Bitcoin: Short-term Traders Have Lost Big

A wave of panic sweeps across the bitcoin market. Within six weeks, short-term investors have lost more than $100 million, caught in a brutal correction. Should we see this as a troubling signal or a disguised opportunity for savvy investors?

Bitcoin investors trapped by volatility

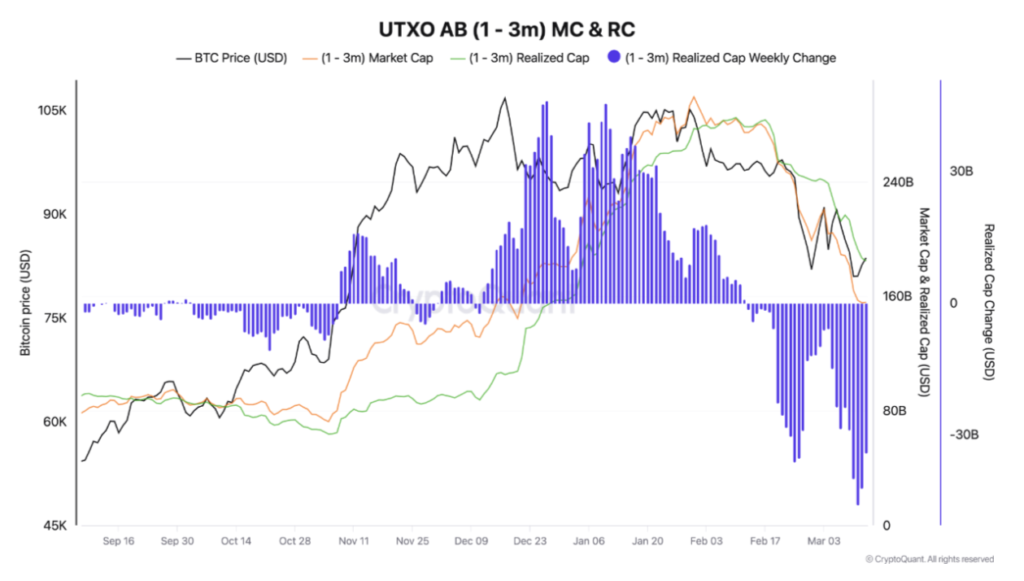

Since its historic peak in January, bitcoin has fallen by 30%, forcing many recent investors to liquidate their positions in panic. According to data from CryptoQuant, BTC holders who have held for 1 to 3 months are suffering the largest losses.

This phenomenon follows a classic dynamic: during a rising period, speculators rush in for quick gains. When the trend reverses, the less experienced sell in panic, resulting in this loss of over $100 million. On-chain indicators confirm massive sell-offs, worsening the current correction and increasing market instability.

Whales in ambush: discreet accumulation

While small bitcoin investors abandon their positions, the major market players see the situation differently. Unlike short-term speculators, these long-term holders and institutions seem to be taking advantage of this dip to strengthen their portfolios.

On-chain data then shows accumulation around $80,000, indicating that some see an opportunity rather than a bearish signal. This redistribution of assets from weak hands to strong hands is a recurring pattern observed during every brutal bitcoin correction in previous bullish cycles.

Can the bitcoin market rebound?

Uncertainty remains: is this correction a turning point or merely a bullish pause? Bitcoin has previously experienced declines of 30 to 40% before rebounding. Analysts are monitoring key levels, especially the $70,000 support. However, macroeconomics and regulations could still weigh on BTC’s trajectory.

Investors are thus paying for their haste, while long-term investors accumulate. Market psychology influences these corrections, but on-chain data suggests a possible stabilization. For seasoned analysts, this decline might be a buying opportunity rather than a warning signal, confirming the market’s resilience.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.