Bitcoin: What to Expect in November. Boom or Crash?

The Bitcoin, a flagship currency in this universe, is at the center of attention. With the arrival of November, investors, experts, and the curious pose an essential question: will Bitcoin continue its meteoric rise or experience a spectacular fall?

Financial roller coasters and institutional interest

November has historically been a pivotal month for Bitcoin since its inception in 2009. The early years witnessed its birth and establishment, followed by exponential growth, particularly in 2013 when BTC went from $198.23 to $1120.40.

After a period of relative stability, 2017 marked a spectacular rise, while 2018 saw a drastic drop. The following years oscillated between growth and retraction, with 2022 registering a decline of about 20%.

However, this historical analysis also shows Bitcoin’s ability to resist, rebound, and, most importantly, defy the most pessimistic predictions.

The year 2023 has seen a growing interest from financial institutions in BTC. Rumors and hints of approval for a Bitcoin-dedicated Exchange-Traded Fund (ETF) in the United States fuel this momentum.

BlackRock, with its iShares Bitcoin Trust, and other players like VanEck, aspire to revolutionize the market. These initiatives aim to make BTC investment more accessible and potentially more secure for the masses.

Beyond these new products, the stance of the SEC, a major regulator in the United States, will be decisive. Recent movements by the agency indicate a potential shift in direction, opening the door to wider Bitcoin adoption.

Geopolitics and Bitcoin: A new safe haven?

The unstable global geopolitics also influences the Bitcoin market. Recent tensions, notably in the Gaza Strip, have highlighted BTC’s potential role as a safe haven.

Institutional investors, often seen as cautious players, are beginning to allocate a portion of their portfolios to Bitcoin. This trend is driven by the quest for diversification against geopolitical risks.

Jack Tan, from WOO Network, highlighted to The Block that Bitcoin is increasingly perceived as a hedge against these turbulences, indicating market maturation and recognition of Bitcoin as a stable financial asset.

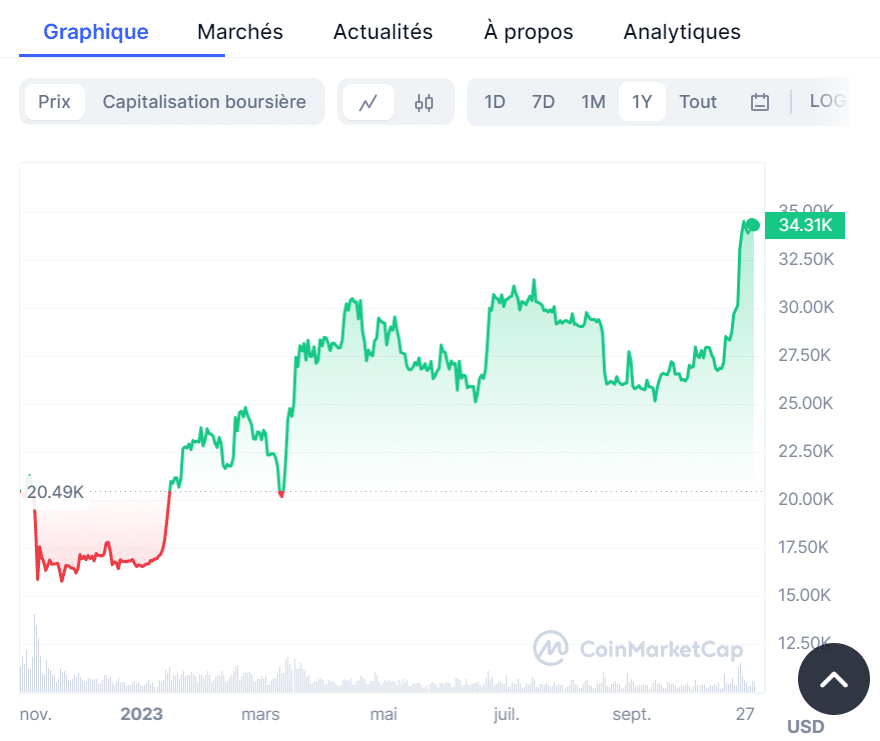

Bitcoin is currently displaying a bullish trend, especially when looking at key indicators like the RSI. However, the $35,000 resistance level remains a critical point to watch.

If this resistance is overcome, Bitcoin could enter a new phase of growth, with the next target being the $37,000 level. However, a correction is never excluded in such a volatile market, with potential support around $31,500.

The Bitcoin dominance, representing its market share compared to other cryptocurrencies, is also reaching interesting levels.

BTC, despite its unpredictable nature, continues to be the center of attention. November will likely be a month full of twists and turns. Whether it’s a boom or a crash, Bitcoin, with its tumultuous history, has taught us one thing: always expect the unexpected. In the meantime, the UN takes a look at its price.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Fascinated by Bitcoin since 2017, Evariste has continuously researched the subject. While his initial interest was in trading, he now actively seeks to understand all advances centered on cryptocurrencies. As an editor, he strives to consistently deliver high-quality work that reflects the state of the sector as a whole.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.