining operations near abundant renewable energy sources, such as geothermal energy in Iceland or hydroelectric power in China. Additionally, the efficiency of mining equipment is constantly improving, reducing the amount of electricity needed for each mining operation. Finally, discussions about alternatives to Proof-of-work, such as Proof-of-stake, which requires much less energy, are gaining popularity and could offer a path towards a more sustainable future for Bitcoin.

How to use bitcoin on a daily basis?

The use of bitcoin as a digital currency has gained popularity worldwide. Whether for online transactions, investments, or even daily purchases, bitcoin offers a decentralized alternative to traditional currencies. Here’s how to properly use this cryptocurrency.

Setting up a Bitcoin wallet

Before you can use bitcoin, you must first set up a digital wallet. A Bitcoin wallet is a software that allows you to store, send, and receive bitcoins. There are several types of wallets, including online wallets, mobile apps, hardware wallets, and paper wallets. Each wallet generates a unique private key that you must keep secure, as it gives you access to your bitcoins. The associated public key is the address you will share to receive bitcoins. It is important to choose a reputable wallet and adopt good security practices, such as using strong passwords and backing up your private key.

Making transactions in bitcoin

To make a transaction in bitcoin, you need to know the recipient’s wallet address. With this information, you can log into your wallet, specify the amount of bitcoins you wish to send, and confirm the transaction. Transactions are then verified by miners on the Bitcoin network and added to the blockchain. It is important to note that transaction fees vary depending on network congestion. Once a transaction is confirmed, it is irreversible, highlighting the importance of accuracy when sending bitcoins.

Management and security of bitcoins

Managing your bitcoins is a significant responsibility. You need to stay informed about best security practices to protect your assets. This includes securing your private key, which should never be shared with anyone. Implementing two-factor authentication for online wallets is also recommended. Furthermore, consider diversifying how you store your bitcoins, using both hot wallets (connected to the internet) for regular transactions and cold wallets (offline) for long-term storage. Finally, remain vigilant against scams and fraud, which are unfortunately common in the cryptocurrency world.

The future of bitcoin

Since its inception, bitcoin has sparked lively debate about its future. On the one hand, it is hailed as a financial revolution, offering a decentralized alternative to traditional currencies. On the other, it is criticized for its volatility and use in illicit activities. Despite this, bitcoin continues to gain in popularity and acceptance, with companies and institutional investors incorporating it into their portfolios. However, its place as an everyday currency remains uncertain, partly due to its volatility and the challenges associated with the network’s scalability.

Current debates surrounding the scalability of the Bitcoin blockchain are at the forefront of concerns. The network can handle a limited number of transactions per block, which causes issues of speed and costs when congested. Solutions like the Lightning Network are under development to address these issues, but their widespread adoption is not yet a reality. Bitcoin’s ability to adapt and evolve will largely determine its future usefulness.

From a regulatory standpoint, bitcoin faces significant challenges. Governments worldwide are determining how to regulate cryptocurrencies without stifling innovation. Regulations could legitimize bitcoin as a financial asset, but they could also limit its growth potential. The balance between consumer protection and preserving the decentralized essence of bitcoin is delicate and will have a profound impact on its future.

Lastly, the environmental impact of bitcoin mining is a growing concern. Research for less energy-intensive solutions is underway, with proposals like the shift to a proof-of-stake consensus mechanism that could significantly reduce the network’s carbon footprint. The future of bitcoin will depend on its ability to align with global environmental values, which could either strengthen its position or render it obsolete in the face of greener alternatives.

Conclusion

Bitcoin stands out for its rigorous mining process and decentralization, which ensure the security and authenticity of each transaction. These fundamental characteristics allow it to operate outside conventional financial systems, offering a digital alternative to traditional currencies. As interest in cryptocurrencies continues to grow, a deep understanding of bitcoin is a must for anyone wishing to partake in this financial revolution.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.