Bitcoin Gold: Origin, Functioning And Future Of The Hard Fork

Bitcoin Gold (BTG) is a cryptocurrency project that results from a hard fork of Bitcoin (BTC). It was created with the aim of making mining more accessible. Since its launch, this project has been adopted by several exchange platforms and crypto wallets. In this article, we will explore in detail the origins of BTG and how it works. We will also attempt to determine what the future holds for this digital asset that has been gaining ground in the cryptocurrency market for several years.

Origins of Bitcoin Gold

Context of Creation

To understand the context of the creation of Bitcoin Gold, it may be interesting to revisit the history of Bitcoin. But to summarize, BTG is the fruit of reflections triggered by the growing centralization of bitcoin mining activities.

Indeed, with the emergence of increasingly sophisticated hardware, Bitcoin mining has become the exclusive domain of large mining farms. This has given them a significant decision-making monopoly over the blockchain at the expense of smaller miners.

Realizing this decreasing centralization, a group of developers, once contributors to the Bitcoin blockchain, initiated a hard fork of it. Named Bitcoin Gold, the project was launched in October 2017.

Objectives and Motivations

Bitcoin Gold primarily aims to further decentralize the mining industry. Indeed, for the project’s founders, it was essential to restore fair competition conditions for this activity.

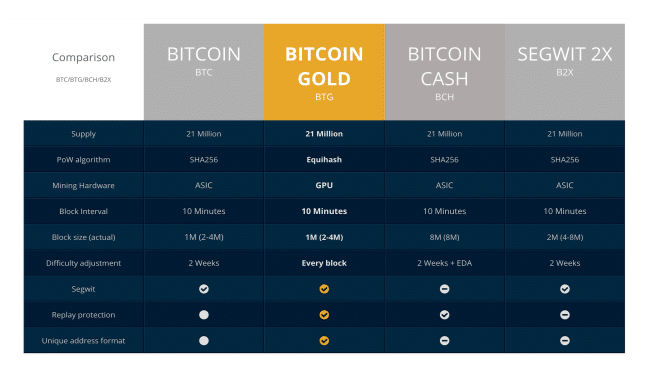

To achieve this, they modified the consensus algorithm so that specialized hardware like ASICs is no longer required. Thus, the SHA-256 hashing algorithm used by Bitcoin was replaced with a less resource-intensive alternative.

How does Bitcoin Gold work?

The functioning of Bitcoin Gold relies on several elements: its hashing algorithm, its consensus mechanism, its economic characteristics, as well as the wallets and exchanges that support it.

The Equihash Hashing Algorithm

Unlike Bitcoin, Bitcoin Gold uses the Equihash hashing algorithm. It is a proof-of-work (PoW) protocol designed to resist ASICs (Application-Specific Integrated Circuits). Indeed, ASIC miners have the particularity of offering exceptional performance. However, they are not accessible to ordinary miners whose means are limited.

The Equihash algorithm allows for mining with more affordable hardware like graphics cards. The goal is to reduce the influence of large companies in the field and democratize mining for miners with more modest budgets.

The Consensus Mechanism

Like Bitcoin, Bitcoin Gold is based on a proof-of-work (PoW) consensus mechanism. Miners must inject computational power to validate transactions and add new blocks to the blockchain. This operation is accompanied by a monetary creation process that allows new BTG tokens to be created. The first miner to solve the complex mathematical problems associated with the process is rewarded for their efforts with the newly created coins.

Regarding mining difficulty, it is regularly adjusted to maintain a block generation time of around 10 minutes. Additionally, the block size is 1 MB. Also, the security of the Bitcoin Gold network depends on the hashing power of the miners. This means that the more miners involved in processing transactions, the more secure the protocol is.

Tokenomics

Issuance and Distribution

Like Bitcoin, the maximum supply of Bitcoin Gold is set at 21 million tokens. This helps preserve the token’s value by creating a sense of scarcity and preventing inflation.

At the time of writing (April 24, 2023), the circulating supply of BTG is 17,513,924 tokens. This means that over 83% of the total supply has already been issued, compared to 92% for Bitcoin.

Furthermore, when Bitcoin Gold was introduced, Bitcoin holders who engaged in this new project received an equivalent amount of tokens in BTG. In other words, the initial distribution of this token’s supply was based on the amount of Bitcoins held at the time of the fork.

