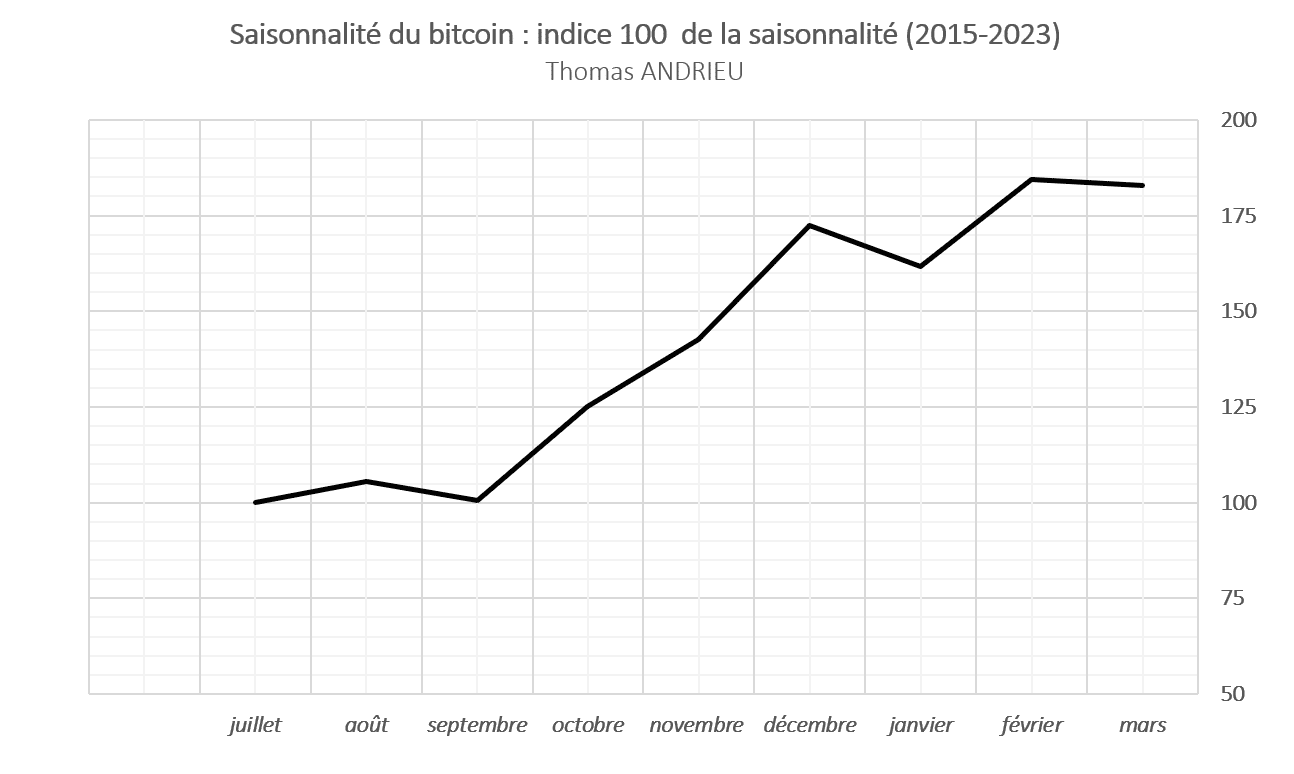

If the month of July is historically bullish and quite reliable, the end of summer shows higher risks.

Home » Archives for Thomas Andrieu

Thomas A.

Author of various books, financial and economics editor for many websites, I have been forming a true passion for the analysis and study of markets and the economy.

The legislative elections have increased the risk of political and financial instability in France. The Paris stock exchange has dropped by nearly 5% since June 9 to hedge against the risk of witnessing economic policy instability.

Finance has profoundly evolved since its inception and especially in recent years: development of environmental or social criteria, arrival of blockchain, etc. At the same time, behaviors have evolved with the rise of ETFs, the rejuvenation of investors, and the reduction in holding periods for securities. In the current political context, radically opposed visions clash. Is finance really viable in France?

The dissolution of the National Assembly brings a great deal of uncertainty to the markets. In one week, the CAC 40 dropped by nearly 7% to erase its gains since January 1st. On the other hand, the CAC for small capitalizations fell by nearly 11%.

The ECB has made its decision: rates will be cut by 25 basis points. An unprecedented cut in over 8 years.

It is plausible to assume the existence of a close connection between the money supply and the price of bitcoin. In this paper, we will focus on describing the nature of the relationship between bitcoin (BTC) and the money supply for the United States.

If the correlation between bitcoin and Ethereum remains high, the cyclicity of the Ethereum price seems to act with as much precision in the structure of this bullish market. Decrypting the indicators and the dynamics of the Ethereum price.

Therefore, the bull market built since early 2023 appears to be following the fundamental rules of intermarket relationships. Bitcoin's correlation with most assets was at its highest in 2023. The subsequent bull market was characterized by a significant decrease in bitcoin's correlation with the S&P 500 and gold, and to a lesser extent, with Ethereum.

As the trend remains bullish with a consensus target of $100,000, has Bitcoin exhausted its bullish potential faster than normal?

Financial markets remain dependent on liquidity. While indices have regained significant valuation, markets are betting on a relaxation of interest rates.

Over the last 8 years, September has been the second-worst month in terms of bitcoin (BTC) performance. On average, bitcoin falls by 5% in September. Conversely, September is often a good opportunity. The end of the year often marks a powerful "Christmas effect", which is usually accompanied by a rise in cryptocurrency. But if studying the past sheds light on probabilities, it's worth looking at the indicators available on the bitcoin price.

Over the week of August 14, the bitcoin price fell by almost 12%. This turnaround was all the more dramatic as major thresholds that could have inspired long-term confidence were broken. The price of bitcoin fell below the $26,000 mark. It had stabilized above this level since March 2023. In our previous analysis in July, we pointed out that “the $26,000 area appears to be a major zone at present, and the absence of a recovery in volatility on traditional indices will probably determine the next move”.

It's not the first time that financial giants have made optimistic statements about bitcoin. But this time, the CEO of the world's largest asset management company openly declared his preference for bitcoin “over investing in gold, […] bitcoin is an international asset”. In the wake of this statement, bitcoin is on the verge of a bull market. As stock market indices consolidate, bitcoin is on its highest levels of the year. But is bitcoin “digital gold”? And what are the aims of this financial giant?

Is seasonality a myth? In this article, we will attempt to give an ideal overview of bitcoin's comparative behavior since 2015. We'll focus on monthly performance, effectively excluding shorter variations. The study of seasonality thus shows that October, February and July are generally the most reliable and best-performing months. Will this be the case in the coming months?