Bitcoin (BTC) is decoupling from other assets

The link between bitcoin and various assets is a strategic indicator of the cryptocurrency market. Indeed, most of bitcoin’s major peaks and valleys are linked to other markets. In this paper, we will study bitcoin’s behavior in relation to the S&P 500, gold, and ethereum over the past few months. The significant symmetry of the correlation of different assets with the bitcoin price provides valuable indicators on the state of the market, after two months of BTC stagnation.

The importance of the link between bitcoin and various assets

« Thus the correlation between bitcoin and indices is generally minimal, or even negative, in the presence of major bitcoin peaks. »

Bitcoin remains correlated with indices – Cointribune

In multiple articles, we have highlighted the importance of bitcoin’s correlation with other assets. Indeed, bitcoin is generally highly correlated in the long term with major assets. Between 2022 and 2024, the correlation coefficient between bitcoin (BTC) and the S&P 500 exceeds 40%. Thus, some periods show a correlation of more than 60%. But over the last 6 months, bitcoin seems to be decoupling from most assets. In any case, notice that, taking only the asset prices into account (rather than the variations), the correlation coefficient exceeds 80%.

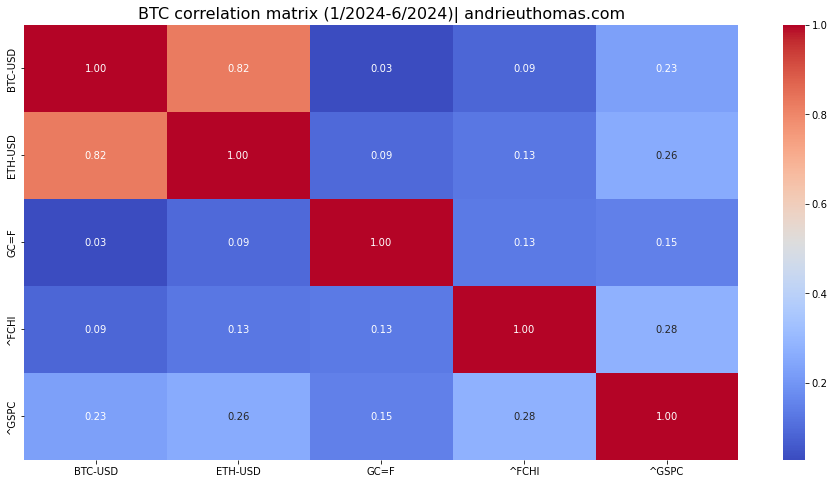

The matrix above thus shows the different correlation coefficients between assets. For example, bitcoin is correlated at 23% with the S&P 500 since January 2024. We thus see that the strongest correlation recently observed is between bitcoin and ethereum. On the other hand, bitcoin does not appear to be correlated (neither positively nor negatively) with the evolution of gold or the CAC 40. We thus propose to compare these correlations from a historical perspective and deduce the associated indications.

Correlation with the S&P 500

Bitcoin’s correlation with major indices is an indicator in itself. Indeed, a high correlation between bitcoin and the S&P 500 will indicate investor behavior constrained by the S&P 500’s movements. Such a market context can be due, as is usually the case, to the persistence of a bearish market. Conversely, a bitcoin decoupled from major indices will indicate a trajectory independent of other indices. In such a case, a traditional portfolio manager may then be tempted to increase their position in bitcoin. Indeed, bitcoin would allow potentially significant performance with a relatively low marginal risk cost (since it is decoupled).

The chart above shows the bitcoin price with the 6-month correlation coefficient with the S&P 500. We observe since 2019 a clear symmetry between this correlation and the major peaks and troughs of bitcoin. Thus, mid-2020 or late 2022, the 6-month correlation coefficient with the S&P 500 was at its maximum while bitcoin was at major troughs. Similarly, the correlation coefficient was at its minimum mid-2019 and late 2021, which also corresponded to major peaks.

Recently, the correlation coefficient reached a minimum close to 0%. This obviously signaled the risk of a major peak in the bitcoin price. The peak remains fairly contained for now. Here we find the idea that the bull market of 2024 has potentially lost part of its upward potential (Has bitcoin (BTC) exhausted its upward potential? – Cointribune).

