Bitcoin ETFs Could Attract $100 Billion in Inflows by 2024!

The Standard Chartered Bank is displaying optimism about the future of the flagship cryptocurrency. According to the bank, the Bitcoin ETF could be propelled by a massive inflow of 50 to 100 billion dollars in 2024, provided that the SEC gives the green light to the Spot Bitcoin ETF. This promising momentum would undoubtedly boost the price of BTC, propelling it toward dizzying heights by the end of 2025.

An Influx of 100 Billion Dollars in Play

As crypto investors eagerly await the SEC’s approval of Bitcoin ETFs, a recent analysis by Standard Chartered Bank injects an additional dose of optimism into the market.

The bank asserts that the exchange of Bitcoin ETFs could experience a significant rise in the event of SEC approval. Indeed, it anticipates an influx of 50 to 100 billion dollars into Bitcoin ETFs in 2024. This potential influx will likely lead to a rise in the crypto’s price.

In its analysis, Standard Chartered estimates that the Bitcoin ETF market is evolving more quickly. It is reaching maturity faster than the gold market, it explains. The bank used the introduction of the first US-based gold ETP in November 2004 as a point of comparison.

The price of gold was multiplied by 4.3 over the seven to eight years following the introduction of the first ETP, a period necessary for the gold holdings to reach maturity. If the flagship cryptocurrency follows a similar scenario but reaches market maturity more quickly, the BTC price could soar up to $200,000 by the end of 2025.

The SEC May Soon Approve Bitcoin ETFs

Standard Chartered has stated that the approval of Bitcoin ETFs by the Securities Exchange Commission (SEC) is imminent. Indeed, this is expected to happen this week. Of course, the approval of the spot ETFs will have a significant impact on the price of Bitcoin (BTC), which has reached $47,000 today.

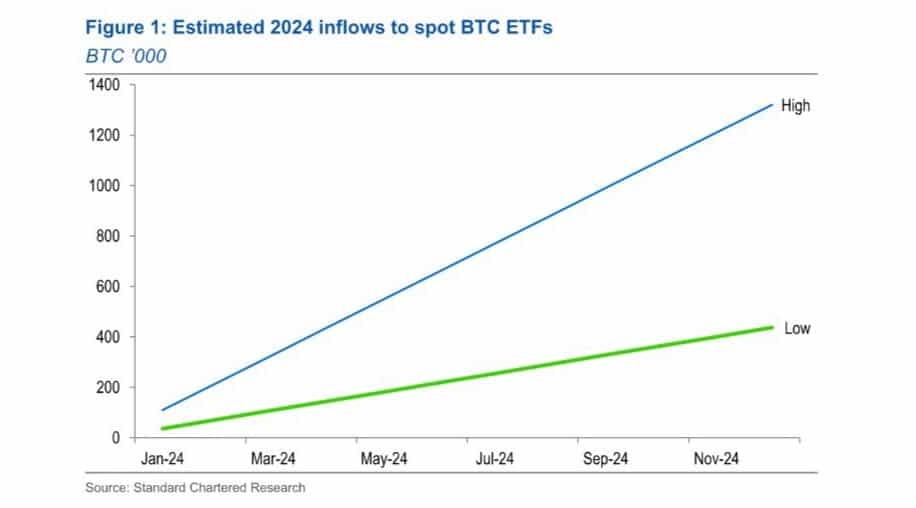

Standard Chartered expects Bitcoin to experience price gains of a magnitude similar to that following the introduction of the ETP. However, it forecasts these gains to materialize over a shorter period, between one to two years. This implies that between 437,000 to 1.32 million new Bitcoins will be held in American ETFs by the end of 2024.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Je suis passionnée par les cryptomonnaies, un monde que j'ai découvert il y a peine 3 ans. Mon seul but est de vous informer de cet univers incroyable à travers mes articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.