Review: Is Revolut the Best Crypto Bank?

By introducing Bitcoin trading to its millions of users in 2017, the neobank Revolut has undeniably played a major role in the cryptocurrency boom. Thanks to the simplicity of its banking application and account opening process, beginners are particularly well-catered to.

As such, it is now one of the big names in the crypto world, alongside Binance, Kraken, and Coinbase. Could it overshadow these established exchanges? By allowing its users to trade cryptocurrencies since 2017, Revolut has fully participated in the incredible boom of this sector.

Introduction to Revolut Bank

Founded in 2014, Revolut originated as a British payment institution launched by two Russian friends. The principle? Launch an innovative banking app to limit fees abroad and assist travelers.

Immediately, the concept worked, and the fintech (a term for startups combining finance and technology) had the resources to develop an innovative offering at an impressive pace. Users were captivated all over Europe.

With features like a multi-currency account, next-generation mobile app, metal bank card, vaults, insurances, and, of course, cryptocurrencies, the list of functionalities is long and continues to grow every year.

This culture of innovation led Revolut to become the first payment institution to offer a cryptocurrency service in 2017. At that time, cryptocurrencies were primarily viewed as a threat to the banking sector rather than an opportunity.

Since 2022, Revolut has operated in France through a Lithuanian credit institution banking license. This is an important change because, through Revolut Bank UAB and the European passport, French customers now benefit from a French IBAN and deposit insurance from the Bank of Lithuania up to €100,000.

Why Revolut is a Key Player in the Crypto World

In 2022, Revolut reached the milestone of 25 million customers worldwide, a huge number for a bank present in nearly 200 countries that aims to be the Amazon of banking.

This success is largely due to the absence of income and activity conditions. For example, with the Standard plan, it is possible to have a Revolut bank card and pay nothing if it is not used.

Revolut’s offering consists of four monthly subscriptions:

- Standard: Free and without commitment

- Plus: €2.99 per month

- Premium: €7.99 per month

- Metal: €13.99 per month

By granting access to its cryptocurrency offering to all users starting with the Standard plan, it is easy to understand why Revolut enjoys a privileged status in the crypto world.

Indeed, thanks to its reach, tens of millions of people can buy fractions of Bitcoin for the first time with the snap of a finger.

Revolut’s Cryptocurrency Offering

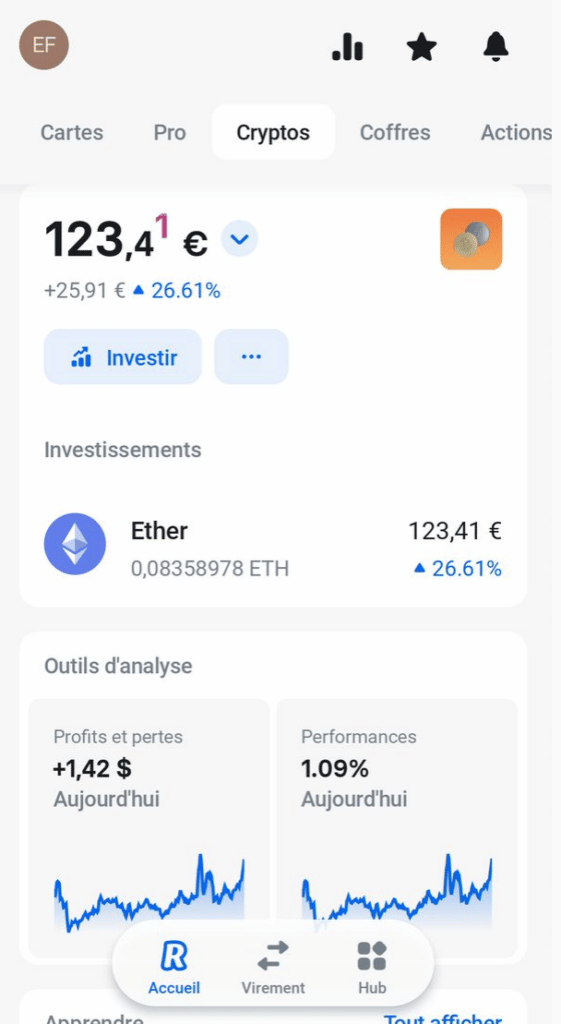

By clicking on the “cryptos” tab in the app, Revolut users immediately access the cryptocurrency investment space, structured as follows:

- Current asset value

- Performance statistics

- Access to learning resources

- Activity (ongoing orders and past transactions)

- Cryptocurrency news

Designed for beginners, this space emphasizes ease of use and portfolio position tracking. Unlike platforms like Binance, it is very easy to navigate through the offered functionalities.

