Bitcoin: 5 Key Elements To Absolutely Monitor This Week

Bitcoin evolves in a context of uncertainty marked by economic fluctuations and contradictory signals in the financial markets. Between the resistance of safe-haven assets, low volatility, and macroeconomic expectations, investors are scrutinizing the upcoming market movements. Here are 5 elements that could be decisive for BTC this week.

5 signals not to be ignored about Bitcoin this week

Bitcoin navigates troubled waters, between hopes of a rebound and fears of a pullback. This week, 5 decisive factors could well shape its trajectory in a tense market.

1. Bitcoin tests a key support around $90,000

Bitcoin remains in a tight range after the Bybit hack, slowing its bullish momentum. Traders are watching liquidity levels and anticipating a battle between buyers and sellers. Some see a bullish potential towards $94,700, while others expect a return towards $90,000 before a possible recovery.

2. US inflation and the risk of stagflation

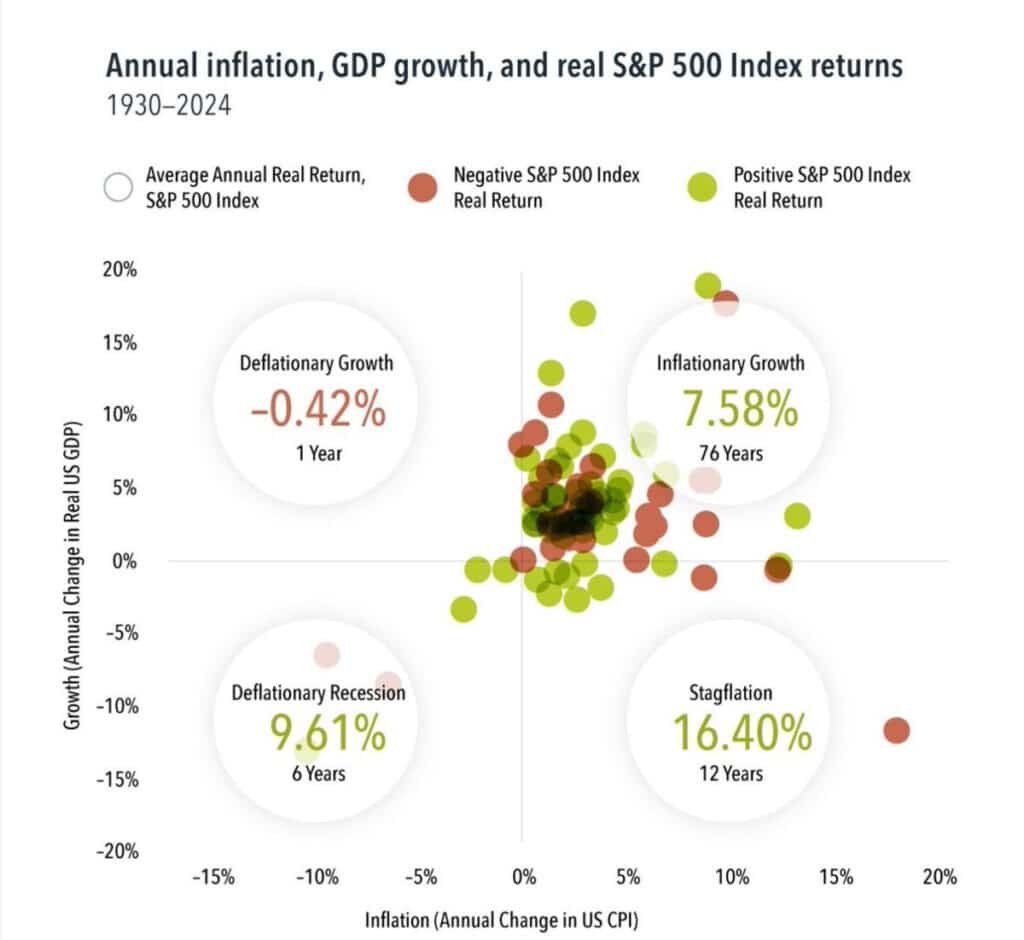

The market is awaiting the publication of the PCE index on February 28, the main inflation indicator for the Federal Reserve. Despite signs of economic slowdown, history shows that stagflation does not necessarily imply a decline in stock markets. The S&P 500 has recorded gains in 75% of the years marked by stagflation since 1930.

3. Gold rising sharply despite a strong dollar

Gold continues to break historical records, unlike the stagnating cryptos. Interestingly, gold and the dollar are rising simultaneously, a rare phenomenon. Some analysts believe that Bitcoin often follows gold with a lag of three to six months, which could signal a significant rise for BTC in the coming months.

