Bitcoin SV (BSV): What Is It?

Bitcoin SV (BSV), which stands for “Bitcoin Satoshi Vision”, is a cryptocurrency that emerged in November 2018 following a hard fork of the Bitcoin Cash (BCH) protocol. Since then, it has become one of the most valued cryptocurrencies on the crypto market, with an increasingly growing adoption. To better understand the potential of this digital currency, let’s take a closer look at its origins, technical characteristics, ecosystem, as well as the investment opportunities and challenges it faces.

Origins and History of BSV

The Conflict of Bitcoin Cash

Bitcoin Cash was born in 2017 from the split of the Bitcoin (BTC) blockchain. This cryptocurrency was created to address the scalability and cost issues that Bitcoin faced at that time. However, in 2018, a war broke out within the Bitcoin Cash community, pitting two camps against each other.

On one hand, some sought to improve the crypto payment experience, scalability, and fungibility of Bitcoin Cash. On the other hand, some wished to restore the original vision of Satoshi Nakamoto with BTC and significantly increase scalability.

The Creation of Bitcoin SV

This conflict ultimately led to the split of Bitcoin Cash into two distinct branches: Bitcoin ABC and Bitcoin SV. The latter was created in November 2018 by Craig Wright, a controversial Australian entrepreneur who claims to be Satoshi Nakamoto, the anonymous creator of Bitcoin.

Presentation of BSV and Its Objectives

Bitcoin SV aims to be a robust blockchain for decentralized applications (DApps). This project seeks to be a comprehensive development platform by offering advanced features such as smart contracts and the issuance of tokens.

In reality, this blockchain is intended to be more versatile and flexible than its predecessors. Backed by the company nChain, it also emphasizes scalability and security.

The Technical Characteristics of Bitcoin SV

Bitcoin SV is distinguished by several technical features.

Block Size and Scalability

BSV stands out from other cryptocurrencies due to its larger block size. Indeed, the maximum block limit for Bitcoin SV is 4 GB, compared to 1 MB for Bitcoin Core.

This difference allows the protocol to handle a greater number of transactions at once. This helps to prevent network congestion and improves its scalability. It also contributes to reducing transaction fees.

Furthermore, thanks to this, Bitcoin SV is able to compete with traditional electronic payment methods.

Security and Proof-of-Work Consensus

BSV uses the Proof-of-Work (PoW) consensus mechanism to validate transactions and add new blocks to the blockchain. This consensus is considered to be one of the most secure because it requires high computational power to carry out attacks on the blockchain.

However, this process is costly and energy-consuming. This raises concerns about the environmental impact of Bitcoin SV and other cryptocurrencies that use this mechanism.

Smart Contracts and Advanced Features

Bitcoin SV also offers advanced features such as smart contracts. Smart contracts are self-executing computer programs that allow for automating tasks and managing digital assets autonomously, without the intervention of a trusted third party.

The programming language used for smart contracts on this network is sCrypt. This is a scripting language that offers advanced functions such as multisig verifications, hashlocks, and timelocks. These options allow for adding additional layers of security and complexity to smart contracts, making them more flexible and powerful.

Moreover, Bitcoin SV supports tokenization. This process allows for creating digital tokens representing real assets such as stocks, bonds, or properties. Tokens can be exchanged, transferred, and stored on the blockchain, thus offering a new form of investment and financing.

Finally, Bitcoin SV has an “OP_RETURN” feature, which allows adding metadata or arbitrary data to a crypto transaction on the blockchain. OP_RETURN is generally used to store additional information that is not directly related to the transfer of funds in a transaction. This data may include messages, images, files, or other types of information.

The Development and Ecosystem of Bitcoin SV

The Development Team and Key Players of the BSV Project

Bitcoin SV is developed by a dedicated team of developers and contributors, led by the founder of nChain, Craig Wright. The development team consists of experts in cryptography, programming, economics, and finance. They actively work on improving the protocol and adding new features to the crypto platform.

In addition to the development team, there are many key players involved in the Bitcoin SV ecosystem. BSV miners are important players, as they secure the network and validate transactions. Companies and developers of DApps are also key players, as they build applications on the Bitcoin SV platform.

Partners and Projects Supported by Bitcoin SV

BSV has many partners in the cryptocurrency industry, including payment companies, exchange platforms, financial service providers, and investors. Some of the key partners of Bitcoin SV include TAAL, a blockchain infrastructure company, and SFOX, a crypto trading platform.

There are also many projects supported by Bitcoin SV, ranging from DApp development projects to research and development projects. Some of the most well-known projects are MetaNet, a decentralized data platform, and Money Button, a payment platform.