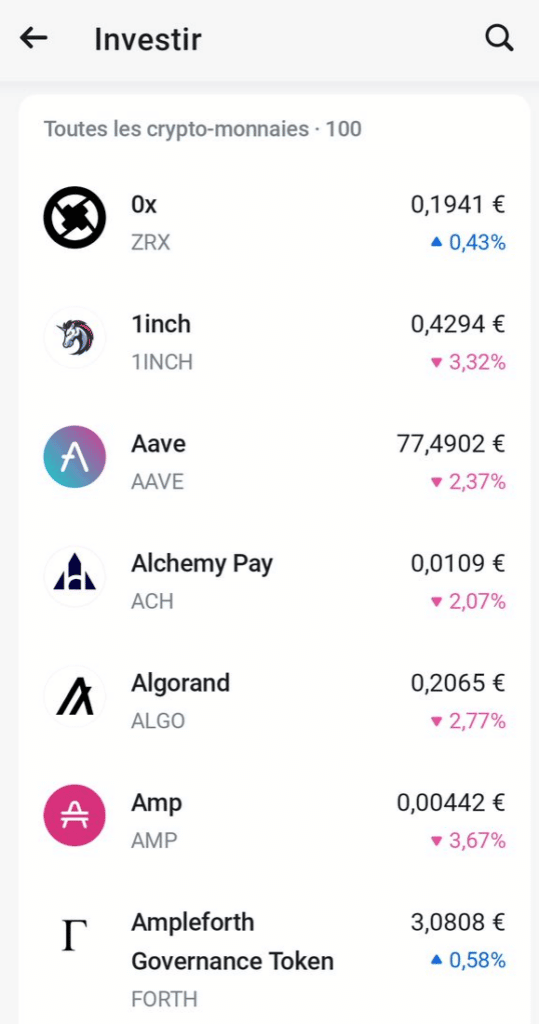

Regarding the crypto asset offering itself, it consists of about a hundred tokens ranging from well-known ones to more specific projects.

Examples include:

- Bitcoin

- Ethereum

- Litecoin

- Dogecoin

- Polkadot

- Cardano

- Shiba Inu

- Axie Infinity

- Dash

- Kyber

- Uniswap

- Yearn.finance

- Etc.

In other words, due to its depth, Revolut’s token offering is broad enough to appeal to both beginners and investors looking for niche projects (e.g., in decentralized finance).

An excellent point, though expert investors might regret the absence of confidential or early-stage projects, risking everything for very high returns.

However, as we explain in more detail later in this review, Revolut is not actually targeting them but the general public and investors.

Where Do Crypto Prices Come From?

Revolut’s main partner for sourcing crypto assets is Bitstamp, a long-standing recognized exchange. According to Revolut’s help section, other commercial partners may also be involved, but Revolut does not explicitly disclose their identities.

Revolut explains that the token prices presented in the app are calculated using the volume-weighted average price method.

The main drawback of this calculation method is that it does not immediately reflect small price variations. In other words, users who wish to trade—buy and sell in very short timeframes—are at a disadvantage.

Therefore, Revolut primarily caters to investors who want to take their time to benefit from the anticipated rise in token prices.

How to Buy and Sell Cryptocurrencies on Revolut

Making a cryptocurrency purchase is very simple:

- Click on Invest in the crypto space

- Click on the desired cryptocurrency

- On the cryptocurrency’s value sheet, click on Buy and then select the type of order (market order, etc.)

- Select the Revolut account to debit (which can be in euros, dollars, pounds sterling, etc.)

- Enter the desired amount

- Confirm the purchase order

Once the purchase is confirmed, the transaction is stored in the corresponding tab, and you can track the price changes in real-time in the statistics space.

In addition to market orders, several types of orders are available:

- Stop order: Executes when the crypto asset’s price reaches a high limit

- Limit order: Executes when the crypto asset’s price reaches a low limit

- Recurring order: Buys a fixed amount at a set interval (daily, weekly, etc.)

To sell cryptocurrencies, the procedure is identical to buying, except you naturally need to click on the Sell tab on the value sheet of a cryptocurrency you hold positions in.

Revolut’s Cryptocurrency Fees

All transactions, whether purchases or sales, are subject to a fee from Revolut in two different forms:

- A variable commission on the exchange rate, i.e., the rate offered to Revolut by its technical partner (most often Bitstamp)

- A fixed commission depending on the user’s subscription

Thus, the total transaction cost is the sum of the variable commission and the fixed commission. Unfortunately, the variable commission is aptly named because it is impossible to know it in advance without simulating a purchase or sale.

Regarding the fixed commission, it is calculated as follows:

- Standard: 1.99% of the transaction amount (with a minimum of €0.99)

- Plus: 1.99% of the transaction amount (with a minimum of €0.99)

- Premium: 1.49% of the transaction amount

- Metal: 1.49% of the transaction amount

Before each transaction, Revolut summarizes the fees on the order ticket. However, these are indicated in the unit of the considered cryptocurrency, which does not always facilitate fee readability.

For example, here is an order ticket for €100 purchased in ETH:

Ultimately, compared to other exchanges, Revolut’s fees can be considered relatively high.

For long-term purchases, it is important to keep in mind that such a fee level does not fundamentally pose a problem as it is absorbed over time. However, in the context of active and short-term trading, making a profit becomes a much more difficult task.