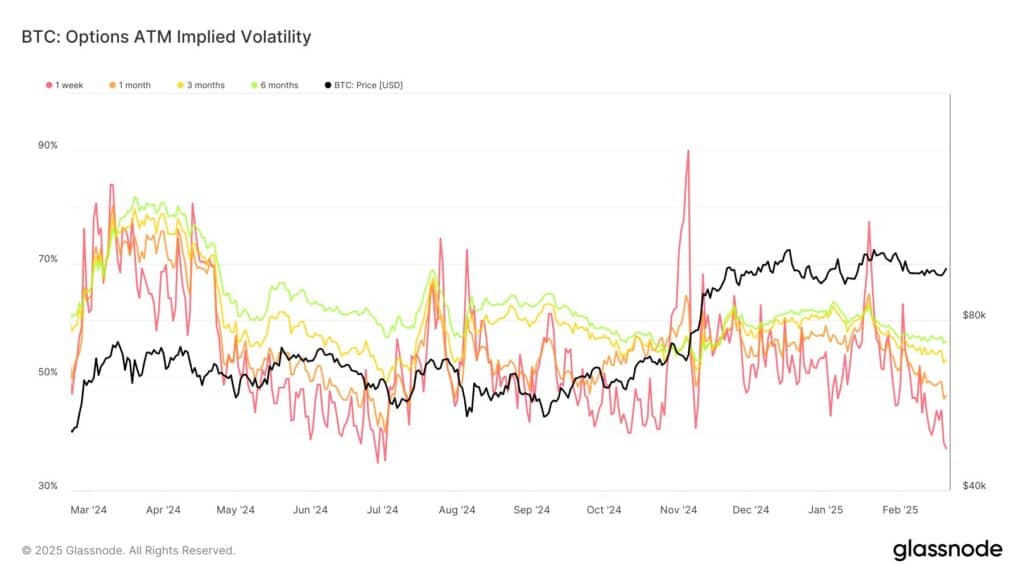

4. A volatility at its lowest, signaling a major movement

The realized weekly volatility of Bitcoin is close to its historical lows, according to Glassnode. Such compression levels have historically preceded significant market movements. The low interest from buyers and sellers creates a tense expectation, suggesting that a violent movement, bullish or bearish, is imminent.

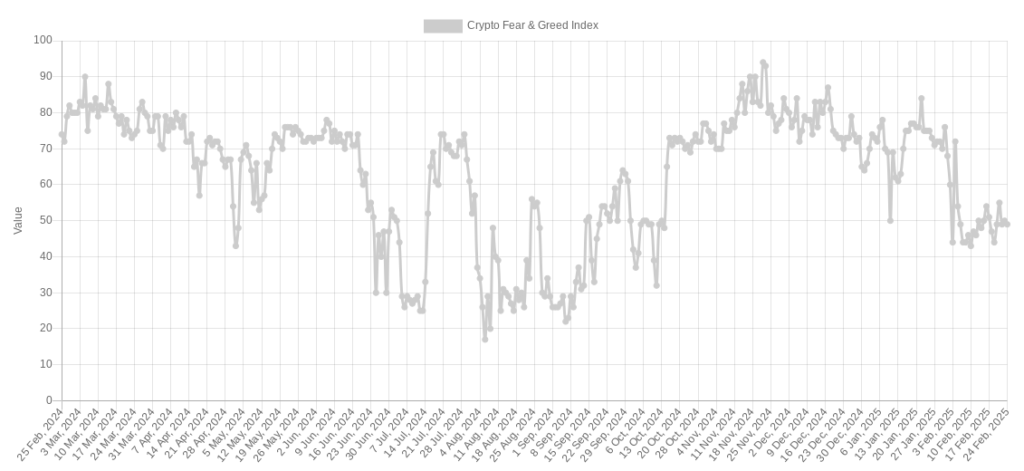

5. Decline in on-chain activity and investor sentiment

Bitcoin network indicators show a slowdown in activity, with a decrease in active addresses and a weakening of ETF demand. CryptoQuant compares this trend to previous corrections in the bullish cycle. The Fear & Greed Index stagnates in neutral territory, highlighting the persistent uncertainty in the market.

What should Bitcoin investors expect this week?

This week, crypto investors should prepare for a period of high uncertainty. Bitcoin may test the $90,000 support, influenced by U.S. inflation, the rise in gold, and compressed volatility signaling a sharp movement. In such an environment, caution is essential. It will be crucial to monitor macroeconomic and technical indicators, avoid impulsive decisions, and be ready to seize an opportunity or limit losses.

Bitcoin therefore finds itself at a decisive crossroads this week, between risks of a drop and hopes of a rebound. Investors will need to navigate with caution, watching for macroeconomic and technical signals. In this tense climate, patience and responsiveness will be essential to take advantage of the upcoming movements.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.