Decentralized finance is revolutionizing the world of finance by providing an alternative to traditional banking systems through blockchain technology. This innovation promises greater transparency, efficiency, and accessibility. However, it also comes with specific challenges, particularly regarding security. Investors and users must be aware of potential dangers and know how to avoid them. This article presents the different types of traps in DeFi and strategies to effectively protect investments.

DeFi

Decentralized finance, commonly known as DeFi, is redefining the global financial landscape by offering innovative and transparent solutions for transactions and investments. At the heart of this revolution is Ethereum, a blockchain that supports a multitude of DApps, enabling financial interactions without intermediaries. This article aims to guide you through the nuances of DeFi on Ethereum, from its advantages to its risks, along with the flagship projects that are shaping this rapidly growing ecosystem.

Decentralized finance (DeFi) has revolutionized the investment world, providing an alternative to traditional financial systems through blockchain technology. However, this innovation comes with certain challenges, particularly in the areas of taxation and regulatory compliance. DeFi users must navigate a complex and ever-changing tax environment while managing the risks associated with these new forms of investment. This article explores the fundamentals of DeFi, the specifics of its taxation, as well as the tax reporting practices that users must comply with.

Decentralized finance, or DeFi, has emerged as a transformative force in the world of finance, challenging traditional models through blockchain technology. This digital revolution offers an alternative to established financial systems, emphasizing transparency, efficiency, and accessibility. However, with this rapid innovation come unique challenges in terms of security, regulation, and adoption. This article explores the latest statistics and growth of DeFi, examines current trends, and discusses forecasts for its future.

Many DeFi protocols offer impressive and often impossible returns in the banking system. These returns, which can be in the double or triple digits, lead many users to believe that DeFi is the realm of easy money. To avoid disappointment or even losing money, it is crucial to understand where these returns come from. It is essential to keep in mind that there is no magical money. The Luna disaster, whose distant origins include the excessive yield of Anchor for stablecoin, should make us aware of this statement and bring us back to reality.

Decentralized finance, or DeFi, has quickly become an essential component of the modern financial landscape. With its promise of greater accessibility and transparency, DeFi attracts a growing number of professionals and enthusiasts. However, diving into this innovative world requires a clear understanding and mastery of the underlying concepts and technologies. In light of this necessity, it is important to turn to appropriate training programs. This article aims to guide readers through the various training options in DeFi while providing practical advice on how to choose the program best suited to their goals.

Decentralized finance (DeFi) has revolutionized the world of blockchain and cryptocurrencies, offering unprecedented investment and financial management opportunities. However, with the rapid emergence of numerous DeFi platforms, choosing the one that best suits each user’s personal needs can be complex. This choice involves considering various key factors. In this article, we explore these main aspects to help you select the platform that best aligns with your financial goals and investment style.

Decentralized finance (DeFi) has radically changed the landscape of digital investments, and DeFi Saver positions itself as a key player in this expanding universe. This platform offers advanced tools for managing and optimizing cryptocurrency assets, thus attracting the attention of both novice and experienced investors. This article aims to dissect DeFi Saver by examining its main features, its impact on asset management, the initial steps for new users, and the challenges and limitations it presents.

