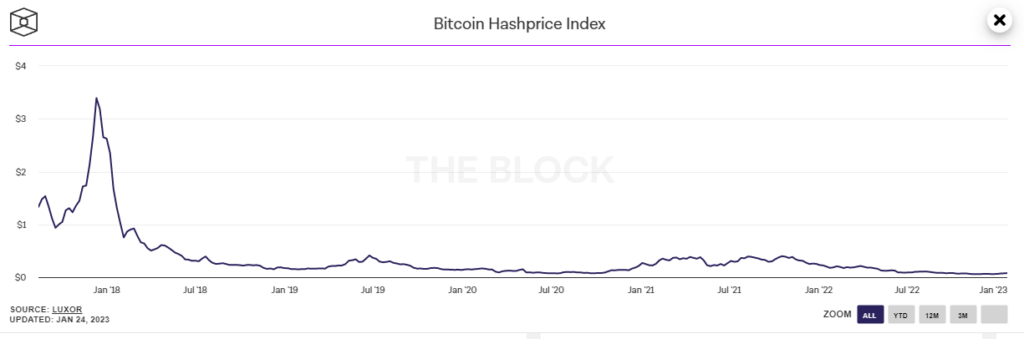

Bitcoin Hash Price: What You Need to Know

The hashprice or hash price is a very important measure for crypto miners. It is particularly useful to them when it comes to determining the profitability of their operations. Therefore, if you are interested in Bitcoin mining (BTC), or if you are simply a cryptocurrency enthusiast, you will probably want to know more about it. This article explains in detail what hashprice is and why it is so relevant in the crypto industry.

What is the hashprice?

The hashprice is an indicator that allows valuing the computing power used to run a Proof-of-Work (PoW) network. In other words, it is the market value of each unit of hashrate (hash rate) that miners deploy to validate and secure transactions on the network.

More specifically, it’s the answer to the question: “How much do miners earn on average each day for each terahash (TH) they produce?” The hashprice is often expressed in dollars per terahash per second and per day ($/TH/s/d). However, depending on the network, this unit of measurement may change.

How is the bitcoin hashprice calculated?

The hashprice is obtained by dividing the daily revenue (in dollars) of miners by the global daily hashrate (Terahash per second).

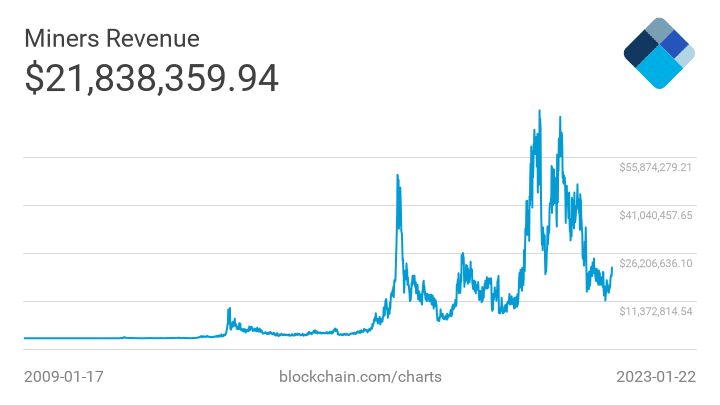

The revenue of miners includes both block rewards and transaction fees. Thus, the Bitcoin hashprice essentially depends on two factors: the adjustment of mining difficulty and the fluctuations of the bitcoin price.

