Bitcoin at $100,000: Analyst's shocking bet if the Fed cuts rates!

As the crypto market eagerly awaits the Fed’s next decisions on interest rates, an analyst claims that Bitcoin could reach new heights if the U.S. high-yield interest rates fall below 7%. However, the path to $100,000 could be fraught with challenges.

High-yield interest rate, compass for Bitcoin’s price

Jerome Powell, chairman of the Fed, is about to deliver a highly anticipated speech that could seal Bitcoin’s short-term fate.

According to Timothy Peterson, founder and manager of Cane Island Alternative Advisors, the evolution of interest rates is the main indicator to watch to anticipate BTC’s future trajectory.

“The high-yield interest rate in the U.S. is an excellent barometer. It really needs to fall below 6-7% for Bitcoin to sustainably beat its all-time high,” he confided to Cointelegraph.

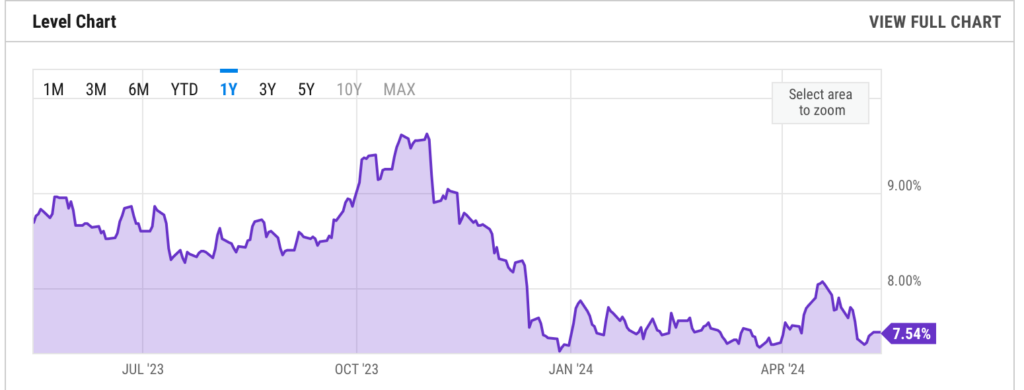

Currently, the high-yield interest rate in the U.S., which represents the rate of high-yield corporate bonds, stands at 7.54% according to YCharts. Mr. Peterson estimates that if this rate falls within a range of 6 to 7%, Bitcoin could reach the much-anticipated price of $100,000 by the end of 2024 or at the latest by the second quarter of 2025.

Fed’s monetary policy, arbiter of the crypto market

In general, when the Federal Reserve lowers its key rates, it leads to an increase in high-yield interest rates. This is what nearly two-thirds of economists surveyed by Reuters predict for next September.

These interest rates are closely followed by crypto investors. Indeed, a decrease in rates reduces the yields of safe-haven assets like bonds, pushing more investors toward riskier but potentially more rewarding assets like Bitcoin.

However, the road to $100,000 could be bumpy. Mr. Peterson points out that markets are often “stable and volatile” between September and October, and that uncertainty will be even greater this year due to the U.S. elections on November 4.

On his side, crypto analyst Scott Melker, aka “The Wolf of All Streets”, reminds that a Fed rate cut is not always good news for the markets. “Rate cuts generally precede major declines,” he warns.

If Timothy Peterson’s analysis proves correct, Bitcoin could experience a meteoric rise to $100,000 by the end of 2024. But for that to happen, U.S. high-yield interest rates must drop significantly, and the market must navigate the uncertainty surrounding the American elections unscathed. The upcoming months will be decisive for the future of the crypto queen.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Passionné par le Bitcoin, j'aime explorer les méandres de la blockchain et des cryptos et je partage mes découvertes avec la communauté. Mon rêve est de vivre dans un monde où la vie privée et la liberté financière sont garanties pour tous, et je crois fermement que Bitcoin est l'outil qui peut rendre cela possible.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.