Bitcoin, and now: Heading towards $34,000?

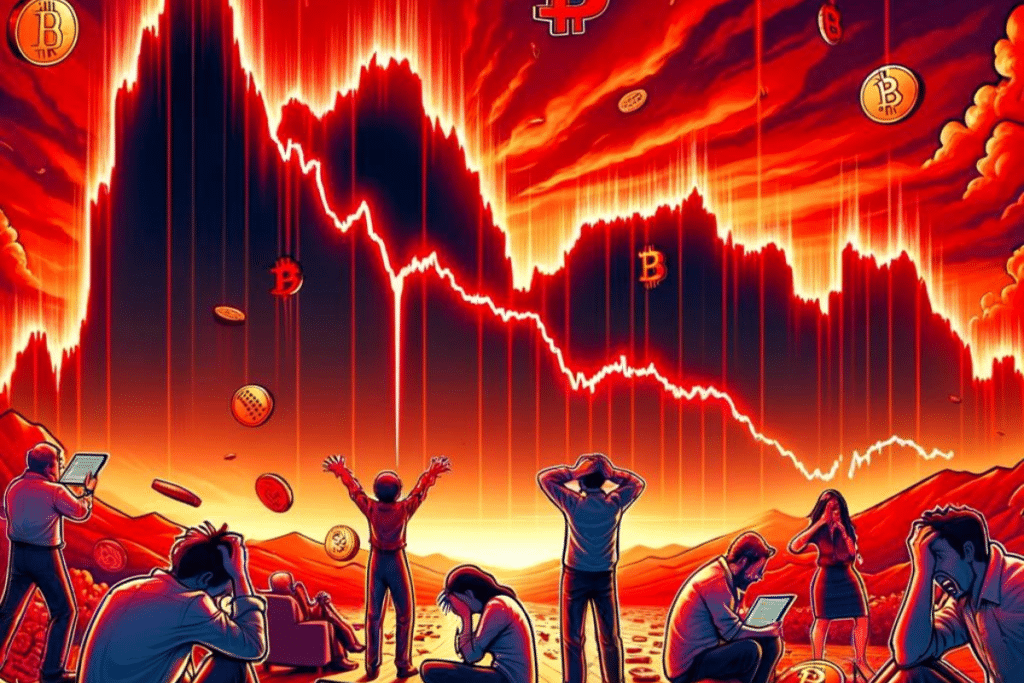

Bitcoin is currently facing a major challenge with a potential devaluation of 30%, leading it towards a critical floor of $34,000. This underscores a period of uncertainty and increased volatility.

A Panic Wind Blows Across the Bitcoin Market

The crypto market, that unruly child of modern finance, seems to be going through a rebellious phase. With Bitcoin leading the charge, we are witnessing a spectacle where trust is as scarce as the bitcoins themselves.

Breaking through the psychological threshold of $40,000 has sent shivers down the spines of investors. It transforms the crypto space into a financial thriller where each percentage drop adds a dose of adrenaline.

The recent decline of 3% in a single day, amounting to a total correction of 18.5% since the peak of January 10th, isn’t just a number; it’s a distress cry echoing in the wallets of investors.

And while analysts play Cassandra, predicting a descent to $34,000, one can’t help but wonder: Is this the beginning of the end or simply another roller coaster ride in Bitcoin’s amusement park?

Behind the Scenes of an Announced Storm

At the heart of this financial turmoil, Grayscale and its dumping maneuvers seem to play the spoil-sports. Imagine an awakened giant, whose movements shake the markets.

Grayscale, with its Bitcoin Trust (GBTC), holds more than 550,000 BTC, a treasure that, when poured into the market, causes waves capable of capsizing the crypto ship.

Yet, in this apparent chaos, a glimmer of hope emerges. Bitcoin ETFs, those lifebuoys thrown into the storm, seem to absorb the selling pressure without flinching.

Tether and VanEck, armed with strategies and optimism, see in this trial a reshuffling of the deck, where bitcoin moves from shaky hands to grips that are firmer and more resolute. Is it the calm before the storm or the promise of a more serene horizon?

In this turmoil, the altcoin market does not remain on the sidelines, sharing the fate of its elder Bitcoin. Solana, Avalanche, Chainlink, and Litecoin are collapsing one after another, painting the market a hard-to-ignore crimson hue.

Yet, despite the dark clouds gathering, optimism is not dead. History has taught us that bitcoin is a phoenix capable of rising from its ashes. The discussions around FUD (Fear, Uncertainty, and Doubt) intensify, perhaps signaling the beginnings of a spectacular resurrection. After all, isn’t it in chaos that the most beautiful opportunities are born?

As bitcoin tries to regain its footing, flirting once again with the symbolic $40,000 mark, the outcome of this saga remains uncertain. The future of the crypto market, like a coin flipped in the air, hangs in a precarious balance. Meanwhile, the crypto sphere is gearing up for the launch of the first regulated stablecoin.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Fascinated by Bitcoin since 2017, Evariste has continuously researched the subject. While his initial interest was in trading, he now actively seeks to understand all advances centered on cryptocurrencies. As an editor, he strives to consistently deliver high-quality work that reflects the state of the sector as a whole.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.