Bitcoin: Metaplanet Injects 1 Billion Yen Into BTC!

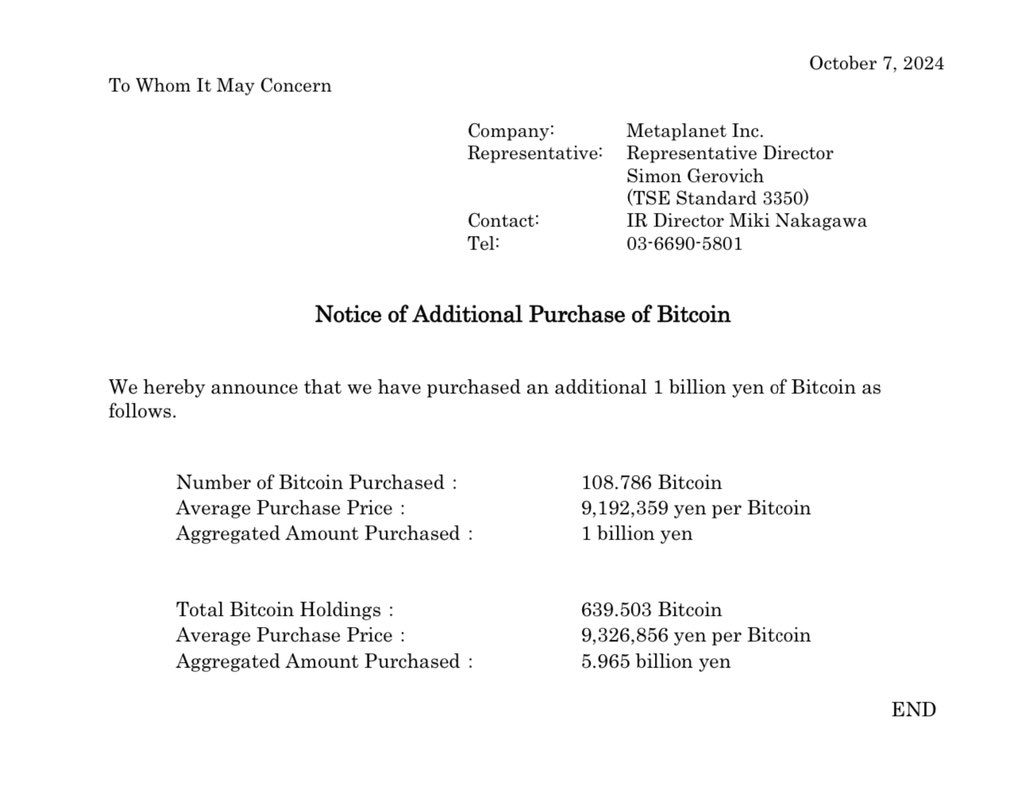

Bitcoin continues to attract large companies, and Metaplanet is no exception. This Japanese investment firm, which is multiplying strategic acquisitions, has just announced a new purchase of 108.78 bitcoins for a total amount of 1 billion yen (approximately 6.1 million euros). This investment places Metaplanet among the world’s most influential companies in the Bitcoin ecosystem, reinforcing its heavyweight status in the cryptocurrency world. But what does this recent acquisition conceal? Between strategic vision and a race for domination, Metaplanet seems determined to make history in the realm of Bitcoin.

A strategy of accumulation that is asserting itself

Since last May, Metaplanet has been playing the Bitcoin card. The company stated from the outset its desire to build a “strategic reserve,” using price fluctuations to gradually increase its holdings.

Today, with 639.5 bitcoins under its custody, Metaplanet now holds a significant position among the most committed Japanese companies in digital assets.

Why this keen interest in Bitcoin? Metaplanet seems to believe in its potential as a store of value and means of asset diversification.

Indeed, the company has relentlessly strengthened its positions while maintaining a subtle balance between buying and selling to optimize its profits.

Last week, for instance, it made a capital gain of about 1.3 million euros by selling 23 bitcoins. This flexible and thoughtful approach suggests a long-term vision on Metaplanet’s part, which wants to both secure its market presence and capitalize on price fluctuations.

This strategy is paying off. At an average purchase price of 9,192,359 yen per bitcoin (56,588 euros), Metaplanet continues to acquire BTC at strategic times, particularly during price dips.

This positioning indicates a thorough market analysis and renewed confidence in Bitcoin’s ability to play an increasingly central role in the global financial system.

A long-term vision and a bet on Bitcoin

For Metaplanet, Bitcoin is not just a speculative asset. It’s a bet on the future of finance. By accumulating BTC, the company is preparing for a scenario where Bitcoin could become a safe haven in times of economic volatility.

The decentralized and limited status of the cryptocurrency makes it a particularly attractive diversification tool in a world where fiat currencies are increasingly subject to aggressive monetary policies.

In addition to that, Metaplanet registers its name among the world’s major bitcoin holders. Although still far behind giants like MicroStrategy and Marathon Digital Holdings, which hold 252,220 and 26,842 bitcoins respectively, the Japanese company is now a key player on the international stage.

Its growing influence could even inspire other Japanese companies to follow suit, thus strengthening Japan’s position as a strategic hub for cryptocurrency development in Asia.

This week’s acquisition also allows Metaplanet to consolidate its status in Japan and in the crypto world.

It is gradually approaching the companies that dominate the ranking of the largest Bitcoin holders.

More than a simple investment, this approach could foreshadow a trend among other Japanese companies, especially those seeking alternatives to traditional investments. Such dynamics could be the start of a broader movement towards institutional adoption of Bitcoin.

The impact of Metaplanet’s strategy extends beyond its own reserves. Its support for Bitcoin could influence the market as a whole, sending a strong signal to other institutional investors. Meanwhile, the Fear & Greed index is diving into fear!

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Fascinated by Bitcoin since 2017, Evariste has continuously researched the subject. While his initial interest was in trading, he now actively seeks to understand all advances centered on cryptocurrencies. As an editor, he strives to consistently deliver high-quality work that reflects the state of the sector as a whole.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.