Correlation with the price of gold

The study of the correlation between gold and bitcoin reveals another interesting behavioral characteristic. It is noteworthy that the correlation between gold and bitcoin is at its maximum at the start of bitcoin bull markets. Conversely, a zero or slightly negative correlation coefficient generally accompanies major bitcoin peaks. So how to explain this relationship?

Gold and bitcoin, contrary to many established beliefs, are two fundamentally very different assets (The fundamental differences between Gold and Bitcoin (BTC) – Cointribune). Nevertheless, gold and bitcoin converge on certain characteristics.

« Gold implies a passive conception of money (the parameters of the gold market act on money independently of human wills), whereas bitcoin implies an active conception of money, by humanly determining the parameters that set the money. »

The fundamental differences between Gold and Bitcoin (BTC) – Cointribune

In this context, a close relationship between the evolution of the two assets informs us about market psychology. A high correlation coefficient between the two assets will indicate that investors are “seeking” bitcoin as much as gold. In this case, bitcoin appears more like a “safe haven” instrument. Conversely, a low correlation coefficient will signal the speculative nature of bitcoin, outside any “safe haven” market logic. And thereby, potential peaks.

The correlation between gold and bitcoin was thus at its maximum in early 2023. With the bull market observed since 2023, the 6-month correlation of bitcoin with gold has collapsed. Once again, this configuration is generally closer to that of an end of a bull market.

Correlation with ETH

Let’s continue our study with ethereum. We again see a behavioral configuration of bitcoin in relation to the second largest cryptocurrency in the world. Indeed, it is often accepted that bitcoin initiates bull markets, and altcoins benefit from this movement in a second phase.

We notice in our case that a high correlation coefficient between bitcoin and ethereum is conducive to major lows in bitcoin. Conversely, a low correlation coefficient (sharp trough of the coefficient) indicates a sudden weakening of market strength, and major peaks. A major explanation would be that during bull markets, the dependence of altcoins on bitcoin decreases.

Therefore, when bitcoin is completely decoupled from other cryptocurrencies, it can signal an excess upward movement. Thus, this decoupling can warn of the potential end of the bull market within the next 12 months. A maximum correlation coefficient will instead indicate symmetrical investor behavior across all cryptocurrencies. This type of configuration can be characteristic of general liquidation phenomena (and therefore of exhaustion of term sellers). And thereby, potential lows.

Recently, we observe a strong decrease in the correlation between bitcoin and ethereum. This movement, without rebound, would have signaled a risk of future exhaustion of the bull market. Since April 2024, the correlation between bitcoin and ethereum has experienced a notable rebound. This could ideally indicate the maintenance of bitcoin’s upward potential.

Conclusion and perspectives

Ultimately, we have shown throughout this paper that:

- A high correlation between bitcoin and the S&P 500 usually indicates major lows. Conversely, a low correlation can be a negative signal.

- Bitcoin’s correlation with gold was most remarkable at the beginning of the bull market. A low correlation between gold and bitcoin can indicate a certain market euphoria. This phenomenon generally implies major highs in the bitcoin price.

- Bitcoin is generally strongly correlated with ethereum. However, during bitcoin’s upward excesses, ethereum can become more independent of the bitcoin price. This context often implies an exhaustion of the upward movement.

Therefore, the bull market built since early 2023 seems to follow the fundamental rules of intermarket relationships. Bitcoin’s correlation with most assets was maximal in 2023. The following bull market thus manifested itself by a strong decrease in bitcoin’s correlation with the S&P 500 and gold, and to a lesser extent, with ethereum.

Considering the relationships described above, we therefore see that bitcoin has exhausted part of its upward potential. The consolidation movement initiated in March 2024 revived a certain rebound potential, but we see that bitcoin has become quite independent of the S&P 500 and gold. Historically, this signal invites caution and avoidance of impulsive decisions, although it alone does not constitute a decision criterion. The evolution of bitcoin’s correlation with major asset classes will therefore need to be closely monitored…

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Author of various books, financial and economics editor for many websites, I have been forming a true passion for the analysis and study of markets and the economy.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.