Bitcoin: Correlation With Returns, A Myth?

There has been a lot of volatility in interest rates over the past two years. How can a change in the yield rate affect an asset like bitcoin? This is where we will look at the different factors surrounding interest rate changes and the consequences for bitcoin.

Why is the 10-year yield rate important?

The 10-year US yield rate is one of the most watched interest rates in the world. There are several factors that explain this. Firstly, it is used as the least risky investment because the US Treasury is expected to repay the invested capital at the maturity date. The risk lies in the country’s solvency. Therefore, as it is considered low-risk, it will often be compared to other asset classes. This is to determine whether the compensation will be worth it. So, the objective is to seek a higher return than the “free risk” if we take an asset with more risk. Secondly, the 10-year yield rate will also play a role in relation to other debts. For example, it will affect the rates used for mortgages or loans.

Factors influencing the 10-year yield rate

The variation in the 10-year yield rate (interest rate) can come from several reasons such as growth evolution, inflation, central bank decisions, supply and demand… Since it evolves according to multiple factors, the impact on assets can sometimes differ. That’s why it’s important to know the underlying reason for the movement and the environment.

For example, the 10-year yield rate might rise because we are in a growth acceleration phase. And then, it could continue to rise because there is inflationary pressure resulting from the growth acceleration. In both cases, the interest rate rises, but the impact on interest rate-sensitive assets will be different. It’s all about balance concerning the target inflation rate.

Given the economic climate (inflation, growth), central banks’ decisions on the key interest rate will also influence yield rates and supply and demand. For example, when the central bank raises its rates to slow down inflation, there comes a stage where short-term rates exceed long-term rates. This is when it becomes restrictive. This will then prompt investors to favor short-term treasury bonds over long-term bonds because the remuneration rate is better. Conversely, when the central bank decides to lower its rates, this may encourage investors to favor bonds as the yield curve is expected to normalize (short-term rates lower than long-term rates).

How will the 10-year yield rate impact bitcoin?

Bitcoin is quite sensitive to interest rate fluctuations like many other assets. In the past, there have been instances where the yield rate rose and bitcoin also rose, just as there have been times when the rate fell and bitcoin rose. And more rarely, there have been times when rates fell and bitcoin also fell. This can be confusing, but this is where we need to determine the reason for the yield rate movement. We will take some examples to facilitate understanding.

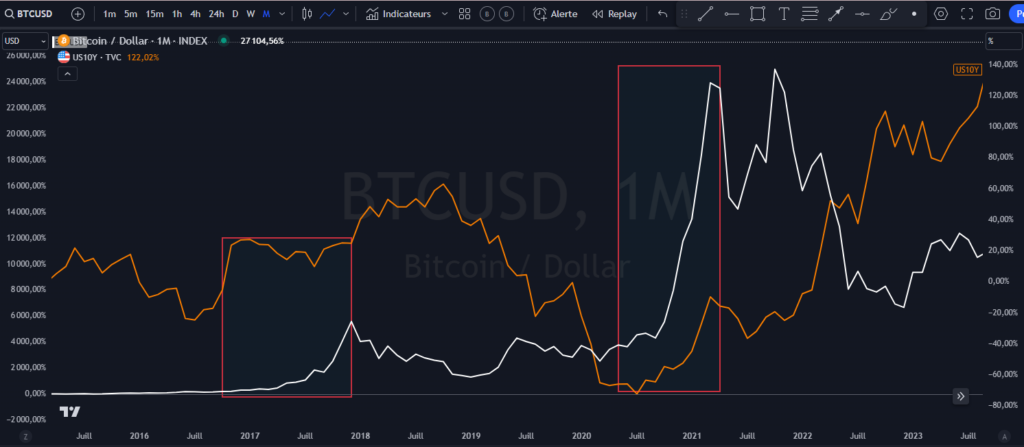

For example, if the 10-year yield rate rises because growth accelerates, the variation in bitcoin should be positive since investor confidence to invest is back. This can be seen in the chart below after the trough of the Covid crisis. Yields rose with bitcoin.

