Bitcoin towards $20,000? Technical signals point to the worst

The price of Bitcoin is currently going through a turbulent zone, having fallen by 20%. This drop follows the launch of the first Bitcoin Spot ETFs in the United States. However, several analysts agree that the bottom has not yet been reached for the flagship cryptocurrency.

Bitcoin, the mood remains bearish despite a slight rebound

The bitcoin has seen a slight rebound from its low at $38,500, to about $42,000 on January 26. However, many observers doubt that the bottom has been hit.

According to a recent study by Matrixport, Bitcoin is expected to continue its descent to its critical support level around $36,700.

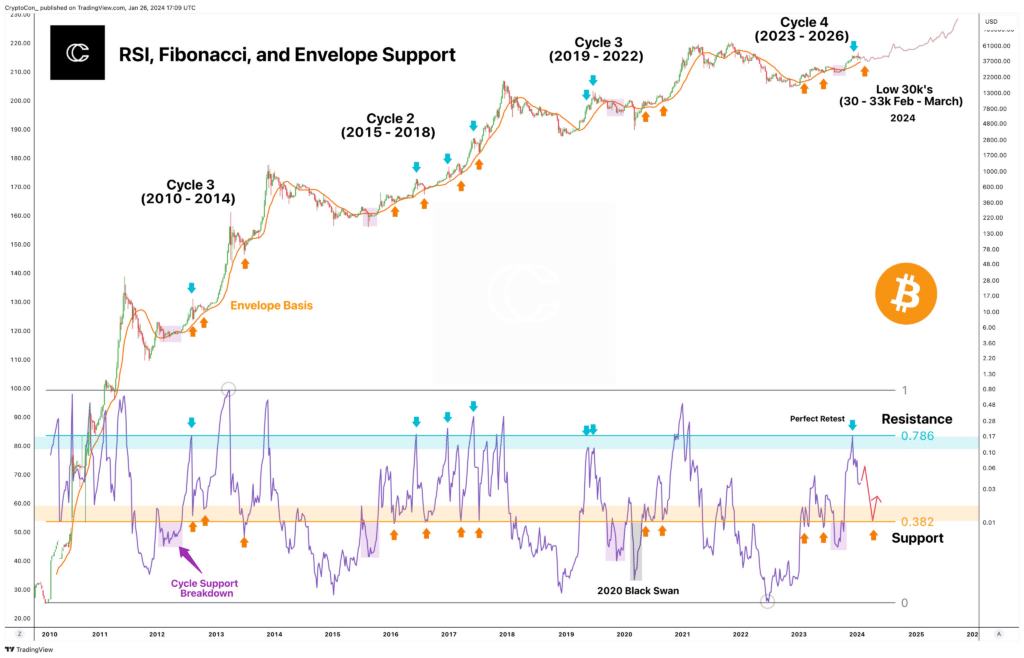

This scenario is supported by several renown experts, including CryptoCon. The latter bases this pessimistic forecast on several worrying technical and fundamental factors on this chart.

Firstly, the BTC’s weekly RSI is inexorably heading towards the fateful zone of 0.382. This technical point would correspond to a floor price around $30,000, which is an additional 25% drop.

In addition, despite the promising launch of the first cash-settled ETFs, institutional investor appetite is not as ravenous as expected.

Finally, the ongoing outflows from the behemoth Grayscale (GBTC) exert a persistent downward pressure on the market.

Building on 12 historical precedents, the weekly RSI indicator suggests that bitcoin could plummet to the abyss of $30,000. The hope of having already reached the bottom following the recent 20% correction seems quite fragile.

Indeed, this debacle follows an almost 100% bull run which was even more vertiginous than previous rallies. The technical indicators had already been signaling blatant overvaluation, and could again sound the alarm in the event of an imminent undervaluation.

Increasingly pessimistic forecasts

Yet, the arrival of the first bitcoin-backed ETFs was considered an ultra-bullish catalyst.

Ironically, their successful launch did not prevent the flagship currency from falling by about 15% since January 10.

This is partly explained by the massive withdrawal of capital from GBTC due to its conversion into an ETF. This status change finally allowed investors to cash out, to Grayscale’s detriment, with over $3 billion in redemptions.

On social networks, prominent investor Chris Burniske, partner at Placeholder fund, now estimates that bitcoin could continue its vertiginous plunge to the critical threshold of $20,000.

A recent survey by Deutsche Bank echoes the same alarmist tone, suggesting that a third of respondents expect a collapse of bitcoin below the symbolic $20,000 mark by the end of 2024.

Although widely exaggerated, the persistent negative sentiment around bitcoin is not completely unjustified nonetheless. Sure, circumstantial headwinds like the capital flight out of GBTC still persist.

Nevertheless, in the longer term, regulations are gradually becoming clearer, and crypto adoption continues at a steady pace. As summarized by Chris Burniske, the virtue of patience will remain crucial in this uncertain environment. A test towards $30,000 is not to be ruled out before the ascent to new heights.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Passionné par le Bitcoin, j'aime explorer les méandres de la blockchain et des cryptos et je partage mes découvertes avec la communauté. Mon rêve est de vivre dans un monde où la vie privée et la liberté financière sont garanties pour tous, et je crois fermement que Bitcoin est l'outil qui peut rendre cela possible.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.