Bitcoin: The Halving, a fatal blow to gold as an anti-inflation refuge?

The highly anticipated Bitcoin “Halving,” scheduled for the weekend of April 19, 2024, has raised many questions among analysts. Will this halving of new BTC emissions have a significant impact on its inflation rate and its status as a safe haven compared to gold?

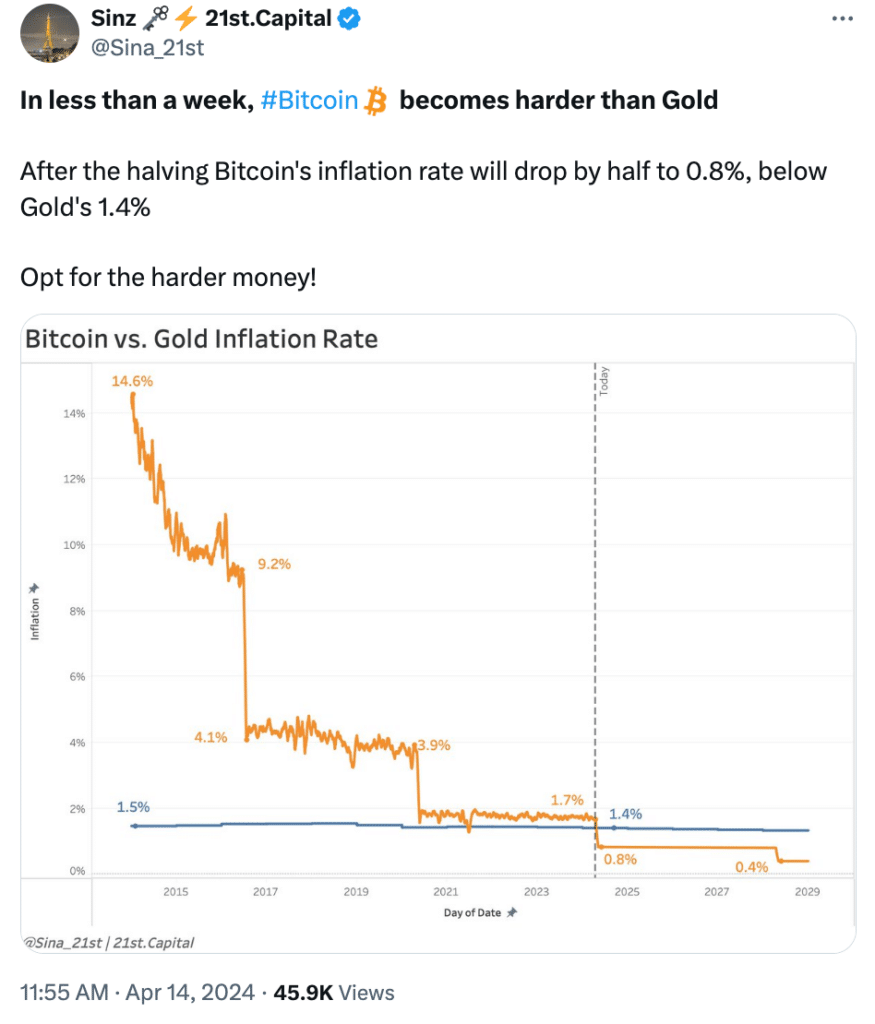

A soon-to-be lower inflation rate than gold

The Halving, a deflationary mechanism unique to Bitcoin and coded into its protocol, occurs every 210,000 blocks mined (approximately every 4 years). On April 19, the miners’ reward will drop from 6.25 BTC to 3.125 BTC per block.

According to the analysis by 21st.Capital, this reduction in the pace of issuance of new bitcoins mechanically compresses the annual inflation rate. Currently around 1.7%, it is expected to fall below 1% after the event, thus becoming lower than that of gold (about 2% per year).

Unlike fiat currencies whose central banks can increase the supply at will, Bitcoin limits its offering to 21 million units. About 19.7 million BTC have already been mined, and this cap will only be reached around the year 2140, according to estimates.

This programmed scarcity gives Bitcoin a unique resistance to inflation, where the annual production of gold tends to increase, a potentially decisive advantage for cementing its status as a safe haven according to many financial analysts.

A budding store of value despite volatility

However, despite these unique deflationary properties, Bitcoin remains a relatively young and volatile asset compared to gold, a tried-and-true store of value for millennia. Its increasing adoption, marked by milestones such as the approval of spot ETFs by the SEC in the US and its record high of $73,000 in March 2024, does not prevent it from experiencing sharp fluctuations.

To establish itself as a recognized store of value against inflation, Bitcoin will still need to prove its durability and gain stability. The challenge will be to transform its theoretical “Hard Money” into concrete and reliable protection of wealth, a role currently held by gold according to experts like Peter Schiff.

In short, this 4th Halving offers a new demonstration of Bitcoin’s programmed resilience against inflation. With increasing scarcity and an inflation rate on track to fall below that of gold, its potential as a capital protection is garnering growing interest. The challenges of volatility should gradually diminish as this revolutionary technology matures.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Passionné par le Bitcoin, j'aime explorer les méandres de la blockchain et des cryptos et je partage mes découvertes avec la communauté. Mon rêve est de vivre dans un monde où la vie privée et la liberté financière sont garanties pour tous, et je crois fermement que Bitcoin est l'outil qui peut rendre cela possible.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.