Bitcoin Ponzi Schemes: How to Spot Them

The Ponzi schemes have long been associated with fraudulent investments. With the advent of cryptocurrencies such as Bitcoin (BTC), new forms of this classic scam have emerged. This article will help you master the basics of this type of Bitcoin scams, recognize the warning signs to look out for in order to detect them, and know how to protect yourself.

Understanding how a Ponzi scheme works

To avoid being a victim of this type of scam, you must understand how they work and know how to distinguish them from legitimate crypto opportunities.

Basic principles

A Ponzi scheme is a fraudulent money-placement system that relies on the recruitment of new investors to pay the returns of previous clients. This system is named after Charles Ponzi, who orchestrated a vast scam using this strategy in the 1920s. The characteristics of a Ponzi scheme are:

- The promise of high and guaranteed returns with little or no risks;

- The constant recruitment of new investors to maintain the cash flow;

- The lack of transparency and details about the company or the investment product.

The differences between a Ponzi scheme and a reliable crypto opportunity

The key differences between a Ponzi scheme and a legitimate crypto investment plan boil down to the following elements:

- The source of income: Legitimate crypto opportunities derive their profits from real business activities, while Ponzi schemes rely on recruiting new investors;

- Returns: Reliable crypto plans offer realistic income based on market performance, whereas those of Ponzi schemes are high and supposedly guaranteed;

- Transparency : The companies behind legitimate crypto opportunities are transparent about their business model and financial performance, while Ponzi schemes are often opaque and mysterious regarding this information.

Warning signs

Here are some common warning signs to watch for when it comes to detecting a pyramid scheme related to Bitcoin or other cryptocurrencies. Keep them in mind so you can quickly identify them when they present themselves to you.

High and guaranteed returns

A major warning sign is the promise of high and guaranteed returns with little or no risks. Reliable crypto opportunities generally involve a certain degree of risk and do not guarantee high returns. If a crypto investment opportunity guarantees you millions of dollars in returns in record time, it is likely to be fraudulent.

