Bitcoin reserves on exchanges hit an ALL-TIME LOW! 📉

— TheLordofEntry (@thelordofentry) October 13, 2024

Bitcoin reserves on exchanges have continued to decline, suggesting that investors are opting to hold rather than sell. pic.twitter.com/jrefZIrtdM

A

A

Bitcoin Reserves Are Collapsing On Exchanges, A Bullish Signal?

Mon 14 Oct 2024 ▪

3

min read ▪ by

Getting informed

▪

Centralized Exchange (CEX)

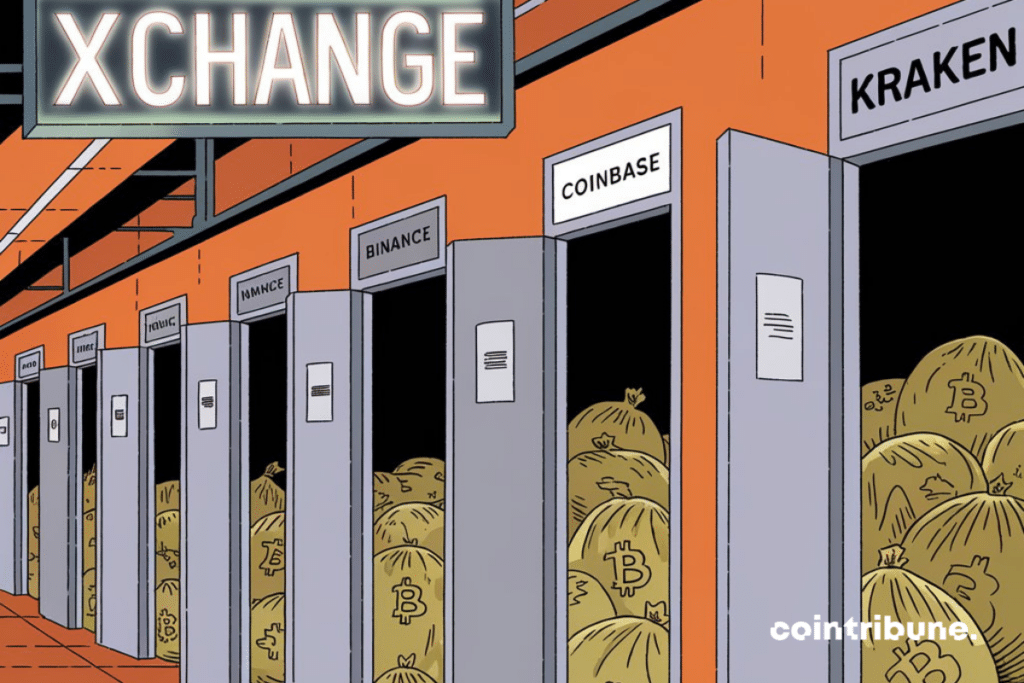

Times are changing in the world of cryptocurrencies: Bitcoin reserves on exchanges are dropping to a historic low. Is this the signal of a shift toward true decentralization of finance? While prices have been undergoing a correction since the last halving, on-chain data shows that fundamentals remain solid. Investors now prefer to hold their BTC away from trading platforms, thereby reducing short-term selling pressure.

BTC Traders Retreat: Historical Decline in Crypto Exchange Reserves

Since the last peak at $73,700 in March, the price of Bitcoin has struggled to maintain momentum, fluctuating around $62,600 recently. Yet, despite this instability, BTC reserves on exchanges continue to fall, hitting an all-time low.

This trend indicates that traders are increasingly opting for self-custody wallets, favoring direct ownership. This shift can be explained by:

- A 1.96% drop in Bitcoin prices;

- A substantial reduction in positions on the derivatives market;

- The persistence of high network activity, with a constant transaction volume.

The reduction in leveraged positions shows that traders are seeking to avoid excessive risks, which could mitigate short-term volatility, even if the path remains fraught with challenges.

Bitcoin: Long-Term Accumulators in Full Action

Data reveals an interesting phenomenon: long-term holders continue to accumulate BTC, while short-term investors seem tempted to sell. This appetite for accumulation reinforces Bitcoin’s position as the “flagship crypto” in the digital universe.

According to TheLordofEntry, the decline in exchange reserves is a bullish signal. He states: “Fundamentals remain strong, despite current volatility.“

While caution remains among investors, long-term trends appear more promising, supported by the regular accumulation by loyal holders and the reduction in selling pressure.

As a reminder, last April, Bitcoin reserves on exchanges reached a record low, signaling a marked trend toward self-managed wallets, a sign of a rush toward greater decentralization.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

A

A

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.