First Republic Bank about to become a penny stock. pic.twitter.com/umbZaVJEHV

— Genevieve Roch-Decter, CFA (@GRDecter) April 29, 2023

A

A

Banking carnage: First Republic on the brink of bankruptcy

Tue 02 May 2023 ▪

12

min read ▪ by

Getting informed

▪

Summarize this article with:

Following the bankruptcy of Silicon Valley Bank (SVB), which created shockwaves in the banking industry, numerous institutions began to feel the effects of this collapse. This is particularly the case for First Republic bank. It is going through a period of crisis and getting closer to the edge of the precipice day by day. Is the banking carnage just beginning in America?

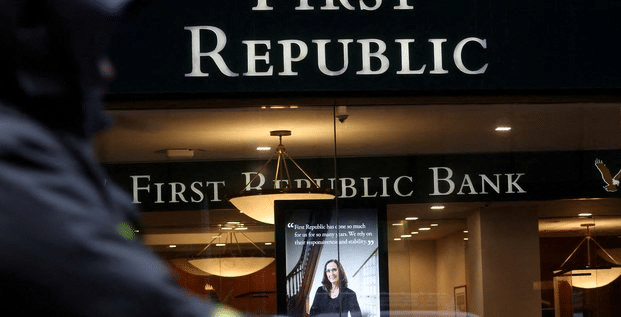

First Republic facing deposit flight

For seven weeks now, First Republic has been struggling to avoid a massive flight of its deposits. FDIC uninsured deposits (the government body responsible for compensating depositors in the event of bankruptcy). Representing nearly 75% of the bank’s total deposits, have started to evaporate since the SVB bankruptcy.

This flight was predictable. Since some banks can be saved, due to their critical size (too big to fail banks), and others may not be, depositors have every interest in withdrawing their funds as quickly as possible to protect them.

Faced with this situation, the First Republic Titanic had to take drastic measures. The company borrowed billions from JP Morgan and the Federal Reserve. It receives nearly $30 billion in deposits from a consortium of American banks too. Despite these injections of liquidity, the bank’s valuation looks suspiciously like that of a shitcoin.

With a fall of nearly 97% in two months, the American finance industry is starting to worry. So much so that the FDIC announced a few days ago the imminent takeover of First Republic.

The descent into hell of First Republic

In the event that this happens, we would witness the second-largest bank failure in US history. Boom.

With a total asset value of $230 billion, First Republic has a greater weight than Silicon Valley Bank.

This situation is part of a series of financial crises that have already led to the collapse of three major global financial institutions. First Republic’s difficulties are like a slow-motion simulation of the SVB and Signature episodes.

First Republic holds high amounts of deposits not insured by the FDIC. It has heavily invested in long-term, low-yielding assets whose value has been diluted by rising interest rates. And like Credit Suisse, its wealthy clientele has begun to withdraw their deposits.

However, First Republic was in a better position than most of these institutions. It was more diversified in terms of industry and geography. Although it caters to wealthy clients, it was not exclusively reserved for the super-rich. Despite substantial deposit growth linked to the tech boom, it did not feel the effects of the Tech sector’s recession. And while it was heavily concentrated in long-term, low-yielding assets, these were mainly traditional mortgage loans.

If these strengths seem insufficient to avoid bankruptcy, it could well illustrate the existence of a latent banking crisis. This could affect a very large part of the US financial system.

A hint of SVB…

The collapse of Silicon Valley Bank and Signature Bank is partly due to a critical mass of uninsured deposits. Account holders whose balances exceeded the $250,000 insurance limit set by the FDIC then chose to transfer or withdraw their funds due to the growing risk of bank failure.

In both cases, more than 90% of deposits were uninsured, and depositors were mainly geographically and sectorally concentrated businesses. For First Republic, uninsured depositors accounted for about 70% of total deposits. This figure is higher than most banks, but lower than that of Signature and SVB.

In the case of a bank run, where many depositors withdraw their funds, it would have been necessary for almost all the uninsured deposits to leave the bank. This is precisely what happened. At the beginning of the year, First Republic held $120 billion in uninsured deposits. By the end of March, that number had dropped to $20 billion, excluding deposit inflows from other large banks.

100 billion leakage in 3 months

In just three months, First Republic has had to deal with a $100 billion drain.

Like Silicon Valley Bank, in 2020 and 2021 First Republic invested heavily in long-term assets with low returns. The share of total assets made up of loans or bonds with maturities of 5 years or more was higher at First Republic than at SVB.

However, unlike Silicon Valley Bank, these long-term assets were primarily traditional real estate loans rather than debt securities. First Republic’s real estate loans increased significantly during the pandemic, from $70 billion in early 2020 to $140 billion at the end of 2022.

As a result, First Republic’s management invested heavily in longer-term Treasury bonds and other low-yielding securities, and saw the value of these longer-duration assets plummet as interest rates rose in 2022. The gap between the book value and fair value of First Republic’s mortgage assets reached nearly $20 billion at the beginning of the year.

Bis repetita.

Please, JP Morgan!

When depositors began to flee, First Republic had to look for other sources of funding, which it did by borrowing more than $100 billion from various sources. These loans came in part from the Federal Home Loan Banks, the lenders of last resort that First Republic regularly used before the crisis, but also from a line of credit with JPMorgan Chase and directly from the Federal Reserve discount window.

The main problem is that these funding sources are extremely expensive, relative to First Republic’s deposit funding base. The interest rate on First Republic’s discount window loans is currently 5%, which far exceeds the 3.18% average yield on First Republic’s real estate loan portfolio. This is a reminder of the interconnection between illiquidity and insolvency.

