Avalanche (AVAX) Is Gaining Momentum: December 14 Analysis

Avalanche experienced a surge of nearly 70% in the first week of December. Let’s look at what’s in store for the price of AVAX.

Avalanche’s (AVAX) Situation

By surpassing the psychological threshold of $20, the Avalanche price (AVAX) has maintained its bullish momentum, reaching a new yearly high around $40. This level matches the last bullish target mentioned in our analysis from November 29. It was designated as a long-standing key resistance. Currently, AVAX is trading slightly below this level, with a price close to $38.

Thus, it seems that Avalanche has officially reversed its medium and long-term downtrend. This can be supported by the 50 and 200-day moving averages, which have crossed and are trending upwards. However, despite oscillators indicating bullish momentum, the RSI reveals an overbought situation and suggests the emergence of bearish divergence. This could indicate a potential period of consolidation or correction for the cryptocurrency.

The current technical analysis has been carried out in collaboration with Elie FT, an investor and trader passionate about the cryptocurrency market. He now trains at Family Trading, a community of thousands of proprietary traders active since 2017. Here you will find Live sessions, educational content, and mutual aid focused on financial markets in a professional and friendly atmosphere.

Focus on Derivatives (AVAXUSDT)

The open interest for AVAXUSDT continues to follow the direction of its price. It has increased by +116% since the start of the month with a position adding (Long and short) of approximately + 166 million dollars. This reflects a rise in trader participation, theoretically on the buyers’ side.

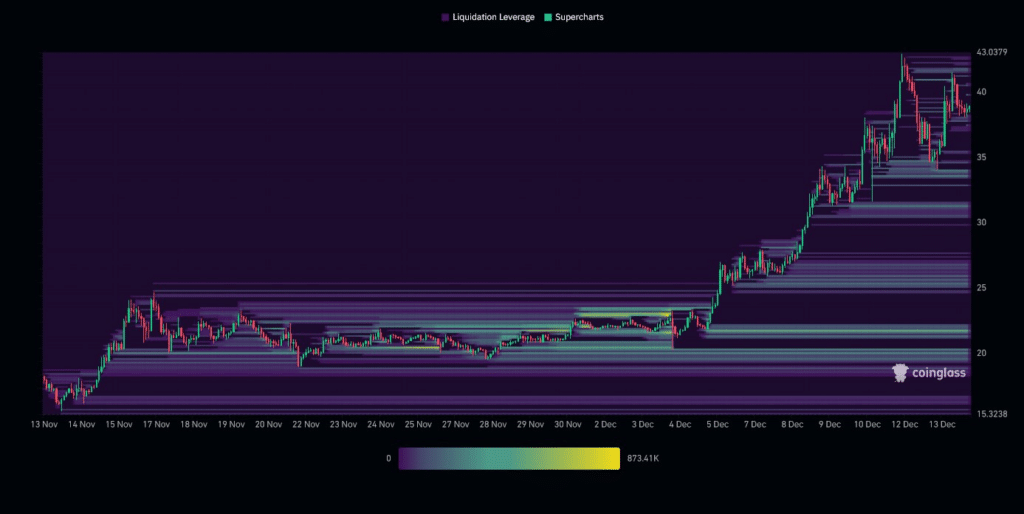

The liquidation heatmap for AVAX reveals key zones containing pending buy and sell orders. Just above the current AVAX price, the $42 area stands out. Below the current price, the important levels to watch include $34, $31, $25, and finally the $20-22 zone. As the market approaches this level, this could trigger these orders, possibly leading to increased cryptocurrency volatility. Consequently, this zone could attract investors. It is worth noting that these orders can be removed over time leaving.

Hypotheses for Avalanche’s (AVAX) Price

If the AVAX price manages to stay above $40, we might anticipate a bullish continuation toward the $55 to $60 level. The next resistance to consider if the bullish move continues would be around $80. At that stage, this would represent an increase close to +96%.

If the AVAX price fails to break through and maintain above $40, we could see a retrace back to $31. The next level to consider, if the downtrend continues, would be around $22 to $20. At this point, this would represent a drop close to -47%.

Conclusion

Avalanche has kept up its bullish momentum, recording an impressive gain of over 245% in less than two months. This progression strongly suggests that the medium and long-term trend of AVAX is reversing. However, after such a parabolic increase, a phase of consolidation or correction is necessary to healthily follow its dynamic. Therefore, it will be important to closely observe the price’s reaction at the various identifiable levels to confirm or refute the various hypotheses made. Be cautious of potential “fake outs” and market “squeezes” in each situation. Moreover, let’s not forget that these scenarios are based solely on technical analysis. The price of cryptocurrencies can move more or less quickly, depending on other more fundamental factors.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Family Trading est une Communauté de traders a compte propre active depuis 2017 offrant Lives, contenus éducatifs et entraides autour des marchés financiers dont celui des cryptomonnaies avec à ses côtés Elie FT, investisseur et trader de passion sur le marché crypto.

The contents and products mentioned on this page are in no way approved by Cointribune and should not be interpreted as falling under its responsibility.

Cointribune strives to communicate all useful information to readers, but cannot guarantee its accuracy and completeness. We invite readers to do their research before taking any action related to the company and to take full responsibility for their decisions. This article should not be considered as investment advice, an offer, or an invitation to purchase any products or services.

Investment in digital financial assets carries risks.

Read more