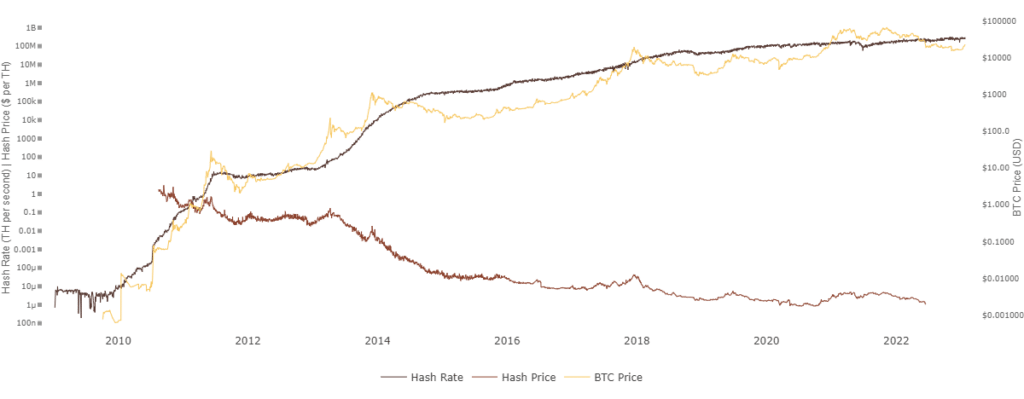

As a reminder, mining difficulty evolves according to the global network hash rate. As the hashrate increases, it becomes harder to mine a block. Miners must therefore invest more computing power to maximize their chances of earning new bitcoins. Since the block reward is constant, the increase in difficulty reduces the value in BTC of each unit of hashrate expended. Conversely, a reduction in difficulty leads to an increase in hashprice.

Moreover, as miners’ earnings are paid in bitcoins, when the price of Bitcoin rises, the dollar-denominated hashprice also increases. Conversely, a drop in its price implies a decrease in hashprice.

It should also be noted that the volume of transaction fees is positively correlated with the hashprice, as it also affects miners’ income.

The curve above illustrates the type of hardware used to mine bitcoins. Specifically, it shows the transition between the generation of GPUs (low hashprice high hashrate) and ASICs (high hashprice low hashrate) around 2014.

Indeed, the hashprice has significantly decreased over time as miners turned to more robust devices. Furthermore, despite the sharp rise in the price of the leading cryptocurrency, the hashprice tends to decline.

Why is the hashprice important?

In recent years, the hashprice has gained some popularity among miners. This metric provides information on the real value of the hashrate. It enables miners to better assess the performance of their resources in terms of yield.

That said, it is also possible to use this indicator to forecast future gains. For instance, if you multiply the hash power of mining equipment by the current hashprice, you can deduce an estimate of its profitability. Thus, if we assume that, at a given moment, the expected hashprice is 0.2/TH/s/d, a miner with a hash capacity of 70 Th/s could generate 14 dollars a day.

Finally, by following the evolutions of the hashprice over time, miners can adapt their mining strategy to optimize their revenue.

How to monitor the bitcoin hashprice?

To keep an eye on the fluctuations of Bitcoin’s hashprice, various methods are available to you.

The first consists of consulting specialized aggregation sites such as Glassnode, Woobull and Hashrate Index. These platforms gather data from major blockchain networks, providing a real-time overview of the bitcoin hashprice and/or other cryptocurrencies. This allows miners to have an insight into the evolution of this metric over time.

The second approach is to use an API to query external data sources. This approach is particularly interesting when developing a custom application that leverages this information.

Conclusion

The hashprice allows pricing the computing power engaged in securing the network. It functions not only as a profitability barometer but also as a strategic tool through which miners can have an overview of the mining sector and plan development strategies accordingly. Furthermore, the Bitcoin hashprice is a relatively volatile measure, as it varies according to the token price, total network hash rate, and transaction fees. While the hashprice offers a perspective on mining profitability, it is essential to understand the role of Bitcoin Hashrate in this context. The hashrate, reflecting the network’s computing power, directly influences mining difficulty and, consequently, hashprice. An increase in the hashrate indicates increased competition among miners, thus impacting profitability. This interdependence underlines the importance of tracking the hashrate to better understand Bitcoin mining dynamics and anticipate hashprice trends.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The Cointribune editorial team unites its voices to address topics related to cryptocurrencies, investment, the metaverse, and NFTs, while striving to answer your questions as best as possible.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.