What can save First Republic?

The situation seems devastating for the American bank. Few financial institutions have bounced back from rumors of an FDIC takeover. Although only $20 billion in uninsured deposits could go away, that alone would cost hundreds of millions of dollars a year in additional interest charges if it were replaced by more borrowing. Insured deposits could also begin to soar if people simply decide to close their accounts or if they want to avoid the potential inconvenience of the FDIC’s collection process.

Selling First Republic’s assets at auction would result in significant losses for the bank, so most experts are looking at buying back the assets at higher prices in exchange for an equity stake in First Republic. However, this is a difficult transaction to manage.

Government comes to the rescue of the banks

The government could also try to arrange a forced marriage by offering federal assistance, credit or guarantees to facilitate the sale to another institution. Some believe that JP Morgan Chase would be interested in buying First Republic.

The Federal Reserve’s lending terms could also be relaxed to keep First Republic alive a little longer. The bank can’t borrow much under the Fed’s new Bank Term Funding Program, which offers loans of up to one year against collateral valued at par, because First Republic has few high-quality securities eligible for the program.

The Fed could expand BTFP eligibility to include more types of assets, it could increase the length of the discount window loans as it did at the beginning of COVID, or find another way to buy as much time as possible.

Is the financial system about to blow up?

The impending failure of First Republic, a bank with a healthier balance sheet than Silicon Valley Bank, Signature Bank or Credit Suisse, reveals the growing stresses facing the U.S. banking system.

Rising interest rates and the Fed’s quantitative tightening have led to colossal financial losses for U.S. banks that owned these long-term assets.

Most of the deposit leakage has been in savings and demand deposits. Amounts deposited in savings and money market deposit accounts have declined by nearly $2 billion since the beginning of 2022. The money transferred tends to leave the banking system entirely for money market funds.

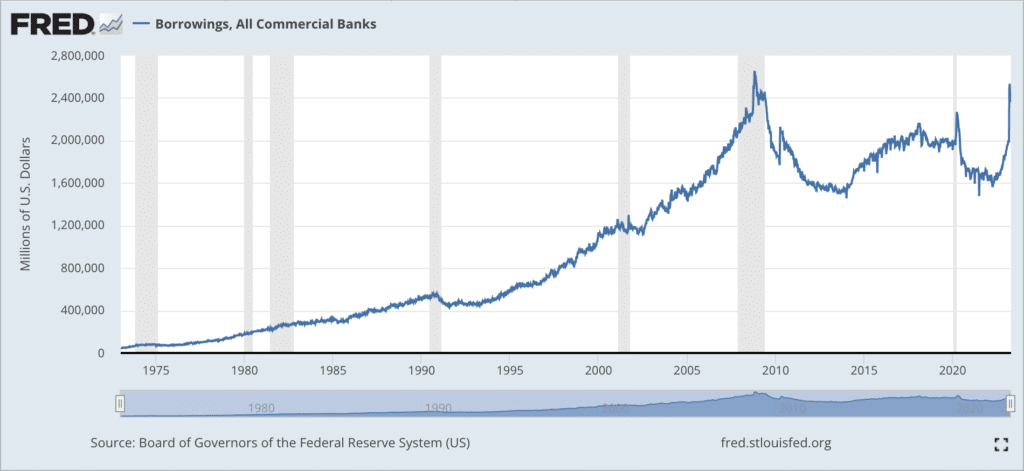

To compensate for the loss of these deposits, banks are borrowing heavily to cover their funding needs. Overall borrowing has increased by more than $400 billion since March 1, and borrowing from Federal Home Loan Banks has exceeded $1 trillion for the first time since the 2008 crisis.

Direct lending by the Federal Reserve to the banking system also remains high, although discount window lending has declined slightly in the weeks following the SVB collapse.

This borrowing results in higher funding costs for the banking system and reflects increased financial risks. To alleviate these strains and stabilize the banking sector, coordinated actions by regulators and financial institutions may be needed in the coming months. This could include measures to strengthen depositor confidence, support troubled financial institutions, and possibly reform regulations to prevent future crises.

The interest rate problem

Fundamentally, a bank’s business is to borrow short term (via deposits) and lend long term. This financial model becomes more difficult when short-term interest rates exceed long-term rates.

Inflation, tightening monetary policy and the risk of recession have caused the yield curve to invert. Especially as rates have risen at a surprising rate. Indeed, financial institutions had very little time to adjust to the era of 5% rates. The turnaround in monetary policy was so rapid after a decade of money printing that the Fed condemned SVB, Signature and arguably First Republic.

Normally, higher rates would help banks because asset yields rise faster than interest paid on deposits. But that assumes that depositors are mostly sluggish players who don’t move their assets quickly to seek yields or flee if the bank appears to be in trouble.

The slumbering giants that were wealthy depositors with non-FDIC insured accounts have awakened. Accelerating the descent into the abyss of First Republic and … perhaps tomorrow of the other banks that relied on it.

In the wake of SVB and Signature, First Republic is on the brink of hell and may well go bankrupt imminently. The trigger is always the same. A lightning increase in interest rates by the Fed that has degraded the value of the long-term bond assets of these banks and a panic phenomenon that leads to a crisis of illiquidity and then insolvency. The American financial system is in trouble!

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

A

A

The Cointribune editorial team unites its voices to address topics related to cryptocurrencies, investment, the metaverse, and NFTs, while striving to answer your questions as best as possible.

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.