#Bitcoin is the Exit Strategy. pic.twitter.com/aauBgmE25a

— Michael Saylor⚡️ (@saylor) February 20, 2024

A

A

Bitcoin - Michael Saylor Will “Never” Sell

Thu 22 Feb 2024 ▪

3

min read ▪ by

Getting informed

▪

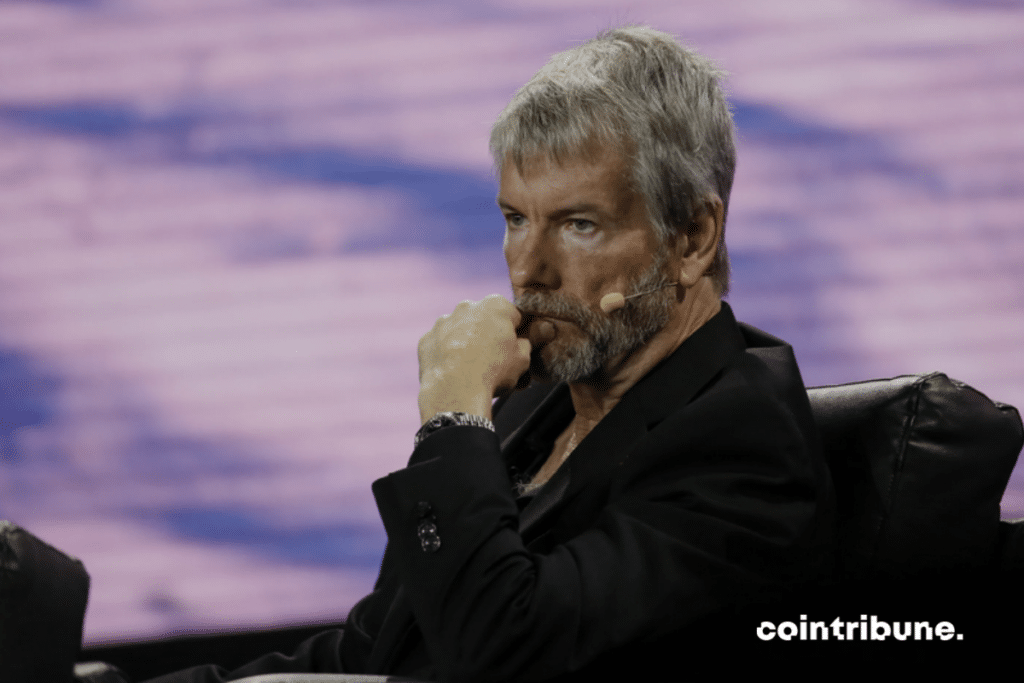

Michael Saylor came back on Bloomberg to preach the good word about Bitcoin.

“You don’t sell your bitcoin”

Microstrategy shows a latent gain of 70% on its treasury converted into bitcoins. Bloomberg wanted to know if Michael Saylor plans to take profits on these 200,000 BTC ($10 billion).

I’m going to be buying the top forever. Bitcoin is the exit strategy. It’s the most powerful asset. It’s an asset class that has just reached $1 trillion. It stands side by side with major assets like Apple, Google, Microsoft. But unlike the magnificent seven (Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia, and Tesla), bitcoin is an asset class all by itself. It’s not a multinational corporation.

There’s not a lot enough room in the capital structure of those companies to hold 10 trillion or $100 trillion worth of capital. So Bitcoin is competing against gold, which is 10x. What it is right now, it’s competing against the S&P index, it’s competing against Real Estate $100 trillion-plus asset class as a store of value. We believe that more capital will leave those asset classes for a safe haven in bitcoin. Bitcoin is technically superior to those asset classes. And that being the case, there’s just no reason to sell the winner to buy the losers.

As written in this article, the launch of bitcoin ETFs coincides with divestment from gold-backed ETFs. The latter are experiencing an outflow. They have recorded total outflows of $2.1 billion when, at the same time, Bitcoin ETFs have taken in $5 billion.

For your information, a single BTC will be worth $500,000 when its total market cap reaches that of gold. We should reach this figure within 7 years if, as Michael Saylor believes, BTC appreciates by 40% per year over the coming decade.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

A

A

Bitcoin, geopolitical, economic and energy journalist.

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.