Only a few hours until the new Weekly Close for #BTC

— Rekt Capital (@rektcapital) September 10, 2023

Weekly close below ~$26,000 likely confirms the Double Top breakdown$BTC #Crypto #Bitcoin

A

A

Bitcoin: 5 crypto alerts not to miss

Wed 13 Sep 2023 ▪

6

min read ▪ by

Getting informed

▪

Invest

In the vast crypto universe, every week brings its share of revelations and surprises. As enthusiasts and investors alike scrutinize the evolution of Bitcoin, the crypto giant has a week full of developments in store for us. Without further ado, let’s dive into the fascinating world of Bitcoin, exploring the five major alerts that are on everyone’s lips.

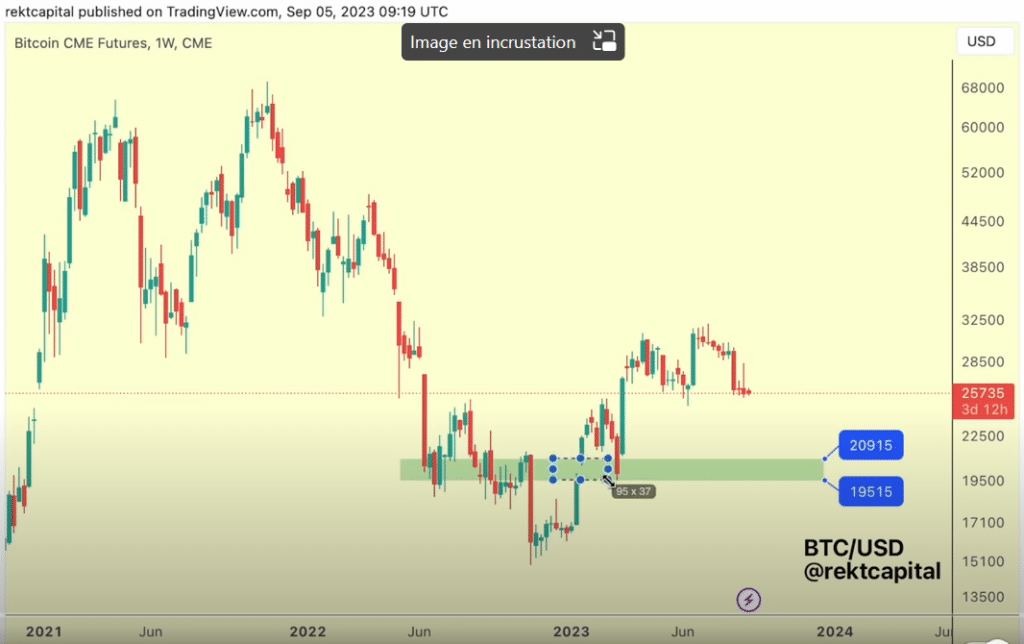

The spectre of Double Top: an ominous sign for bitcoin

Analysis of the Top 5 bullish factors shaking the cryptosphere. A potential double top worries the weekly bitcoin chart. Analysts are divided as to whether a pullback towards $20,000 is on the cards.

At the heart of this upheaval, the persistent weakness of the bitcoin price reveals a dreaded but no less real scenario. Indeed, the crypto behemoth seems to be marking time, foreshadowing a phase of reduced volatility.

In the crypto sphere, specialists are debating with restraint. They venture cautiously into the slippery terrain of bitcoin forecasts. On the other hand, the double top formation is taking shape. It reveals two distinct peaks in 2023, underlining a potential tumble. It also validates the pessimistic outlook of experts such as Rekt Capital.

Despite this gloomy mood, optimism is not totally eradicated. Some analysts remain optimistic. The renowned JT, for example, discerns glimmers of hope. They rely on precise technical indicators. In particular, the 200-week exponential moving average (EMA). This suggests an encouraging level of $25,600.

Gaps in the crypto futures market: a magnet for price fluctuations

Against this backdrop of fragility, all eyes are on the possible gaps emerging in the CME futures markets. This trend, which often emerges on weekends and public holidays, seems to play a significant role in future BTC price fluctuations.

A major gap is currently emerging, putting the $20,000 mark in the sights of investors and traders alike. Rekt Capital was quick to provide an update on its YouTube channel. Indeed, this zone, which has already served as resistance and support at various times, could potentially be revisited.

Although these gaps tend to be filled sooner or later, there are no formal guarantees. The history of Bitcoin remains instructive. It shows that some gaps, even significant ones, remain unexplored. As a result, speculators are sailing in a sea of palpable uncertainty.

Boiling liquidity: a warning signal?

In this atmosphere of unpredictable fluctuations, the current state of liquidity on the Bitcoin/USD markets is fuelling bearish forecasts. Liquidity heat maps, invaluable tools in crypto trading circles, depict a complex and perhaps alarming reality.

Currently, a significant block of liquidity is accumulating for bitcoin around the $24,000 mark. This illustrates a low concentration, unseen since last March. This zone, which has become a battleground for market bulls, appears to be the ultimate line of defense against a potential fall.

Market players must be ready. They must firmly defend this level. Otherwise, they risk initiating a bearish market. In this scenario, falling prices would become the new norm.

CPI and the Fed meeting: a pivotal week for bitcoin

Beyond crypto market trends, the macroeconomic environment is resurfacing as a crucial element likely to influence the volatility of risky assets. This week, all eyes are on the US Consumer Price Index (CPI).

The imminent release of the CPI is awaited with palpable tension. Crypto market players are adjusting their strategies, anticipating significant repercussions on the Federal Reserve’s future interest rate decisions.

According to CME Group’s tracking tools, there is a high degree of confidence that current interest rates will be maintained, news that could prove favorable for risk assets, including cryptocurrencies.

Back to March 2020: A black swan in sight?

As the week progresses, an alert on the blockchain catches the attention of savvy traders. Losing UTXO, an indicator that measures unspent outflows from blockchain trades, is reaching an alarming level, reminiscent of the dark days of March 2020.

Glassnode, a renowned blockchain analysis firm, highlights a worrying reality: the number of UTXO in loss is at its highest since March 2020, a period marked by a dizzying fall in the price of BTC.

The Bitcoin ecosystem seems to be flirting with the idea of another black swan event, similar to the one that shook the market over three years ago. Experts are warning of a possible repeat of this tumultuous period, urging investors to exercise caution.

In this unpredictable landscape, each day brings its own surprises and lessons. As Bitcoin goes through a period of turbulence, it’s imperative to remain vigilant and navigate these tumultuous waters with caution.

Finally, we stand at the dawn of a defining period for Bitcoin, one in which every fluctuation will be scrutinized. Speculation abounds, leaving one lingering question: are we already engulfed in a financial maelstrom, or are we simply witnessing the beginnings of a monumental upheaval? In this ever-changing world, in the image of rapid transformations in nations such as India, now Bharat, the future of Bitcoin remains an open book, ready to unveil its next captivating chapters.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

A

A

Fascinated by Bitcoin since 2017, Evariste has continuously researched the subject. While his initial interest was in trading, he now actively seeks to understand all advances centered on cryptocurrencies. As an editor, he strives to consistently deliver high-quality work that reflects the state of the sector as a whole.

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.