Why IBD is important?

— Ninzabtc (@ninzabtc) April 6, 2024

Why we have to keep block size low?

Why scams are bad?

Why you should run fullnode? and specially knots?https://t.co/UK2o6hPjEK

A

A

Bitcoin - A serious threat to decentralization

Sun 26 May 2024 ▪

7

min read ▪ by

Getting informed

▪

The circus (ordinals, stamps, rune, etc.) seems to be fading, but the damage is already significant. Here’s a look back at this nuisance ruining bitcoin’s decentralization.

Catching up on inscriptions

Inscriptions are data (a jpeg file for example) that squat inside bitcoin transactions.

Some of those inscriptions are linked to what we call an ordinal. An ordinal is a “unique satoshi” acting as a property deed. The term “ordinal” comes from the expression “ordinal theory” which refers to a virtual numbering system used to track these satoshis from one transaction to the next.

This tracking is done with a software totally foreign to the bitcoin protocol. It’s all based on the ordinal explorer. In other words, the data (jpeg/registration) is not transferred from one transaction to another, as one could imagine. The inscription remains linked to the same original transaction (txid) located in the same block.

In short, it is claimed that the inscription changes ownership via ordinal theory.

How does it work technically?

Two things need to be explained first:

Firstly, making a bitcoin transaction means creating a “utxo”. This is a piece of code (a script) that mathematically ties a quantity of bitcoins to a bitcoin address (a public key).

Secondly, the mechanics of transactions rely on a programming language called “script”. It is a simple stack-based language with a very limited number of instructions.

These instructions are called opcodes. Think of them as small digital cogs. The most fundamental of them all is OP_CHECKSIG. This opcode verifies that the signature provided in the transaction matches the bitcoin address in question.

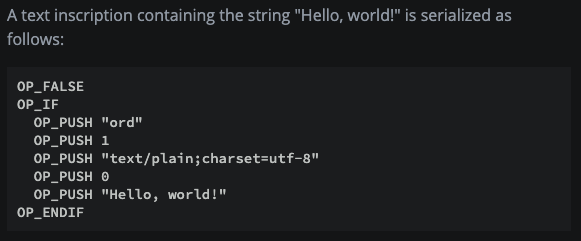

Inscriptions (txt files, jpegs…) are inserted into P2TR and P2WPKH utxo types. They do this using a trick involving 3 opcodes: OP_FALSE, OP_IF, and OP_PUSH.

This combination of opcodes makes it so that nothing really executes during the transaction. However, the data contained in OP_IF is preserved forever in the blockchain.

And that’s about it.

What is the problem for bitcoin?

When you think about it, inscriptions turn transactions into casino chips. All it takes is to attract cryptobros addicted to pump & dump. If the ponzian mayonnaise takes hold, we obtain a self-financing attack.

This is very serious since it flips the financial incentive against bitcoin. Why ? Because pools and miners inherit the juicy transaction fees that come with inscriptions. Bitcoin Core maintainer Gloria Zhao went as far as saying that we can’t act against inscriptions since it would go against miner’s interests.

One of the problems is that these tens of millions of inscriptions are weighing down the blockchain. Some will argue that this is a false problem since ordinals can be pruned. The reason being that they lodge in the “witness” section not needed by lightweight to validate blocks.

True, but full nodes are obliged to keep them in memory. And the fact is that we’ll be in for a nasty surprise if the number of full nodes dwindles too much in relation to the number of pruned nodes.

Here’s the explanation :

Another problem even more pressing is related to the stamps inscription protocol.

Bitcoin STAMPS

While ordinals can be pruned, this is not possible with stamps inscriptions. This time the data is masquerading as public keys inside multiple multisig utxos.

[A “multisig” utxo means that multiple public keys are used to construct it.]

This type of extremely toxic inscription is already resulting in a phenomenal explosion in the total number of utxos. They have more than doubled in just one year. There are now over 180 million.

The unexpected consequence is a monstrous increase in the time needed to set up a node. The latest tests by the founder of the Ocean pool are damning :

“In 2022, I could set up a node in less than 48 hours with a simple Raspberry Pi 4. Now I use a Raspberry Pi 5 with a processor twice as powerful. And despite that, the process took more than 100 hours instead of 48 hours!”

“The situation is much worse than before. It’s a difference of several orders of magnitude. This is not FUD. The more we turn a blind eye [on inscriptions], the more we accelerate the centralization of the bitcoin network.”

Today, almost 50% of utxo is already spam. At this rate, it will take 26 days to set up a node in just a decade…

The “right” way to do it

Many believe that no arbitrary data should be found in the blockchain, period.

In general, however, inscriptions are tolerated if done intelligently. That is, without negative impact on the stability of the network. These inscriptions use an opcode specifically created for this purpose: OP_RETURN.

OP_RETURN was created in 2014 to provide an alternative to more harmful techniques for inserting arbitrary data. And by the way, stamps is just a carbon copy of the counterparty protocol which led to the creation of OP_RETURN.

OP_RETURN offers a space limited to 83 bytes per transaction, enough to enter a SHA-256 hash (32 bytes) and an identification tag. Those utxos are special in that they cannot be spent. Lightweight nodes can therefore prune them entirely.

All this to say that some troublemakers deliberately do things in the worst possible way, which speaks volumes about their intentions. Doubling the time required to install a node in less than a year should provoke an outcry.

Faced with the troubling inaction of Bitcoin Core, your humble servant strongly recommends using the BitcoinKnots client. This implementation of the Bitcoin client stands out due to a series of bug fixes taking care of inscritptions.

If you are a miner who actually wants to secure Bitcoin, direct your hash to @ocean_mining. This pool founded by Luke Dash and Jack Dorsey mines blocks almost without inscriptions.

Don’t miss our latest article on Bitcoin Core’s inaction: Bitcoin Core breaks silence.

This article was first written in french.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

A

A

Bitcoin, geopolitical, economic and energy journalist.

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.