Bollinger Bands: Mastering Volatility in Trading

Bollinger Bands are a technical analysis tool that provides essential insights into volatility and price trends in financial markets. This technical indicator, widely recognized, does, however, require a deep understanding to be used effectively. An overview of the specifics of Bollinger Bands.

What are Bollinger Bands?

Bollinger Bands were developed by John Bollinger in the 1980s. They are used to assess volatility and the levels of overbought or oversold for an asset. These bands consist of three lines: a central moving average, typically a simple moving average over 20 periods, and two bands (upper and lower) that adjust based on the asset’s price standard deviation.

Interpretation of Bollinger Bands

Bollinger Bands, a widely-used volatility indicator in trading, offer a dynamic view of potential price movements in financial markets. They are particularly useful for identifying periods of high or low volatility, as well as potential overbought or oversold points. Here’s how to interpret the variations in these bands and the signals they may provide to traders.

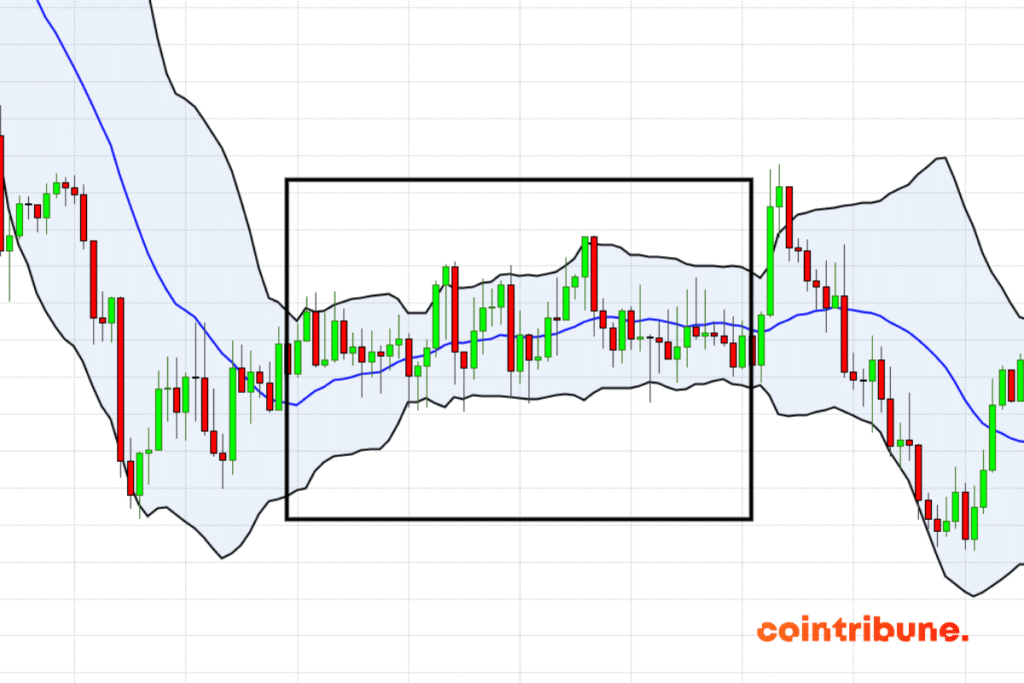

Meaning of Narrow and Wide Bands

When Bollinger Bands tighten, it indicates a period of low volatility in the market. This situation is often interpreted as the calm before a potential significant increase in volatility. Traders closely monitor these periods of contraction, as they may precede significant price movements. Conversely, widened bands signal an increase in volatility. This expansion suggests that the market is in motion and that prices are fluctuating more strongly. Traders use this information to anticipate larger price movements and adjust their strategies accordingly.

Analysis of Trading Signals

Bollinger Bands also provide valuable trading signals. When the price of an asset approaches or touches the upper band, it may indicate an overbought condition, suggesting that the price may soon decrease. Conversely, if the price reaches or touches the lower band, it may signal an oversold condition, implying a potential price rebound. However, it is important for traders not to rely solely on these signals to make trading decisions. Supplementary analysis using other technical indicators is recommended to confirm these signals.

Market Context and Bollinger Bands

It is important to consider the overall market context when interpreting Bollinger Bands. Market conditions, such as dominant trends and economic events, can influence how the bands should be interpreted. For example, in a strongly bullish market, the price may oscillate near the upper band for an extended period, which requires a different interpretation compared to a neutral or bearish market. Traders should therefore integrate the analysis of Bollinger Bands into a broader market analysis strategy to obtain a complete understanding of potential signals.

In which trading strategies should Bollinger Bands be used?

Here are 4 trading strategies in which Bollinger Bands can be utilized.