Storage and Transfers of Cryptocurrencies on Revolut

Revolut users do not have individual addresses for their crypto assets. This means their funds are pooled with those of other Revolut users.

This has significant implications:

- No possibility to withdraw tokens from the platform, for example, to secure them in a physical wallet

- No possibility to pay merchants with tokens

- Impossible to make outgoing or incoming transfers outside the Revolut ecosystem

Investing with Revolut therefore implies blind trust in the platform regarding fund security. Although there have been no security breaches to date, this remains a significant drawback, as it is generally advised not to leave tokens on a centralized exchange for long-term investments.

Aware of this limitation, Revolut allows token transfers between Revolut users and indicates that it is working on improving its crypto infrastructure.

In some jurisdictions, it is already possible to withdraw Bitcoin to private keys. Given Revolut’s capacity for innovation, it is reasonable to expect progress on this point, although no launch date has been announced.

Finally, it is important not to misunderstand the Lithuanian deposit guarantee attached to Revolut Bank, which covers up to €100,000. Being a banking guarantee, funds deposited in cryptocurrencies are not protected by this guarantee.

Summary: Advantages of Revolut’s Crypto Offering

- Ease of account opening

- A varied cryptocurrency offering

- The ability to manage a current account and crypto investments in one app

- User-friendly crypto space for buying, selling, and tracking investments

- Crypto transfers between Revolut users

- The possibility of making recurring purchases, e.g., €50 every month

- Customizable price alerts

Summary: Weaknesses of Revolut’s Crypto Offering

- No possibility to make incoming transfers in cryptocurrencies

- Impossible to make outgoing transfers, for example, to a physical wallet

- Cannot pay merchants in cryptocurrencies

- A centralized quotation system not suitable for trading

- Relatively high fees with fixed and variable commissions

Final Thoughts on Revolut’s Cryptocurrency Offering

In terms of ease of account opening and usability, it is hard for a beginner not to fall for the charm of the Revolut app. Buying and selling cryptocurrencies is indeed remarkably simple.

Adding to this the commercial power of Revolut, one of the largest fintechs in the world, there is no doubt that Revolut rightly plays a leading role in democratizing the cryptocurrency market. However, this impressive introduction also has its limitations.

First, it is necessary to distinguish between investment and trading. While in the former case, relatively high fees are not a major barrier to achieving long-term financial gain, this is not the case with trading. On very short timeframes, these same fees and the asset quotation system are simply not suitable.

Specialized exchanges like Binance can still sleep soundly on this point.

Another drawback is the lack of private keys, meaning there are simply no other uses for the cryptocurrency offering than seeking long-term gains.

Indeed, without the possibility to withdraw tokens from the platform, Revolut users have no choice but to place blind trust in the platform. The risks associated with centralized exchanges are well known.

Revolut, the Best Crypto-Friendly Bank?

The First Neobank to Offer Cryptos

As the first neobank to get on the cryptocurrency bandwagon, Revolut fully deserves its reputation as a crypto bank, especially since the competition has been slow to challenge it in this area.

To date, the most serious initiative likely comes from the German-origin neobank Vivid, with a cryptocurrency offering launched in 2021. However, it is based on derivatives, thus involving an additional credit risk.

Next, how can we not mention Revolut’s major competitor, N26? After staying away for a long time, this other German-origin neobank seems to want to get back in the game with a cryptocurrency offering launched in 2022 in German-speaking markets. This offering will therefore be closely monitored upon its arrival in France.

More “Crypto-Friendly” Neobanks

Clearly, all crypto-friendly initiatives in the banking market come from neobanks—young, dynamic, and ambitious establishments. Are more “traditional” banks completely resistant to the world of cryptocurrencies?

At first glance, this seems to be the case, as for them, there is little doubt that cryptocurrencies are to be considered a threat. Therefore, a rapid change in mentality on this subject is unlikely.

Nevertheless, all hope is not completely lost, especially if we consider the signal sent by the online bank Boursorama Banque, owned by Société Générale. As explained in this review of Boursorama Banque, this institution is undoubtedly the most innovative among French banks.

In this respect, it is through Boursorama Banque that we see the most crypto-friendly initiative from traditional finance. Its claim to fame? Accepting specialized exchanges Binance, Kraken, and Coinbase in its Wicount Patrimoine account aggregation service. Through this tool, Boursorama Banque clients can view their crypto account balances directly in their client space.

In Conclusion

Certainly, this step towards the cryptocurrency world may seem very modest, but it nevertheless constitutes a first foray.

Will it eventually challenge Revolut’s status in crypto? As we have seen in this review, Revolut has taken a significant lead over the competition, and as long as it maintains its innovative approach (which seems to be the case), the risk appears limited. Thus, we await further developments with anticipation.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The Cointribune editorial team unites its voices to address topics related to cryptocurrencies, investment, the metaverse, and NFTs, while striving to answer your questions as best as possible.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.