Bitcoin (BTC): $500,000 In 2025?

The beginning of 2025 marks a historic turning point for Bitcoin. Technical indicators are showing green, institutional investors are flocking massively through ETFs, and macroeconomic prospects are improving. Now, the scenario of $500,000 is highly probable in 2025.

Bitcoin’s technical indicators are very positive

A deep analysis of on-chain data reveals a situation exceptionally favorable. The MVRV-Z score, a key indicator measuring the ratio between price and market capitalization, suggests that we are still far from a cycle peak, reinforcing the idea that the bull run is not over.

The current levels strangely remind us of May 2017, a period when Bitcoin was trading for only a few thousand dollars. This historical comparison suggests a considerable potential for growth.

The Pi Cycle indicator, which tracks the 111 and 350-day moving averages, provides additional insight. The increasing distance between these two averages signals a resumption of bullish momentum.

Moreover, after a consolidation period in 2024, Bitcoin seems to be entering a more vigorous growth phase that could extend over several months.

The exponential phase of the Bitcoin cycle

Historical data shows that Bitcoin cycles often include a “post-halving cooling period” of 6 to 12 months before entering an exponential growth phase.

We are approaching this breaking point, and even taking into account diminishing returns relative to previous cycles, the potential gains remain substantial.

Bitcoin: an increasingly rare asset

The numbers speak for themselves: in November 2024, ETFs absorbed 75,000 Bitcoins while only 13,500 were mined. This buying pressure, 5.58 times higher than monthly production, creates unprecedented tension on the available supply.

CoinGlass data reveals that only 2.25 million Bitcoins remain on exchanges, an historically low level that indicates massive accumulation by long-term investors.

Bitcoin is replacing gold

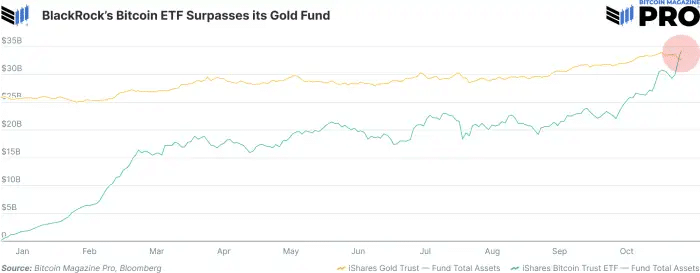

BlackRock’s Bitcoin ETF recently surpassed its own gold fund in terms of assets under management, a strong symbolic event. This evolution marks a major paradigm shift: Bitcoin is gradually establishing itself as a credible alternative to gold in institutional portfolios.

Bitcoin ETFs have already accumulated more than 936,830 Bitcoins, and the million threshold could be crossed before the end of the year.

Revised upward price projections

Analysis of previous cycles thus suggests that after the last historical peak of $70,000, a doubling or tripling could push Bitcoin between $140,000 and $210,000.

The Bitcoin Cycle Master Chart, which aggregates several on-chain metrics, places the overvaluation level around $190,000, an objective that seems increasingly realistic.

A favorable macroeconomic context for Bitcoin

Bitcoin progressed in 2024 despite a strong US dollar, an unusual situation as these two assets usually evolve inversely.

A potential weakening of the dollar in 2025 could therefore amplify the increase in BTC price.

Other macroeconomic indicators, such as high-yield credit cycles and the global M2 money supply, also suggest improved conditions for Bitcoin.

Towards a Bitcoin Act thanks to Trump

The “Bitcoin Act” bill, backed by elected president Trump, could radically transform the landscape.

This initiative envisions the creation of a strategic reserve of one million Bitcoins, or about 5% of the total available supply.

Such an approach would place Bitcoin at the same level as gold in the U.S. national reserve strategy.

All states will scramble for Bitcoin

The impact of a potential U.S. strategic Bitcoin reserve would be significant. With only 2.25 million Bitcoins available on exchanges, the acquisition of one million Bitcoins by the U.S. government would create unprecedented buying pressure.

This situation could thus trigger a race for accumulation among nations, potentially pushing the price towards one million dollars.

The year 2025 has all the ingredients to be exceptional for Bitcoin. The convergence of solid fundamentals, increasing institutional adoption, and potential government support could propel BTC to new heights. The bold scenario of 1.5 million dollars could then become a reality sooner than expected.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Chaque jour, j’essaie d’enrichir mes connaissances sur cette révolution qui permettra à l’humanité d’avancer dans sa conquête de liberté.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.