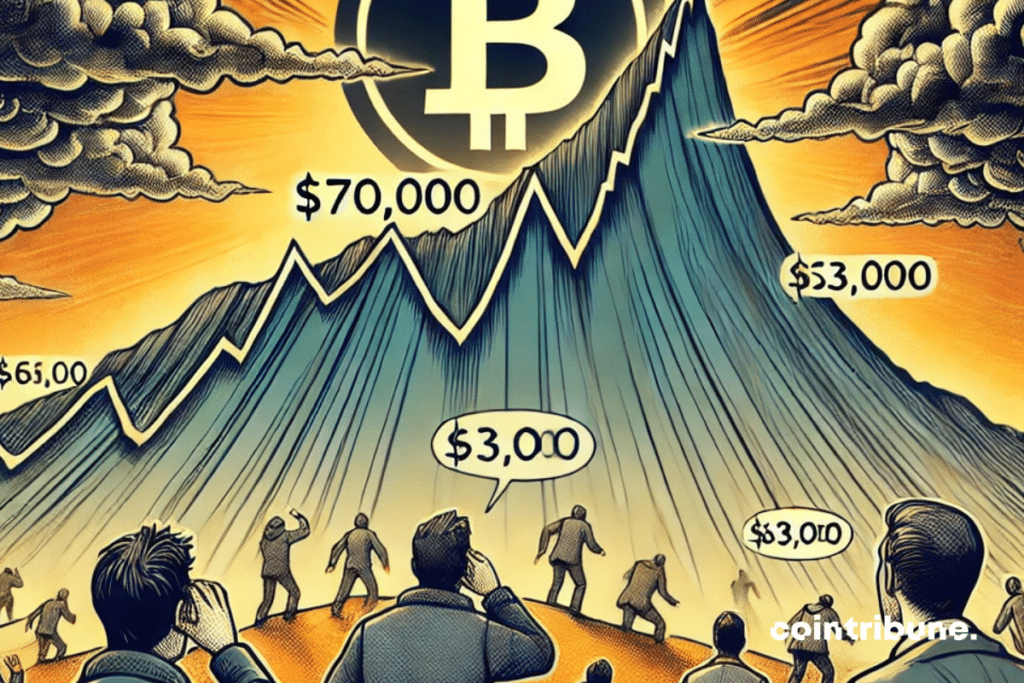

Bitcoin at a crucial turning point : Will it surpass $70,000 or collapse ?

Bitcoin is once again at a crossroads. After reaching new heights in recent weeks, pressure is mounting on the market. Indeed, the queen of cryptos is experiencing a sudden increase in short positions on Binance, signaling significant bearish sentiment. Is this wave of shorts a sign of an imminent correction or a trap set for bearish investors ?

The rise of short positions, a risk signal for Bitcoin ?

New data shows that 58.23 % of open positions on Binance are shorts, revealing a strong anticipation of a Bitcoin price drop. The majority of traders expect Bitcoin to be rejected by the $70,000 resistance. This rise in bearish sentiment comes after several unsuccessful attempts by Bitcoin to break through this key level since March 2024, leading to speculations of a potential imminent correction.

Indeed, behind these short positions, there is a classic market dynamic: after a rapid price rise, traders are betting on a correction, hoping to buy back at a lower price. Resistance levels observed around $69,000 to $70,000 become critical points for assessing Bitcoin’s future direction. Failure to break through these levels could confirm correction fears, especially since the market historically remains volatile at these levels.

A trap for bears or a real correction ?

However, some investors believe that this accumulation of short positions could turn into a trap for bearish traders. Indeed, a potential surpassing of the $68,300 mark could trigger a “short squeeze”. This scenario, where short positions are forced to close quickly due to a sudden price rise, could lead to a new Bitcoin surge. Such a situation has been observed in the past, where Bitcoin’s rapid movements have left many investors on the sidelines, unable to react in time. Thus, a sudden increase could trap those betting on a correction.

The market is therefore at a pivotal moment, where investor decisions could have significant repercussions. If Bitcoin manages to break through this resistance level, it could rally towards its previous highs, or even surpass them, heading towards $73,000. Otherwise, a correction could push the price to lower levels, with a possible return to $63,000.

Thus, the battle between bulls and bears is more relevant than ever, and each camp’s strategy will be decisive in the coming days. The Bitcoin market remains, as always, unpredictable, and any new fluctuation could upset current forecasts.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.