Adoption and Usage of Bitcoin SV

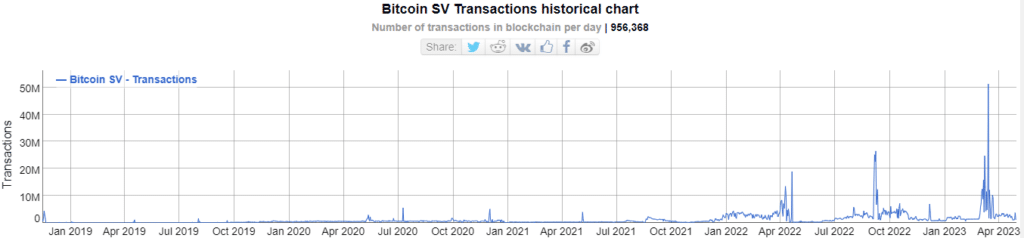

The adoption of BSV is constantly evolving, with a growing number of companies and merchants accepting BSV tokens as a payment method. Transactions on this blockchain have also experienced a significant growth recently.

Moreover, many DApp developers have chosen to build their applications on Bitcoin SV due to its power and flexibility. The DApps built on the platform range from decentralized finance to governance, games, and social media.

The Market and Investment in Bitcoin SV

Market Performance and BSV Capitalization

Since its creation in 2018, the price of Bitcoin SV has experienced volatile evolution. Like many other cryptocurrencies, its price is closely tied to market demand. In December 2019, the price of BSV was around 114 USD, but it reached a peak of over 430 USD in April 2021 before dropping back to around 118 USD in July 2021.

In terms of market capitalization, BSV generally ranks within the top 100 cryptocurrencies, with a valuation of about 645.70 million dollars at the time of writing this article.

Exchanges and Trading Platforms for BSV

Investors have access to several exchanges to buy, sell, and trade BSV. Among the most popular are Binance, Huobi, Bitfinex, Kraken, Bybit, CoinW, Hotcoin, and OKX. Each of these platforms has its own transaction fees, security policies, and identity verification requirements.

Thorough research is essential to find the platform that best suits your needs.

Wallets and Asset Management for BSV

Holders of BSV tokens must use a suitable wallet to store and manage their assets. Several solutions exist, including hard wallets (such as Ledger or Trezor), soft wallets (such as ElectrumSV), and mobile wallets (such as HandCash).

Each of these solutions has its advantages and disadvantages in terms of security, practicality, and cost.

The Future of Bitcoin SV

The future of Bitcoin SV is full of challenges and opportunities.

The Challenges and Opportunities of BSV

One of the main difficulties that BSV must face is the use of cryptocurrencies in everyday life. Although the technology is robust and the blockchain is well secured, the growth of the adoption of a crypto asset depends on many factors. These include user trust, ease of use, and transaction costs. The development of partnerships and innovative projects could help accelerate this adoption.

Bitcoin SV must also face fierce competition from other blockchain projects, such as Ethereum (ETH), EOS, and TRON, which also offer advanced smart contract features. This means that the project’s development team must continue to innovate to remain competitive.

Moreover, Bitcoin SV needs to resolve scalability issues associated with larger block sizes, which can affect transaction confirmation times and the network’s ability to process a large number of transactions.

Finally, Bitcoin SV must overcome the controversies surrounding some key figures in the project, such as Craig Wright, whose claim to the paternity of bitcoin is disputed by many members of the crypto community. This controversy can affect the credibility and perception of the project.

Despite these challenges, Bitcoin SV also offers many opportunities. The advanced features of smart contracts can enable the creation of new decentralized applications and more sophisticated financial tools. Additionally, partnerships and the development of innovative projects can also boost the adoption of the BSV token.

Prospects and Predictions for BSV

The prospects and predictions for the future of Bitcoin SV are mixed. On one hand, some optimistic observers see a growth potential for this cryptocurrency. Furthermore, the increasing adoption of BSV by businesses and users could also contribute to an increase in its value.

However, others are more skeptical about the project’s future. The controversies surrounding the credibility of Craig Wright and the increasing competition from other blockchains like Bitcoin Diamond may hinder its long-term success. Moreover, regulation and market fluctuations may also influence the fate of BSV.

In any case, the future of Bitcoin SV will depend on many factors, including its ability to overcome challenges and seize the opportunities that present themselves. Only time and market evolution will allow us to see if this cryptocurrency will succeed in establishing itself in the crypto scene in the long term.

Conclusion

BSV is a cryptocurrency that has had a tumultuous evolution since its creation. It stands out from similar projects (namely: Bitcoin Gold, Bitcoin Cash, Bitcoin Diamond, etc.) due to its larger block size. This allows for better scalability, as well as advanced features in terms of smart contracts. Additionally, the development of the Bitcoin SV ecosystem is driven by a determined development team and strong partners. Although its development prospects are uncertain, the cryptocurrency presents opportunities for investors and developers looking to get involved in an innovative project. However, it still needs to overcome a number of obstacles.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The Cointribune editorial team unites its voices to address topics related to cryptocurrencies, investment, the metaverse, and NFTs, while striving to answer your questions as best as possible.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.