Bitcoin Is Disappearing From Exchanges! Get Ready For Price Increases

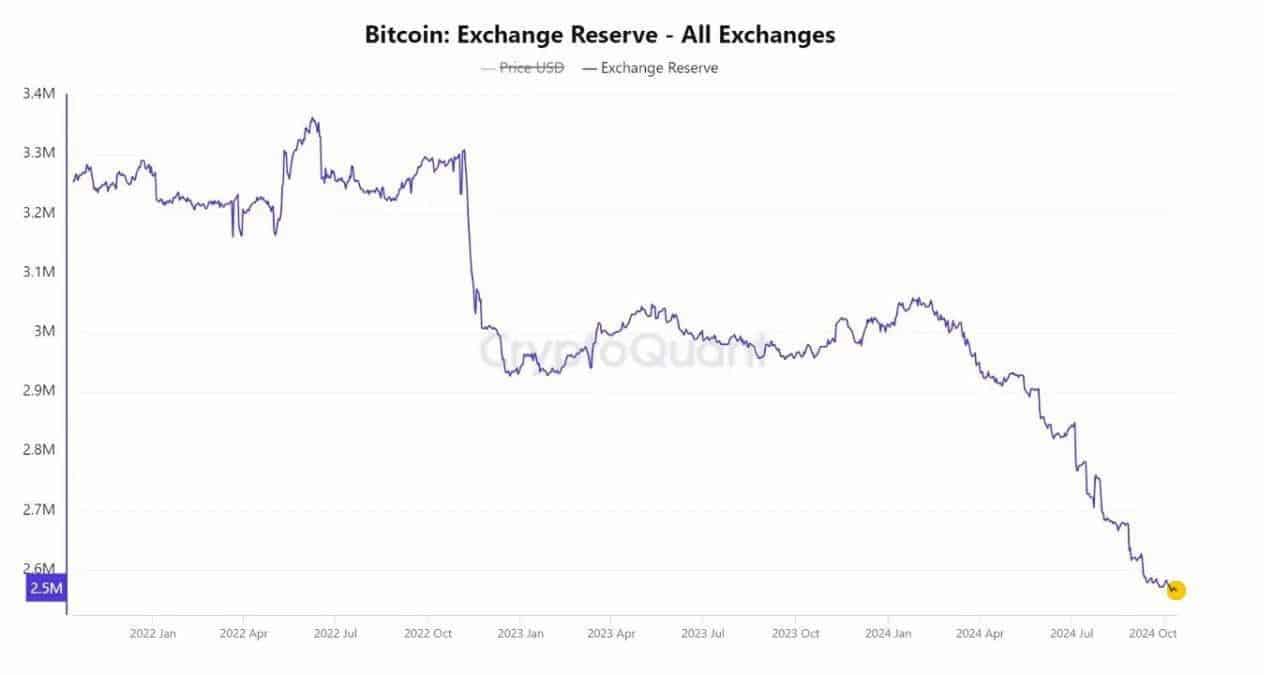

The crypto market is facing a major event. Bitcoin reserves on centralized exchanges (CEX) have reached a new all-time low with only 2.6 million BTC available! This significant decrease in reserves could signal an imminent supply shortage, a phenomenon often referred to as a “supply squeeze.”

Bitcoin drops drastically from centralized exchanges!

A “supply squeeze” occurs when the amount of bitcoin available on exchanges decreases drastically, thus reducing the accessible supply for potential buyers. This situation can lead to a rapid increase in BTC prices, as demand exceeds the available supply.

Recent data shows that bitcoin reserves on exchanges have dropped from more than 3.3 million BTC three years ago to 2.6 million. This downward trend reflects a continued accumulation of Bitcoin by long-term holders, while short-term holders are showing signs of selling.

Several factors contribute to this decline in Bitcoin reserves on exchanges. Firstly, many holders prefer to transfer their assets to private wallets for increased security, thus reducing the amount of BTC available on exchange platforms. Moreover, the growing interest in Bitcoin-based financial products such as exchange-traded funds (ETFs) has also contributed to this decrease in reserves.

Between opportunities and risks!

For investors, this situation presents both opportunities and challenges. Historically, such events have often been followed by significant price increases, thus offering potential gains for those already holding bitcoin. However, increased market volatility can also pose a risk for new entrants.

The record low of bitcoin reserves on centralized exchanges could signal a period of increased volatility and upside potential for the Bitcoin market. Investors must remain vigilant and closely monitor future developments to take advantage of the opportunities offered by this unique market dynamic.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.