Bitcoin (BTC) Bullish or Bearish Continuation in Sight? Crypto Analysis for February 6, 2024

Bitcoin closed the previous week on a positive note, but still shows signs of weakness. Let’s examine the future outlook for BTC price together.

Bitcoin Situation (BTC)

The rise of Bitcoin from $40,000 has halted around $43,000. This last price level had been pointed out in the analysis of January 30. Bitcoin is now showing a consolidation pattern in a range around this area. It is interesting to note that this level coincides with the 50-day moving average. Furthermore, the range of $42,000 to $44,000 forms a significant value zone for Bitcoin.

A value zone is defined as the price range where an asset has been most frequently traded over a given period. It highlights the levels at which the trading volume has been the highest.

As for the oscillators, they are stabilizing around the median threshold. This illustrates the fact that Bitcoin’s bullish momentum has faded. Moreover, the bearish divergence between these oscillators and the price of Bitcoin still exists. This foreshadows a potential downside risk for the market ahead.

The current technical analysis was conducted in collaboration with Elie FT, an investor and passionate trader in the cryptocurrency market. He is now a trainer at Family Trading, a community of thousands of proprietary traders active since 2017. You will find Live sessions, educational content, and mutual support about financial markets in a professional and friendly atmosphere.

Focus on Derivatives (BTCUSDT)

It appears that the open interest for the BTCUSDT increased at the beginning of the week, while its underlying asset continued to stabilize around $43,000. This situation indicates an increase in the engagement of derivative traders. Thus, it suggests that the market is preparing for a significant move. However, the fact that the price of Bitcoin has not been impacted by these developments suggests that Bitcoin is currently “heavy”. This could mean that, despite the increased interest, there is a certain reluctance to push the price beyond resistance.

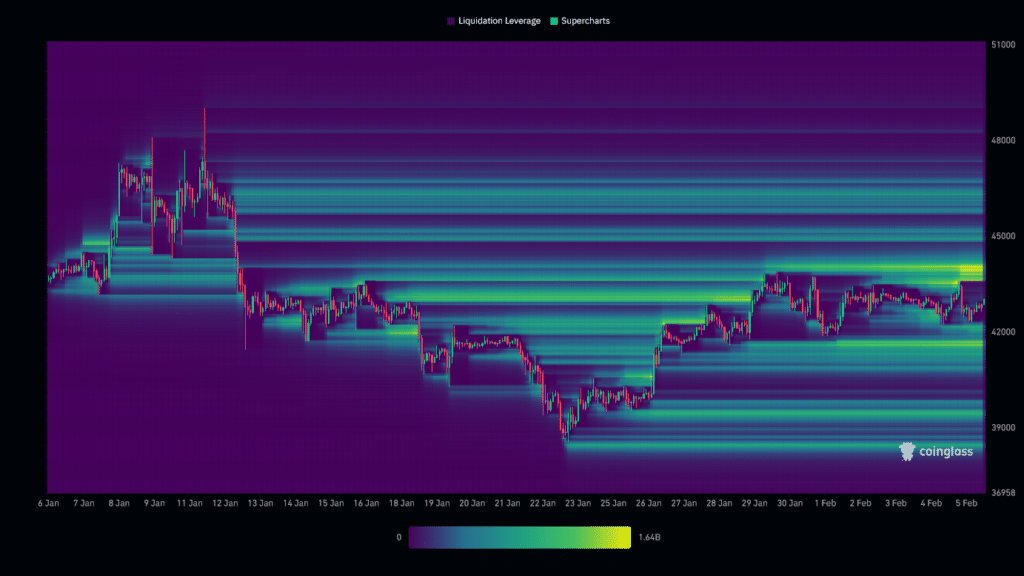

The liquidation heatmap for BTC/USD reveals that the liquidation zone around $44,000 has significantly strengthened. This phenomenon makes this level particularly significant. Therefore, above the current price, the $45,000 threshold is important to watch as the next key step. Similarly, below the current price, the level to watch is around $41,600. As the market approaches these levels, we could witness a massive triggering of orders, which could potentially increase the cryptocurrency’s volatility. These areas, therefore, represent major points of interest for investors.

Potential Scenarios for Bitcoin Price (BTC)

If the Bitcoin price manages to hold above $42,000, we could anticipate a new rise to the $45,000 threshold. The next resistance to consider if the bullish movement continues would be $46,000 or even $49,000. At this stage, it would represent a rise close to +14%.

If Bitcoin fails to maintain support above $42,000, we could see a retracement to the $40,000 mark. The next level to consider if the downward trend continues would be around $38,500 or even $38,000. At this stage, it would represent a drop close to -12%.

Conclusion

Bitcoin has continued its upward trend before entering a phase of consolidation. This situation seems to create a period of uncertainty for the original cryptocurrency. Therefore, it will be crucial to closely monitor the price reaction to the various key levels to confirm or refute the current assumptions. It is also important to remain vigilant about potential “fake outs” and market “squeezes” in each scenario. Finally, let’s remember that these analyses are based solely on technical criteria, and the course of cryptocurrencies can also change rapidly due to other more fundamental factors.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Family Trading est une Communauté de traders a compte propre active depuis 2017 offrant Lives, contenus éducatifs et entraides autour des marchés financiers dont celui des cryptomonnaies avec à ses côtés Elie FT, investisseur et trader de passion sur le marché crypto.

The contents and products mentioned on this page are in no way approved by Cointribune and should not be interpreted as falling under its responsibility.

Cointribune strives to communicate all useful information to readers, but cannot guarantee its accuracy and completeness. We invite readers to do their research before taking any action related to the company and to take full responsibility for their decisions. This article should not be considered as investment advice, an offer, or an invitation to purchase any products or services.

Investment in digital financial assets carries risks.

Read more