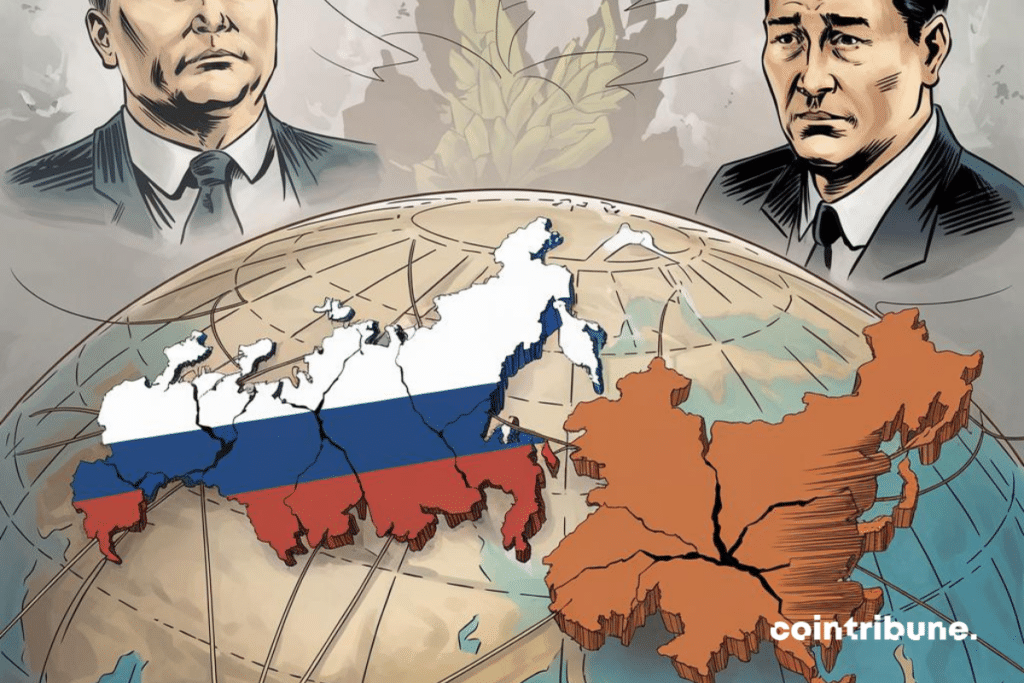

BRICS: Russia Puts China in Great Difficulty!

The Russian economy is increasingly turning towards China, particularly through the massive adoption of the yuan for its international trade exchanges. This significant dependency on the Chinese currency, a direct consequence of Russia’s exclusion from the global financial system, raises more interest from Beijing, which seeks to strengthen its global influence and avoid Western reprisals.

The Russian economic dependence on the yuan

Since the intensification of international sanctions against Russia, the yuan has become the most traded foreign currency in the country. Moscow, excluded from Western financial systems such as SWIFT, has had no choice but to strengthen its commercial partnerships with China, which causes increased dependency on the yuan. Russia has become extremely reliant on the yuan, a situation that could become dangerous for its economy if the flows of this currency were to dry up.

This dependency is exacerbated by the caution of Chinese financial institutions. Faced with Western sanctions, major Chinese banks hesitate to engage further with Russian entities, fearing to face sanctions themselves. This situation creates economic instability for Russia, which could see one of its main financial lifelines shrink. For Russia, this growing dependence on the yuan is not without consequence, as it exposes the country to additional risks, particularly in terms of the stability of its monetary reserves and its trade balance.

Geopolitical risks for China

On its side, Beijing faces a strategic dilemma. Although Russia is an important partner, especially in the BRICS alliance, China must also preserve its relationships with other economic powers, particularly in Europe and North America. Supporting Moscow too openly could lead to sanctions against China, jeopardizing its access to international markets. China walks a tightrope. Beijing cannot afford to lose its key Western markets by excessively supporting Russia.

Furthermore, the strong use of the yuan in Russia is not enough to make it a dominant international currency. Despite its growing role in Russo-Chinese exchanges, the yuan remains underrepresented in global reserves and faces limitations due to strict capital controls in China. The dominance of the US dollar on the global stage remains intact. If Russia continues its dependence on the yuan, China will have to decide if it is ready to assume the risks, both economically and diplomatically.

The implications of this situation are numerous and complex. This growing dependency of Russia on the yuan exposes both countries to major economic and geopolitical risks. China, although it strengthens its ties with Moscow through the BRICS group, must balance its interests to avoid compromising its relationships with other international partners. In the long term, this dynamic could accelerate Chinese efforts to further internationalize the yuan, but the path remains fraught with obstacles, particularly in the face of the continued dominance of the dollar.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.