The other example below highlights the increase in the yield rate following an inflation rise. A price increase can be a late consequence of growth acceleration. In this kind of situation, several risk assets, including bitcoin, face more difficulties because the rate rises to slow inflation while growth slows. In such a climate, bitcoin is more vulnerable. Here is the graph showing bitcoin and the yield rate in such an environment.

There are several reasons that can explain this, notably the weakened purchasing power. Investors are more skeptical about investing capital. Furthermore, as the borrowing cost is higher, it limits the potential leverage used in companies for development. This is also true for households that will borrow less to consume. This can have quick repercussions on more risk-sensitive assets like small businesses or speculative assets. The investor will favor safer placements by favoring low-risk products like treasury bonds.

Bitcoin, inflation, and the yield rate

Bitcoin was strategically designed to tackle inflation through monetary supply expansion. The halving process will reduce its inflation rate every 4 years. This dynamic allows bitcoin to be bullish in the long term as long as we continue to have monetary supply growth.

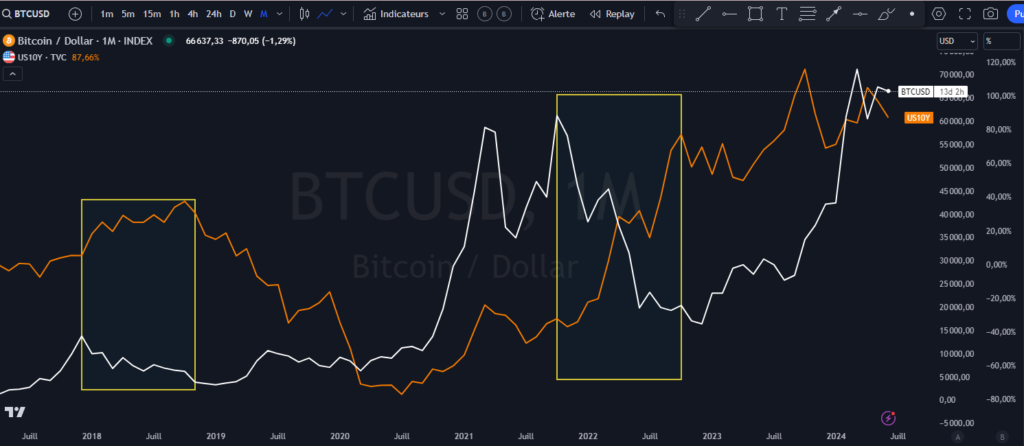

Despite its inflation rate being reduced every 4 years, it has not served as a hedge against the strong inflation surge that accompanied a rise in the yield rate in 2022. This is mainly because bitcoin is a performing asset when financial conditions are favorable. As central banks implemented a restrictive program through rate hikes, financial conditions became more difficult. The US dollar strengthened, yields rose, and the growth of the money supply decreased. Consequently, bitcoin fell.

Bitcoin tends to perform better when financial conditions are more accommodating. Even though the Fed maintained high rates in 2023 (implying high yield rates), the disinflation process, the Fed’s pause, and the dollar’s decline provided more flexible financial conditions. This also explains the economic recovery and bitcoin’s rebound despite still high rates. Hence, understanding the economic environment is crucial to determining the variation of assets like bitcoin.

The interest rate or yield rate has a significant influence on many assets including bitcoin. Generally, the lower the rates, the more it encourages consumption and investment, resulting in price increases, which is positive for bitcoin in the long run.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Après avoir travaillé pendant 7 ans dans une banque canadienne dont 5 ans dans une équipe de gestion de portefeuille comme analyste, j’ai quitté mes fonctions afin de me consacrer pleinement aux marchés financiers. Mon but ici, est de démocratiser l'information des marchés financiers auprès de l'audience Cointribune sur différents aspects, notamment l’analyse macro, l’analyse technique, l’analyse intermarchés…

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.