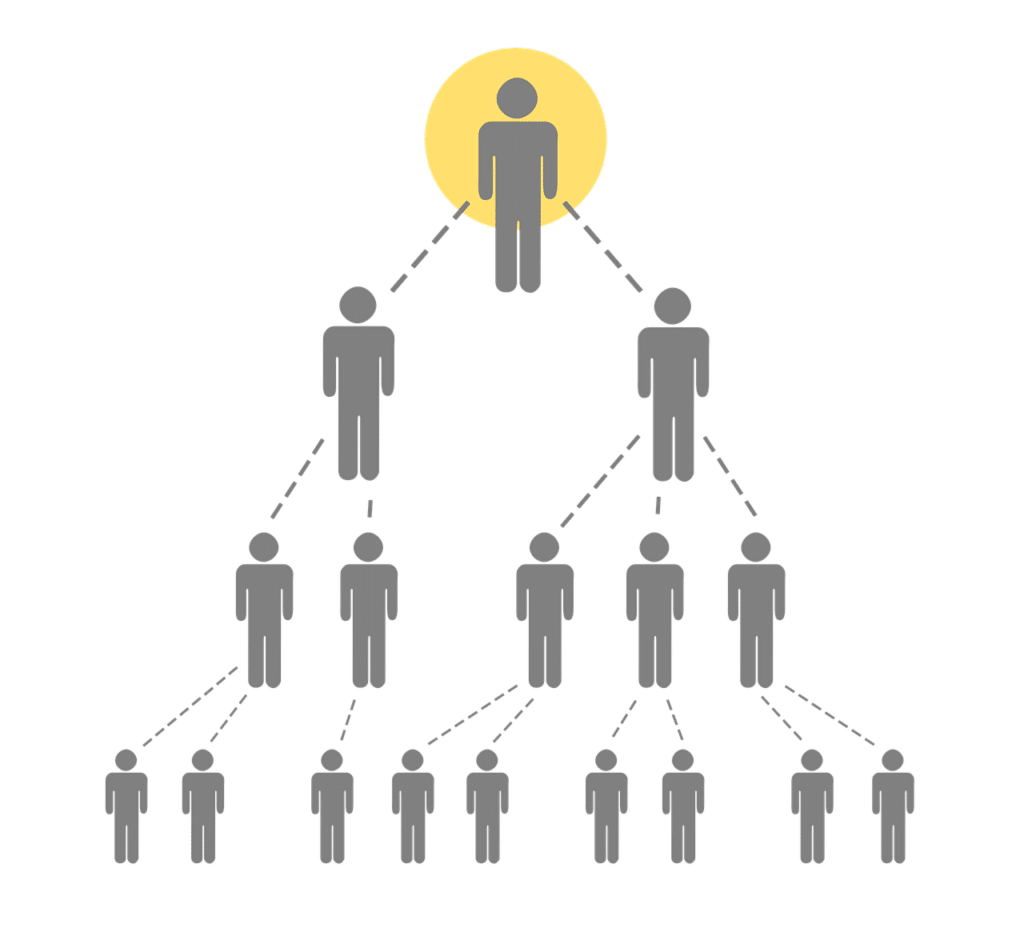

Recruiting investors to increase returns

If a company actively encourages the recruitment of new investors to increase returns, it may be a sign that it is a Ponzi scheme or scam. Legitimate investment plans do not need to constantly attract new participants to generate profits. So be wary of cryptocurrency opportunities that promise to substantially increase your returns by suggesting you invite your relatives to join their ranks.

Lack of transparency and information

Companies involved in Ponzi schemes are often very discreet about their business model and activities. They usually provide little information about their leaders, their headquarters, and their financial performance. You should be cautious of a company that does not provide clear and transparent information, allowing you to locate and assess it at any time.

Absence of a real product or service

A Ponzi scheme may claim to sell a product or service while relying on recruiting new investors to generate income. If a crypto investment company does not seem to have a real product or service to offer to the public, this may be a sign of a Ponzi scheme. In the case of reliable crypto opportunities, the promoted services are generally staking, yield farming, or lending crypto assets like Bitcoin.

Some protection measures against Ponzi schemes

There are several precautions you can take to protect yourself from this type of scam. The following three actions should allow you to stay one step ahead of the pyramid schemes that plague the cryptocurrency market.

Conduct thorough research

Before investing in a crypto opportunity, it is essential to conduct thorough research on them. This includes:

Verify the legitimacy of the company

Ensure that the company behind the crypto offer is registered with financial regulators such as the SEC in the USA and the AMF in France, for example, and has a license to conduct its activities. Therefore, you should be cautious of companies that cannot provide proof of registration or licensing.

Scrutinize user reviews and online comments

Check reviews from other investors and online comments on the company’s official accounts (Facebook, Twitter, Telegram) to get an idea of the reputation of the latter. Keep in mind that positive reviews can be faked, so it is important to check multiple sources and look for warning signs in the various comments.

Do not give in to the pressure to invest quickly

Scammers behind Ponzi schemes related to Bitcoin often pressure victims to quickly invest their funds, particularly by promising limited-time offers or exclusive bonuses. However, you should take the time to evaluate the opportunity presented to you, and not give in to the temptation to achieve returns in record time.

Understand the risks associated with crypto investments

Investments in cryptocurrencies are intrinsically risky due to market volatility and the lack of uniform regulation. You must take the time to understand the associated risks and never invest more than you are willing to lose.

What to do if you are a victim of a pyramid scheme?

If you think you have been a victim of a pyramid scheme related to Bitcoin or other cryptocurrencies, here are some steps to follow:

Report the scam to the relevant authorities

You must contact local or national authorities responsible for law enforcement and financial regulation to report the scam. This can help prevent other victims and, eventually, put an end to the scam based on the elements of your complaint.

Try to recover your funds

It can be difficult to recover funds invested in a Ponzi scheme, but it is sometimes possible to recover some of your money. Work with the relevant law enforcement authorities and, if necessary, hire a lawyer specialized in financial law to assist you in your efforts.

Share your experience

By sharing your experience with other potential victims, you can help raise awareness about scams related to cryptocurrencies. So do not hesitate to share your story on online forums, social media, and with your family and friends to reach as many people as possible.

Conclusion

Pyramid schemes related to Bitcoin and other cryptocurrencies have become commonplace in the market. It is therefore essential to understand how these scams work and to remain vigilant regarding warning signs that allow you to identify them. By conducting thorough investigations and fully grasping the risks inherent in these types of investments, you will be able to minimize the risk of being a victim of a cryptocurrency-related pyramid scam or even a Bitcoin phishing.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The Cointribune editorial team unites its voices to address topics related to cryptocurrencies, investment, the metaverse, and NFTs, while striving to answer your questions as best as possible.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.