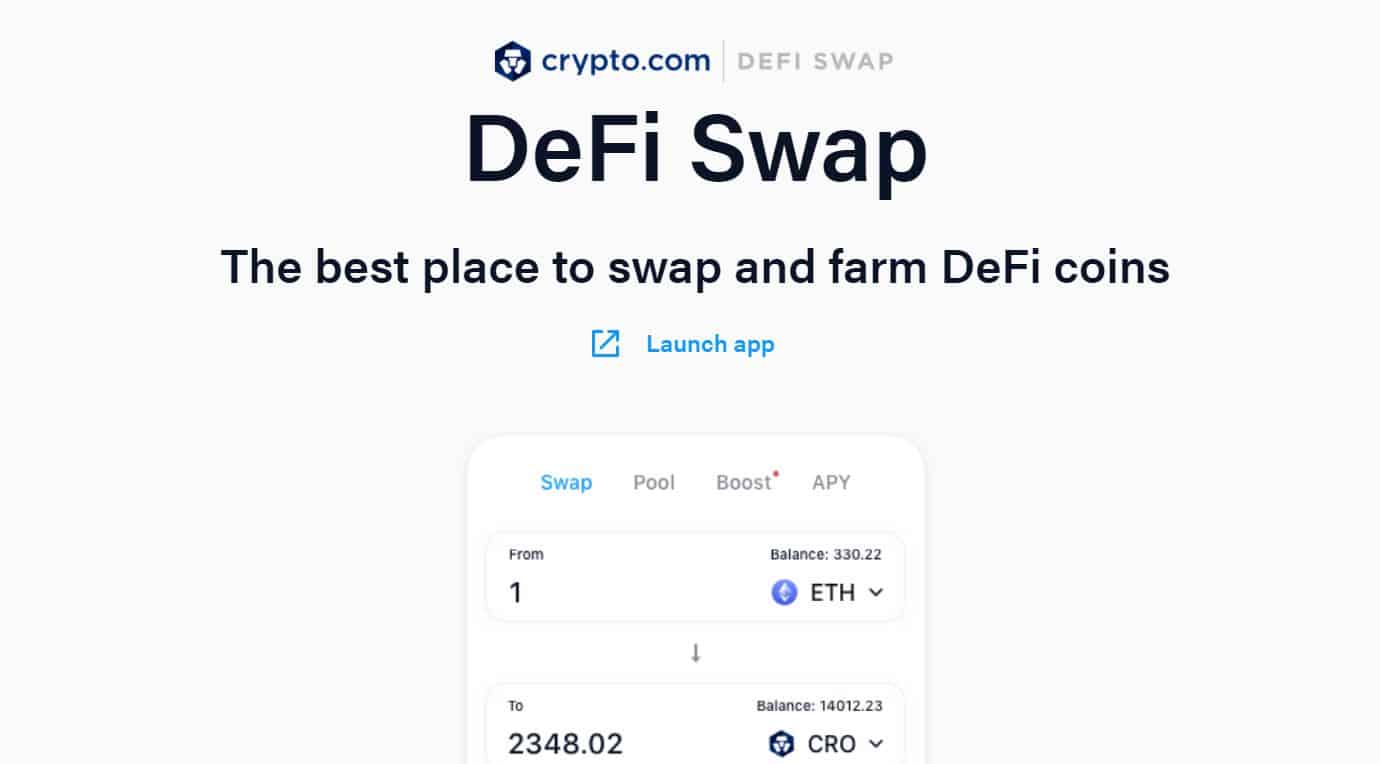

Token exchange on DeFi platforms is an essential practice for anyone interested in decentralized finance. These platforms provide a direct and secure way to conduct transactions without intermediaries, thereby revolutionizing how digital assets are traded. This article offers a practical and detailed guide for performing swaps on DeFi platforms. Aimed at both beginners and experienced users, this guide covers all the necessary steps to execute effective and secure exchanges, emphasizing the understanding of the mechanisms and key strategies in the world of DeFi swaps.

APY is the abbreviation of the English term "Annual Percentage Yield", which can be translated into French as "annual percentage return". This term is used when one decides to lock their cryptocurrencies for a certain period of time in exchange for interest. Nonexistent just a few years ago, this new type of investment is becoming increasingly popular, and many platforms are starting to offer it to their users.

In the rapidly evolving financial world, decentralized finance (DeFi) emerges as an innovative and booming sector. With its promises of high returns and new forms of investment, DeFi attracts a growing number of investors. However, navigating this complex and ever-changing space can be intimidating, especially concerning optimizing gains while minimizing risks. This article aims to demystify investment strategies in DeFi, focusing on best practices to boost profits. We will explore key approaches such as thorough research, risk management, and security, essential practices for succeeding in the DeFi universe.

Have you heard about decentralized finance and are wondering why all the hype? You've come to the right place. In this article, we will answer all your questions:

Decentralized finance (DeFi) has emerged as a revolutionary sector in the investment world, redefining the way financial transactions are conducted. Through blockchain technology, DeFi offers a transparent and accessible alternative to traditional financial systems. However, investing in DeFi can be complex, requiring a clear understanding of the underlying technologies and investment strategies. This article aims to demystify the investment process in decentralized finance, addressing the essential knowledge needed, the steps to get started, and strategies to optimize returns on investment in this rapidly expanding universe.

Decentralized finance (DeFi) is redefining the rules of the game in the lending sector, offering an innovative alternative to traditional banking systems. Thanks to blockchain technology, lending in DeFi promises more autonomy, transparency, and efficiency, attracting a growing number of users. However, despite its apparent advantages, the lending system within the DeFi ecosystem carries risks and complexities that should not be ignored. This article explores in detail how lending works in DeFi.

In the rapidly expanding world of decentralized finance (DeFi), Yield Farming emerges as a key strategy, attracting the attention of cryptocurrency investors. This practice, which involves generating passive returns through various cryptocurrencies, is revolutionizing the way digital assets are utilized and managed. However, despite its lucrative potential, Yield Farming carries risks and complexities that should not be underestimated. This article explores in depth Yield Farming in DeFi, examining its benefits, risks, best practices for getting started, and its future prospects within the cryptocurrency ecosystem.

Remember decentralised finance? The sector, more commonly known as DeFi, has recently exploded and become the latest unavoidable trend in the cryptocurrency market. After Bitcoin (BTC) and altcoins, DeFi actually seems to be a little more than a trend. In the DeFi sector, which today weighs in at more…