Nooooo… 🤭 The OCC dot Gov more than proves there’s a Quantum Financial System and a global reset coming 🔥🐂🇺🇸https://t.co/UF2mw7ViNa

— Derek Johnson (@rattletrap1776) March 16, 2024

A

A

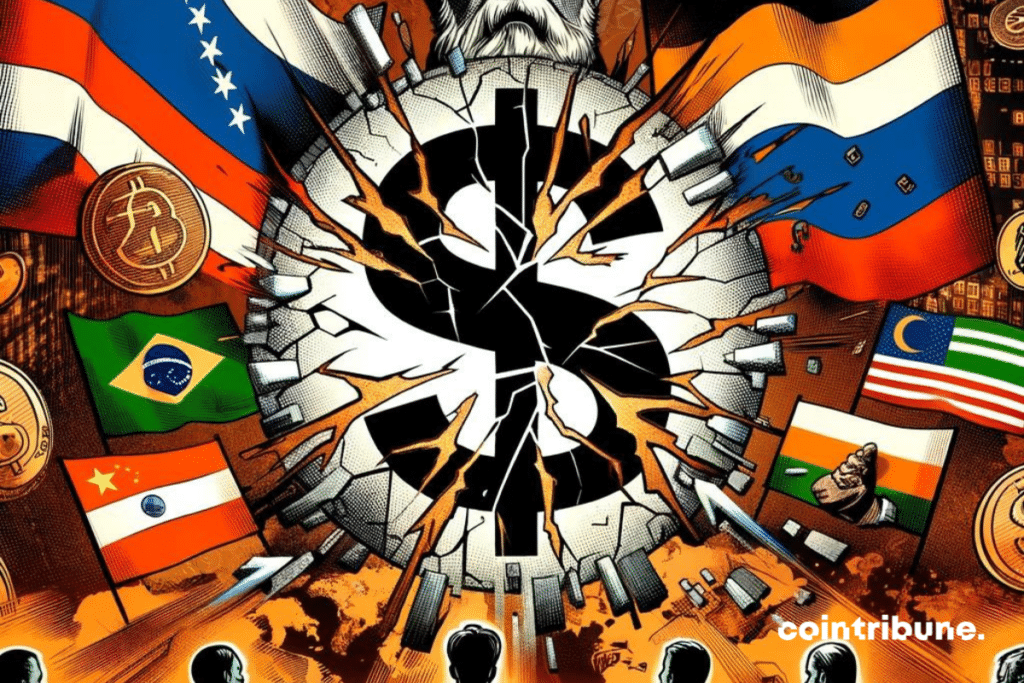

BRICS: Increasing De-dollarization Worries U.S. Treasury

Mon 18 Mar 2024 ▪

3

min read ▪ by

Getting informed

▪

Payment

The BRICS plan to end the hegemony of the dollar in international transactions continues to elicit reactions in the United States. Janet Yellen, the U.S. Treasury Secretary, recently spoke on the subject, indicating her concern about the implementation of this project. Especially since, according to her, detrimental effects are being observed on the dollar.

The future of the American dollar, threatened by the BRICS?

In recent months, the BRICS have emerged as a significant force in global economic affairs, aspiring to reduce the dominance of the dollar as the world’s principal reserve currency.

During a congressional hearing, Janet Yellen, the U.S. Treasury Secretary, acknowledged the momentum this policy is gaining in favor of the BRICS. She is worried about the alliance succeeding in its endeavor.

As evidence, the financier mentioned a growing loss of confidence in the greenback, which has lost 8% of its share in global reserves since 2022. A trend signaling a potential shift in the international monetary landscape.

Meanwhile, the BRICS continue to expand their influence and gain support. This concerted stance poses a significant challenge to the long-standing supremacy of the dollar as the alliance’s efforts to promote dedollarization continue to intensify.

Faith in the dollar’s resilience

Despite these developments, Janet Yellen remains optimistic. She believes in the dollar’s historical capability to meet challenges. However, she also acknowledges the growing interest of nations in diversifying their reserves, spurred by the recent difficulties of the dollar.

Upon analysis, this evolution reflects deep skepticism towards the stability of the dollar. A dynamic that has propelled the BRICS to the forefront as a viable and pertinent economic and monetary alternative.

This situation marks a setback for the dollar, whose dominance is increasingly being undermined. This bolsters the influence of BRICS member states in establishing the global financial system.

In this context, the prospect of a multipolar monetary regime where the greenback is no longer the sole dominant financial force becomes increasingly plausible and conceivable. This, as more countries seek alternatives to the dollar. Ultimately, the dollar still remains the dominant reserve currency. However, the rise of the BRICS and the growing appetite for other reserve currencies pose significant challenges to the supremacy of the American currency.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

A

A

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.