Bitcoin closes March above $70,000: Crypto Analysis of April 2, 2024

After concluding seven consecutive months on the rise, Bitcoin embarks on a new month in the negative. Let’s analyze the future perspectives for the BTC price together.

Bitcoin (BTC) Situation

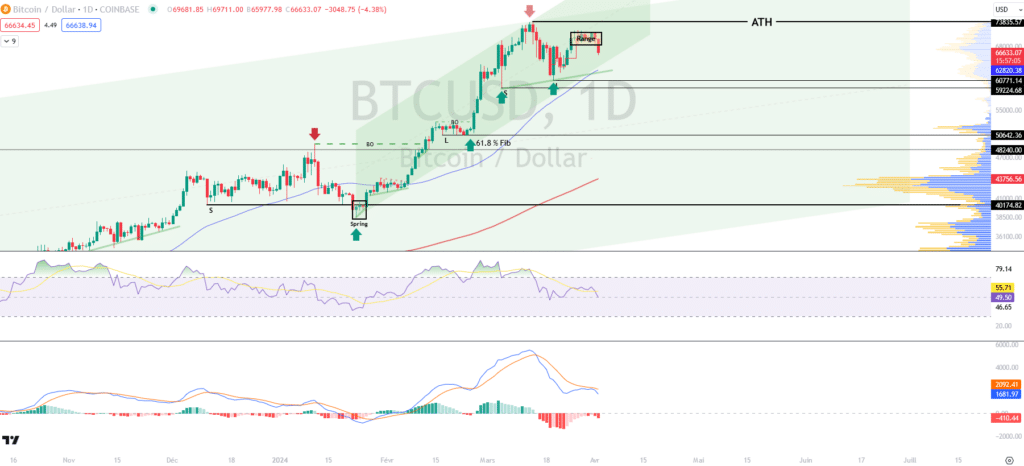

While Bitcoin closed another month positively, with a rise of over 16%, the BTC price starts the month of April with a decrease of -7%. As a reminder, the mother of cryptocurrencies has seen buying interest from $60,000. Since then, the Bitcoin price has stabilized between $68,000 and $71,270. Unfortunately, this Tuesday morning, Bitcoin broke out of this range to the downside, thus showing signs of weakness regarding the continuation of the previously started rise. Nevertheless, we can be reassured by the fact that this decline has not crossed the Fibonacci retracement thresholds taken into account from the $60,000 and $71,270 levels.

As of this writing, Bitcoin is trading around $66,500. It is therefore slightly below the value area around $67,000. This decline does not call into question Bitcoin’s bullish trend, as confirmed by the 50 and 200-day moving averages. However, it affects BTC’s bullish momentum, as shown by the oscillators as well as the price of Bitcoin itself. In the longer term, it seems clear that this phenomenon will not be sustainable.

The current technical analysis was carried out in collaboration with Elie FT, an investor and trader passionate about the cryptocurrency market. Today a trainer at Family Trading, a community of thousands of proprietary traders active since 2017. There you will find Live sessions, educational content, and support around financial markets in a professional and friendly atmosphere.

Focus on the Derivatives (BTCUSDT)

The open interest in BTC/USDT contracts followed the direction of its course, lately headed downward. It has decreased by 10% since April first. This increase was accompanied by subtle liquidations, but predominantly on the buyer’s side, as well as a slight drop in the funding rate. This indicates that interest in Bitcoin perpetual contracts has recently been mostly seller-oriented.

The last month’s liquidation heat map shows that BTC/USDT crossed an intense liquidation zone around the $68,000 mark. Currently, the Bitcoin price seems to be stabilizing below this level, marking a phase of uncertainty. The most significant liquidation zone is now located above the current price, precisely around $72,000. If the market approaches this level, we might witness a massive triggering of orders, thus potentially increasing the cryptocurrency’s volatility. This zone, therefore, represents a significant point of interest for investors.

The Hypotheses for the Bitcoin (BTC) Price

- If the Bitcoin price manages to hold above $65,000, we could anticipate a bullish continuation up to the $72,000 level. The next resistance to consider, if the upward movement continues, would be $74,000 or even $75,000 and beyond. At this stage, this would represent a rise of over 13%.

- If the Bitcoin price fails to hold above $65,000, we could envisage buyer interest support from the $63,000 zone. The next level to consider, if the downtrend continues, would be around $61,500, more or less. At this stage, this would represent a drop of close to -7.5%.

Conclusion

Despite the recent decline of Bitcoin, which marked an exit from its range to the downside, the underlying trend remains bullish suggesting that the path to recovery is still at play despite the current fluctuations. Nonetheless, it will be crucial to closely observe the price reaction at various key levels to confirm or invalidate the current hypotheses. It is also important to stay vigilant for potential “fake outs” and market “squeezes” in each scenario. Finally, let us remember that these analyses are based solely on technical criteria and that cryptocurrency prices can also rapidly evolve based on more fundamental factors.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Family Trading est une Communauté de traders a compte propre active depuis 2017 offrant Lives, contenus éducatifs et entraides autour des marchés financiers dont celui des cryptomonnaies avec à ses côtés Elie FT, investisseur et trader de passion sur le marché crypto.

The contents and products mentioned on this page are in no way approved by Cointribune and should not be interpreted as falling under its responsibility.

Cointribune strives to communicate all useful information to readers, but cannot guarantee its accuracy and completeness. We invite readers to do their research before taking any action related to the company and to take full responsibility for their decisions. This article should not be considered as investment advice, an offer, or an invitation to purchase any products or services.

Investment in digital financial assets carries risks.

Read more