Bitcoin: Bullish season emerging despite the decline!

Bitcoin (BTC) is currently navigating troubled waters. Foreign exchange reserves experience a significant decline at the beginning of the month. However, despite this price drop, new data from the blockchain analytics platform, CryptoQuant, suggests a possible bullish run for the queen of cryptocurrencies.

Towards an unexpected bullish run?

For the past few weeks, Bitcoin (BTC), the queen of cryptos, has been going through a period of uncertainty. In the last 24 hours, its price has seen a decrease of 2.91%. The trading volume during this period reached $15.4 billion. At the time of writing this article, BTC is trading at $26,960.

According to data provided by CryptoQuant, the value of Bitcoin reserves has dropped by around $7 billion in the last month. “At the very least, the amount of Bitcoin circulating on exchanges has decreased over the past month,” read a quick publication from CryptoQuant.

Recently, we have observed price consolidation between $26,600 and $27,200 for BTC, with some unusual fluctuations. Furthermore, CryptoQuant’s data indicates that exchange platforms have lost 2,132,000 Bitcoins from their reserves. This decrease suggests that investors are choosing to hold onto their Bitcoins rather than selling them in large quantities.

Future perspectives for BTC

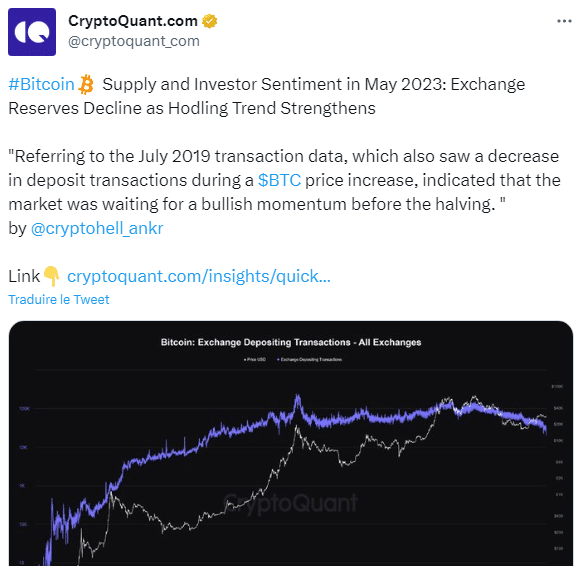

Analyzing past data, it is worth noting that the number of deposit transactions on exchanges has been steadily declining since January 2022. Reminiscent of the situation in July 2019. In fact, during that time, the price of Bitcoin rose from $5,200 on May 1, 2019, to nearly $12,000 on July 1, 2019.

CryptoQuant also highlights that the bullish run observed in 2019 was likely due to the positive sentiment surrounding the upcoming Bitcoin halving event scheduled for May 2020. Based on this, analysts suggest that the Bitcoin halving event scheduled for 2024 could soon trigger a new bullish season.

Despite the recent price decline, this data hints at a possible resumption of the upward trend for Bitcoin. Crypto investors are closely monitoring the market’s development, hoping to seize significant growth opportunities in the future.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The Cointribune editorial team unites its voices to address topics related to cryptocurrencies, investment, the metaverse, and NFTs, while striving to answer your questions as best as possible.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.