Bitcoin, Binance, Ethereum, Solana, And Ripple: The Biggest Crypto News From The Past Week

Amid revolutionary announcements, technological evolutions, and regulatory turbulence, the crypto ecosystem continues to prove that it is both a territory of limitless innovations and a battleground for regulatory and economic conflicts. Here is a summary of the most significant news from the past week surrounding Bitcoin, Ethereum, Binance, Solana, and Ripple.

Trump announces a crypto reserve including XRP, SOL, ADA, BTC, and ETH: the market explodes!

On March 2, 2025, Donald Trump officially announced the creation of a Strategic Cryptocurrency Reserve in the United States, including Bitcoin (BTC), Ethereum (ETH), XRP, Solana (SOL), and Cardano (ADA). Initially, BTC and ETH were omitted from the announcement, causing shock in the community before the error was corrected. This project aims to strengthen the United States’ position in the crypto sector after the “corrupt attacks” of the previous administration. The announcement triggered a price explosion, with XRP (+21%), SOL (+12.5%), and ADA (+37%). This initiative could accelerate institutional adoption and position the USA as a leader in global digital finance. 🔗 Read the full article

BlackRock integrates Bitcoin into its investment portfolios

BlackRock, the world’s largest asset manager ($10 trillion under management), has integrated its Bitcoin ETF (IBIT) into its model portfolios, with an allocation of 1 to 2%. Although modest, this decision sends a strong signal to other institutions, which may follow suit. With 576,046 BTC held, BlackRock already represents 2.9% of the total circulating supply. This announcement could accelerate Bitcoin adoption among traditional funds, despite recent ETF withdrawals and market volatility. 🔗 Read the full article

Ethereum in crisis: The Pectra upgrade goes wrong!

The Pectra upgrade, intended to improve Ethereum, has failed on the Holesky testnet, blocking the finalization of transactions. The error stems from an integration issue with deposit contracts, which calls into question the stability of the network. This upgrade, which includes EIP-7702 to transform wallets into smart contracts, is now delayed. Developers are under pressure, as Pectra must also integrate EIP-7251, which increases the staking limit from 32 ETH to 2,048 ETH. Ethereum must now quickly fix these bugs, or risk losing ground to Solana and other competing blockchains. 🔗 Read the full article

MetaMask buries gas fees and opens up to Bitcoin and Solana!

MetaMask announces a major revolution: the integration of Bitcoin and Solana, the elimination of gas fees, and a completely redesigned interface. Starting in May 2025, users will be able to pay their transactions with any token, thus eliminating issues related to fluctuating fees. The wallet also introduces batch transactions (ERC-5792), speeding up transfers and reducing costs. With 30 million active users, MetaMask positions itself as the most advanced Web3 wallet, continually challenging Phantom and other multichain solutions. 🔗 Read the full article

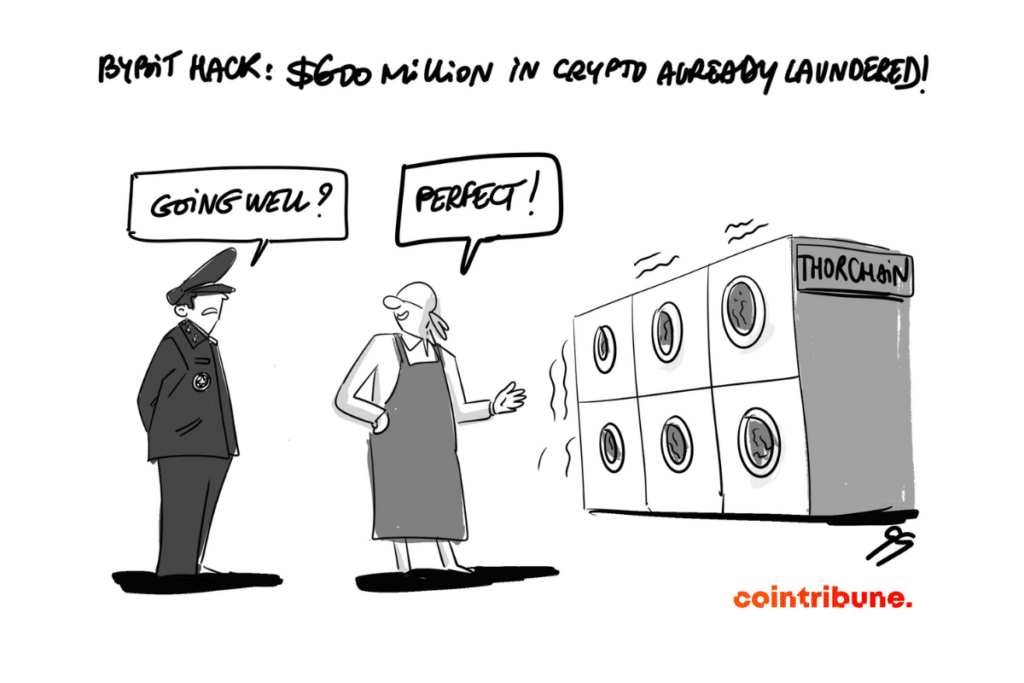

Bybit Hack: $600 million laundered via THORChain!

$605 million from the Bybit hack ($1.4 billion stolen) have already been laundered by the Lazarus group, via THORChain, a KYC-free interchain protocol. Despite attempts to block suspicious transactions, hackers exploited the speed of the protocol to evade authorities. The FBI and several exchanges are cooperating to trace the funds, but the situation divides the community: should DeFi be censored to combat money laundering, or is it essential to preserve transaction freedom? 🔗 Read the full article

Coinbase wins its showdown: the SEC drops the charges!

After months of legal battle, the SEC has dropped its charges against Coinbase, delivering a historic victory to the exchange. Coinbase claims this proves the compliance of its practices and now calls for clear regulation for the crypto sector. This decision could influence ongoing cases against Binance, Ripple, and Kraken, and strengthen the position of crypto companies against regulators. Nevertheless, this victory does not necessarily mean a general easing, and the SEC may return with renewed efforts under a different guise. 🔗 Read the full article

That’s the key takeaway for this week. But if you would like a more detailed recap and in-depth analysis directly in your inbox, feel free to subscribe to our weekly newsletter.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.