Rewards and Halving

Miners in the Bitcoin Gold network receive incentives for their participation in the proper functioning of the network. At the time of writing, the reward for each block is 12.5 BTG. This reward decreases every 210,000 blocks, or about every four years. This process is also called “halving”, as in the case of Bitcoin from Satoshi Nakamoto.

The next halving, which will be the third since the creation of Bitcoin Gold, is scheduled for April 21, 2024, at block 630,000. It will reduce the reward for miners to 6.25 BTG per block.

Price and Volatility

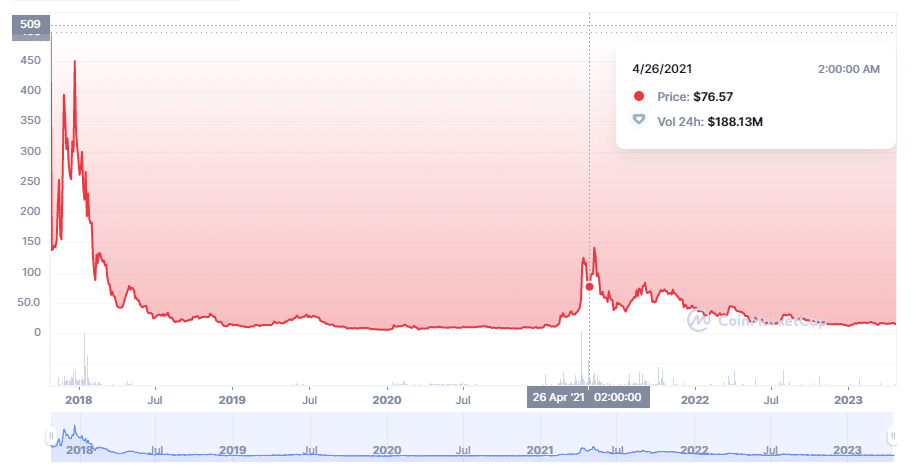

Although Bitcoin Gold is a supposedly “improved” version of Bitcoin, it is far from enjoying the same popularity at the moment. This is clearly evident in its price in the market.

Indeed, the price of BTG primarily fluctuates below the $20 mark since its creation. That being said, at its inception, around December 2017, it managed to reach a peak of $449. It then experienced a sharp decline until May 2021, where it reached a new record of $140. After that, Bitcoin Gold recorded a period of decline before ultimately stabilizing around $14.5 at the time of writing.

Wallets and Exchanges

Several wallets and crypto exchange platforms are compatible with Bitcoin Gold. Among the most popular wallets are: Trezor, Ledger, ElectrumG, Core wallet, Exodus, Coinomi, and Atomic Wallet. Additionally, you can trade BTG on over 75 exchange platforms, including: Binance, Huobi, HitBTC, Bitfinex, Bybit, Bithumb Gate.io, Upbit, and OKEx.

Future Perspectives

Challenges and Threats

Like any other cryptocurrency, Bitcoin Gold is exposed to certain challenges. The first of these is the competition with other crypto assets. Moreover, the reliability of the Equihash algorithm in terms of security is often questioned by some observers. Another threat to this project is the lack of transparency and communication from the development team.

Furthermore, the issue of regulation remains ever-present in the world of cryptocurrencies. Each country has its own laws and regulations, and these must be taken into account. Decisions made by regulators, whether to ban mining operations or restrict access to certain services, can hinder the adoption of existing solutions. Therefore, complying with regulatory policies is essential to ensure the sustainability of these projects.

Development Perspectives

Bitcoin Gold continues to improve by enhancing its blockchain’s performance in terms of security, decentralization, and scalability. In fact, the development team is actively working to strengthen capabilities, optimize the consensus mechanism, and propose new features that facilitate transactions and asset management.

Not to mention that the gradual adoption of crypto assets and blockchain technology in general presents an opportunity for Bitcoin Gold to carve out a niche for itself in the crypto market. The success of the platform will depend on its ability to innovate and provide its users with increasingly competitive services.

Conclusion

Bitcoin Gold is a project born out of a split from the main chain of the Bitcoin protocol. It aims to restore a more decentralized mining model so that everyone can contribute to the functioning of the network. Although it struggles to compete with BTC in notoriety and capitalization, BTG is already well-regarded within the crypto ecosystem. In competition with other forks such as Bitcoin Cash (BCH) and Bitcoin SV (BSV), it must evolve its levels of decentralization, security, scalability, and transparency to gain notoriety and attract a strong community.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The Cointribune editorial team unites its voices to address topics related to cryptocurrencies, investment, the metaverse, and NFTs, while striving to answer your questions as best as possible.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.