Range Trading Strategy

A common strategy with Bollinger Bands is range trading. This approach is particularly effective in a market where the price oscillates within a relatively stable range. Traders use the bands to identify entry and exit points: buying near the lower band and selling near the upper band. This method relies on the assumption that the price will remain within this range and bounce between the two bands. To increase the effectiveness of this strategy, it is advisable to combine it with other indicators, such as the RSI (Relative Strength Index), to confirm overbought and oversold signals.

Breakout Trading Strategy

Another popular strategy is breakout trading. This method is used when the price breaks through one of the Bollinger Bands, potentially signaling the start of a new trend. For example, a breakout above the upper band may indicate the beginning of a bullish trend, while a breakout below the lower band may signal a bearish trend. Traders should, however, exercise caution and seek confirmation of the breakout, such as increased trading volume or another trend indicator, to avoid false signals.

Squeeze Strategy

The “squeeze” is a situation where Bollinger Bands tighten significantly, indicating a decrease in volatility and often the precursor to a significant price movement. Traders watch for these squeeze periods to anticipate a potential breakout. When the price exits the squeeze, it may signal the beginning of a strong trend. Traders can then take a position in the direction of the breakout. As always, it is important to combine this observation with other indicators to validate the signal and effectively manage risks.

How to Manage Risks with Bollinger Bands?

Risk management is a crucial aspect of trading, and Bollinger Bands can be a valuable tool in this endeavor. These bands, by providing information on volatility and potential price levels, help traders make informed decisions and minimize risks.

Setting Stop-Loss and Take-Profit Levels

One of the most important uses of Bollinger Bands in risk management is to establish stop-loss and take-profit levels. A stop-loss can be placed just below the lower band for a long position, providing protection against unfavorable price movements. Conversely, for a short position, a stop-loss can be placed just above the upper band. Similarly, traders may use the opposite band to set take-profit targets, selling near the upper band in a long position or buying near the lower band in a short position. This approach helps secure gains while limiting potential losses.

Adjusting Bands Based on Volatility

Bollinger Bands naturally adjust with market volatility, but traders can also customize the band parameters to better fit their trading strategy and risk tolerance. By increasing the standard deviation used to calculate the bands, traders can create wider bands, providing more room for price fluctuations and thus reducing the chances of prematurely triggering a stop-loss. Conversely, narrower bands can be used for less volatile markets or for more conservative trading strategies.

Combining with Other Indicators for Comprehensive Analysis

While Bollinger Bands are a powerful tool, they should not be used in isolation for risk management. Traders should combine them with other technical indicators such as the RSI (Relative Strength Index) or MACD (Moving Average Convergence Divergence) for a more comprehensive market analysis. This multi-indicator approach helps validate the signals provided by the bands and identify more precise entry and exit points, thereby contributing to better risk management.

Common Mistakes to Avoid When Using Bollinger Bands

While effective, using Bollinger Bands can sometimes lead to mistakes if they are not correctly interpreted or applied. These mistakes can compromise the trading strategy and increase risks. Understanding and avoiding these common mistakes is important for any trader wishing to use this indicator effectively. Here are the most common mistakes when using Bollinger Bands and how to avoid them.

Ignoring Market Context

A frequent mistake is using Bollinger Bands without considering the overall market context. The bands can provide signals of overbought or oversold conditions, but these signals must be interpreted in the context of the current market trend. For example, in a strongly bullish market, the price may remain near the upper band for an extended period, and interpreting this as an immediate sell signal could be misleading. Traders must therefore analyze the bands in conjunction with the general market trend and other indicators to make more accurate trading decisions.

Relying Solely on Bands for Trading Decisions

Another common mistake is to rely exclusively on Bollinger Bands to make trading decisions. Although the bands can indicate potential levels of overbought and oversold, they do not provide a complete picture of the market. Traders should use Bollinger Bands in combination with other technical analysis tools, such as moving averages, the RSI, or the MACD to validate signals. This multi-indicator approach helps create a more robust and reliable trading strategy.

Misinterpretation of Breakouts

Breakouts are moments when the price breaks through the Bollinger Bands, potentially indicating the start of a new trend. However, a common error is to misinterpret these breakouts, viewing them as definitive trading signals without seeking additional confirmation. Some breakouts may be false signals, leading to premature or risky entries. Traders should look for confirmation of the breakout, such as increased trading volume or alignment with other technical indicators, before taking a position. This caution helps distinguish true breakouts from erratic or temporary price movements.

Conclusion

Bollinger bands are a powerful and versatile technical analysis tool for traders. They provide valuable insights into market volatility and potential price levels. However, to maximize their effectiveness, it is important to use them while considering the overall market context, combining them with other technical indicators, and correctly interpreting the signals they provide. By avoiding common mistakes such as excessive reliance on this tool or misinterpreting the signals, traders can use Bollinger bands to significantly enhance their trading strategies and risk management.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The Cointribune editorial team unites its voices to address topics related to cryptocurrencies, investment, the metaverse, and NFTs, while striving to answer your questions as best as possible.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.